|

This week is going to be a blockbuster — not just for the markets, but for Weiss Ratings as well.

Here’s the calendar, one of the hottest in history:

Tomorrow, July 28: We launch the first in our three-part gala summit, Future Shock 2020.

If you’ve already signed up, great! If not, today’s your last chance to grab your free ticket with a one-click here.

Wednesday, July 29: Facebook announces second-quarter earnings. What’s the guidance from the company? None! Due to the pandemic, they essentially admitted they had no clue.

Thursday, July 30: It’s the turn of Apple, Amazon and Alphabet. All in one day! And that’s on the heels of some hot testimony by their CEOs on the Hill the day before.

Together, just these Big Four tech companies have some $5 trillion in market cap, more than the total GDP of Japan. But, due to the economic turmoil, the earnings guessing game on Wall Street is like two dozen guys shooting craps on the steps of a fire escape.

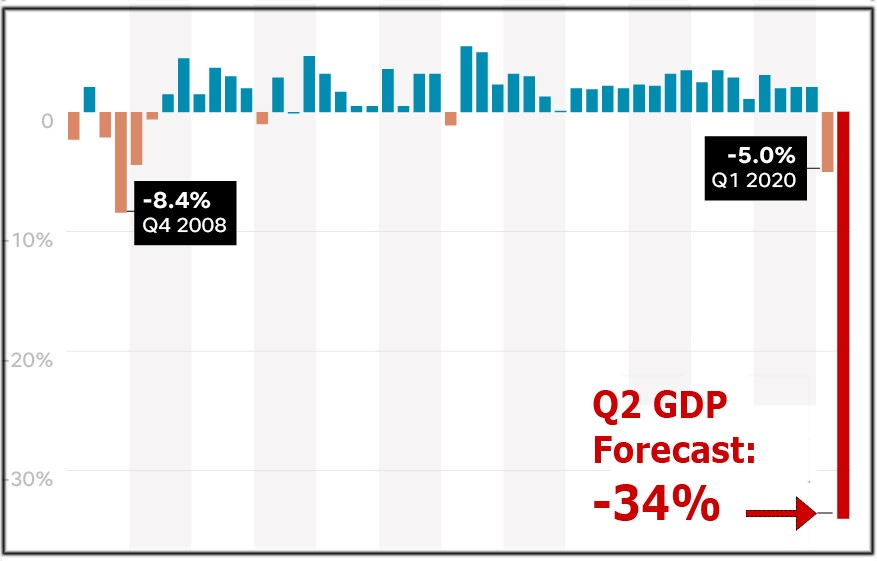

Also on Thursday: The Commerce Department releases its first GDP estimate for the second quarter. Here’s roughly what the chart is going to look like:

|

We’re looking at a GDP collapse at the annual rate of 34%!

That’s four times worse than the worst quarter of the worst recession since World War II! (I’m referring to the 8.42% GDP decline in Q4 2008. See chart.)

It’s nearly SEVEN times worse than the prior quarter!

And no matter how you slice it, it’s a killer for earnings in the traditional brick-and-mortar world.

The pundits will say “it’s all past history — so who cares?”

But is it really?

Sure, that argument may have been believable 30 days ago. But with the COVID-19 resurgence in July, no one on Wall Street knows the heck to believe anymore.

The only big winners: Companies that are not just immune to the pandemic’s impacts, but whose earnings are actually benefiting from the crisis.

Friday, July 31: If investors aren’t already punch-drunk from the biggest one-week bombardment of shocking news in a lifetime, they will be on Friday.

That’s when the numbers will hit the wires on …

- Personal income (for June)

- Consumer spending (June)

- Core inflation (June)

- The Chicago PMI (July)

- The Consumer sentiment index (July)

And it’s these releases, especially the last two, could put to rest the “it’s-all-past-history-so-who-cares” argument.

My view:

Not only do we have a massive disconnect between the economy and the stock market, we also have …

An historic SPLIT between two entirely different worlds moving though time along two divergent paths — the traditional world of brick and mortar, which is in crisis, and the modern digital world, which is booming.

In “Future Shock 2020,” I will name the big winners and losers, tell you how to protect yourself and how to profit.

So be sure to join me online tomorrow at 2 p. m. Eastern.

Good luck and God bless!

Martin