Trillions in Consumer Debt Piling Up, Making These 3 'Haywire Insurance' Recos Critical

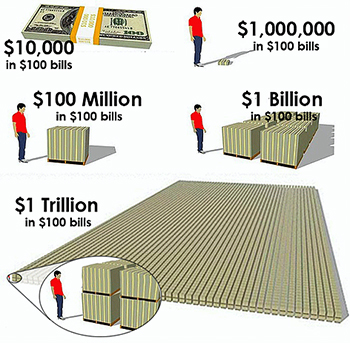

Politicians throw the word “trillion” around so much these days that it is easy to forget how truly massive a trillion really is.

A trillion is one thousand billions, or 1,000,000,000,000.

• One billion seconds ago is 31 years. One trillion seconds ago is 31,688 years ago. Western civilization has not even been around for a trillion seconds.

• A $1 million stack of $100 bills would be about 4 feet high. A billion dollars would be as tall as three Sears Towers stacked on top of one another, and $1 trillion would reach 789 miles high — or 144 Mt. Everests stacked on top of one another.

• If you spent $1 million an hour, you wouldn't run out of money for 411 years.

|

|

Click image for a larger view. |

But if the magnitude of 1 trillion is difficult to fit inside your mind, then 4 trillion may make your head explode. What’s so special about 4 trillion? That is how much consumer lender Lending Tree expects American consumer debt to hit by the end of 2018.

Yup — $4 TRILLION dollars.

Americans have been on a debt binge for years, but it has really taken off recently. Over the last two years, consumer debt has been led by increases in auto loans and credit cards, which both increased by about 7% per year.

|

|

Click image for the full article |

Worse yet, Americans owe more than 26% of their annual income to this debt. That’s up from 22% in 2010. Consumers are now spending about 10% of their income to service that consumer debt.

That’s on top of mortgages, taxes, food, utilities, insurance and other daily living essentials.

The interest rate on 10-year Treasury bonds has gone up 15 out of the first 21 weeks of 2018 and is now just under 3%. Higher interest rates mean higher mortgage rates, which hit a seven-year high of 4.66% last week.

Americans owe a total of $8.8 trillion of mortgage debt and 9% of those mortgages are adjustable. Which means a whole lot of Americans are in for a painfully expensive surprise when their mortgage rate resets.

I doubt that many over-indebted Americans can afford a big bump in their mortgage payments. Heck, just in the month of April, there were 64,183 properties in the U.S. that had foreclosure papers filed against them.

|

|

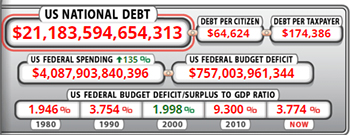

The U.S. national debt is at $21.2 trillion … and soaring. Click to see the U.S. Debt Clock in real time. |

And don’t get me started on Washington, D.C., and our national debt … not to mention financially strapped municipalities all around the country.

One thing that you as an investor should never forget: Assets are contingent, but debt is forever.

What’s that mean? The value of your stocks, ETFs, mutual funds, 401(k) and real estate may have sharply increased. But don’t make the mistake of mentally spending those unrealized gains, because the value of your assets can change rapidly. Just look at what happened in the financial crisis and the implosion of the dot-com bubble.

Unfortunately, any debt that you owe won’t go down like the value of your assets.

“Let no debt remain outstanding, except the continuing debt to love one another.” (Romans 13:8)

And the combination of rising debt and declining asset values that will come with the next bear market will sink millions of American households.

Of course, it is easier said than done to pay down your debt. But as investors, the most important move you can make is to have a meaningful position in the three most important “haywire insurance policies” you can own: (1) cash, (2) physical gold and (3) digital gold, aka cryptocurrencies.

When things go haywire, those two assets and cash will be your most valuable ones. Make sure you own all three.

Best wishes,

Tony Sagami

P.S. Ever since we launched our Weiss Cryptocurrency Ratings in January, the crypto world has been asking us to reveal to the public our ratings for each of the 93 cryptocurrencies we cover. And now through June 5, we are doing just that, PLUS showing the inner components of each of those ratings. Give us your email to claim your free copy of this time-sensitive report.