|

| By Tony Sagami |

Here’s a sad fact: According to the Federal Reserve, one in four Americans has nothing saved for retirement — zilch, zip, nada.

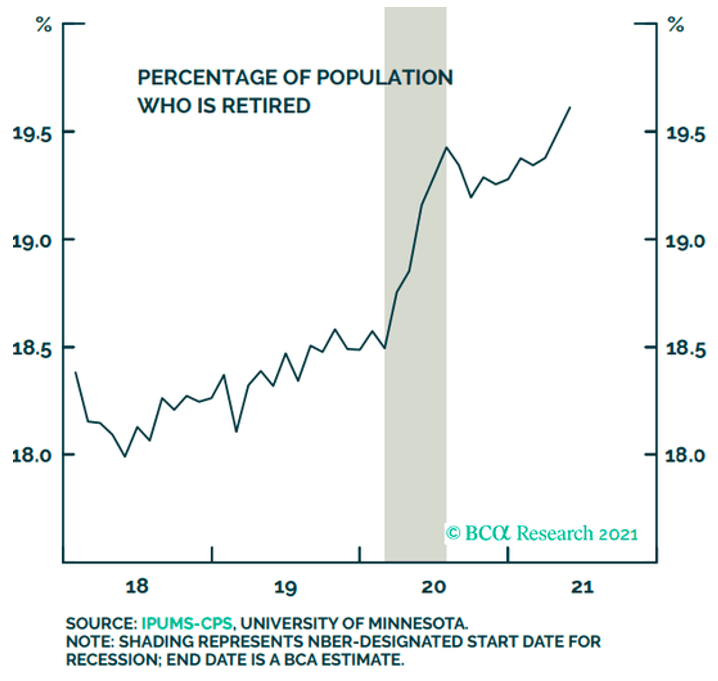

It’s another bad situation made worse by the coronavirus pandemic because a growing number of Americans are retiring early — not because they’re flush with cash, but because they desperately need to start collecting a Social Security check.

|

In fact, Americans are retiring at a faster pace than even during the 2008-09 Global Financial Crisis/Great Recession.

Since the start of the coronavirus pandemic, 2.5 million Americans have retired, twice the number who retired in 2019.

The Surge in Early Retirements

I’m a baby boomer, but I’m not yet one of the 28.6 million of us who are now retired. Sadly, many of my cohorts are far from financially set. The harsh truth is that you need to either work well past the traditional retirement age or save more money.

And the two best ways to save for retirement are through your employer-sponsored 401(k) and a Roth IRA. Let’s focus on the latter.

Back in 1997, Senator William Roth, a Republican from Delaware, championed passage of the individual retirement account that bears his name.

A powerful tool, it’s another sad fact that the Roth IRA is woefully underutilized.

Roth IRAs: Retirement Turbocharger

The Clinton administration was reluctant to give a tax break to the wealthy, so the Roth IRA was limited to individuals making less than $110,000 or couples making less than $160,000, with annual contributions capped at $2,000.

Today, you can sock away up to $6,000 a year into a Roth IRA.

The great advantage of a Roth IRA is that there’s no tax on the growth of your funds while it’s growing. But the most unique (and best) feature of Roth IRAs is that there’s absolutely zero tax when you take out the money.

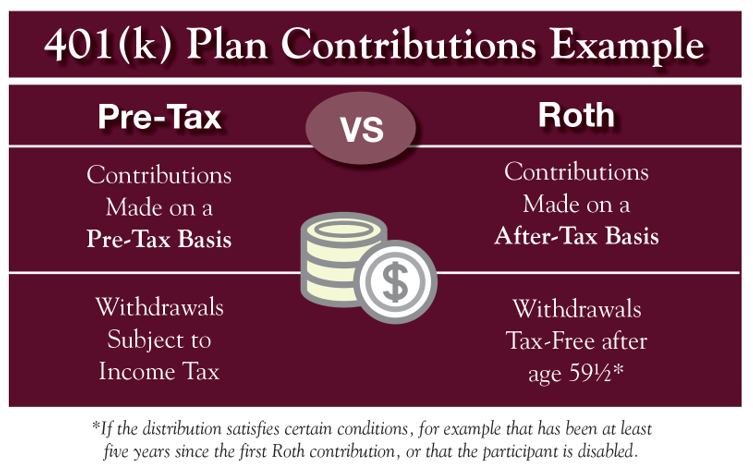

With traditional IRAs and 401(k) plans, you make contributions with pre-tax dollars, so you get a tax break upfront. Your money grows tax-deferred until you withdraw those dollars.

At that time, the withdrawals are considered to be ordinary income, and you pay tax at whatever the current tax rate is that time.

Roth IRAs are essentially the reverse. Your contributions are made with after-tax dollars, meaning there's no upfront tax deduction. However, withdrawals of both contributions and earnings are tax-free at age 59 and a half, as long as you've held the account for at least five years.

That’s a powerful advantage, one that’s on vivid display in the Roth IRA of billionaire Peter Thiel, the co-founder of PayPal Holdings, Inc. (Nasdaq: PYPL) and Palantir Technologies, Inc. (NYSE: PLTR).

Theil started his Roth IRA in 1999 with shares of PayPal, and it’s grown into a $5 billion tax-free piggy bank today.

Yup, that’s $5 billion, with a “b.” Thiel used the profits from PayPal to invest in other Silicon Valley startups like Facebook, Inc. (Nasdaq: FB) — as well as his own hedge fund.

The average investor will never accumulate $5 billion in their own retirement account … but it doesn’t obviate the fact that these plans are incredibly powerful tools. In fact, your current employer may offer a Roth 401(k).

|

Wait, a Roth 401(k)?

A Roth 401(k) is identical to a regular 401(k) except the contributions are not funded with pre-tax dollars. Roth 401(k) plans are funded with after-tax dollars.

One factor to keep in mind: If your employer offers matching 401(k) contributions, those matching contributions will be deposited in your traditional 401(k) account, even if you’ve opted to contribute to a Roth 401(k).

I’m no Peter Thiel … but I do have a Roth IRA, and I encourage you to consider one, too.

Best,

Tony Sagami