Upgrades and Downgrades of the Largest ETFs

Weiss Ratings recently upgraded the investment ratings of 1,121 exchange-traded funds and downgraded 447. We update ETF ratings every two weeks.

The upgraded ETFs on the list below spread across a number of categories. They are listed in descending order from largest total assets.

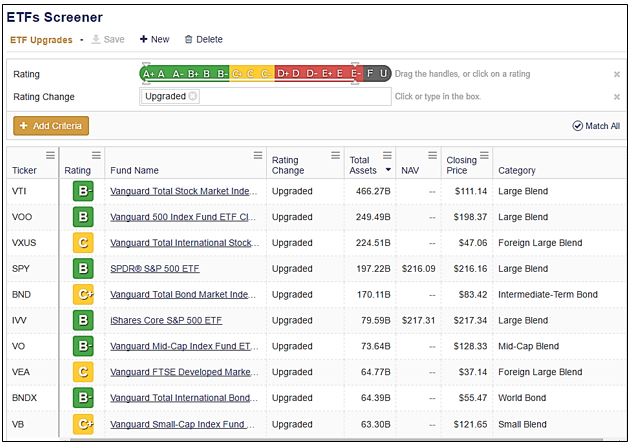

10 Largest ETFs with an Upgraded Rating

Some of the upgrades include ETF giants like Vanguard Total Stock Market Index FUND ETF Shares with over $460 billion in assets, and SPDR® S&P 500 ETF with $197 billion in total assets.

Vanguard Total Stock Market Index FUND ETF Shares is at the bottom of the BUY range with a B- investment rating. The fund offers a 1.86 percent dividend, does not require a minimum amount to open an account, and is much cheaper than the industry average with just 0.05 percent expense ratio. The fund’s top holdings include giants like Apple, Microsoft, Exxon Mobil, and others.

SPDR® S&P 500 ETF currently holds a B rating. This fund is also inexpensive with only a 0.09 percent expense ratio, and pays a 2.04 percent dividend. Its top holdings are very similar to the Vanguard ETF mentioned above, the top five investments include the same companies (Apple, Microsoft, Exxon, Johnson & Johnson, and Amazon) only varying in the weight each represents in the portfolio.

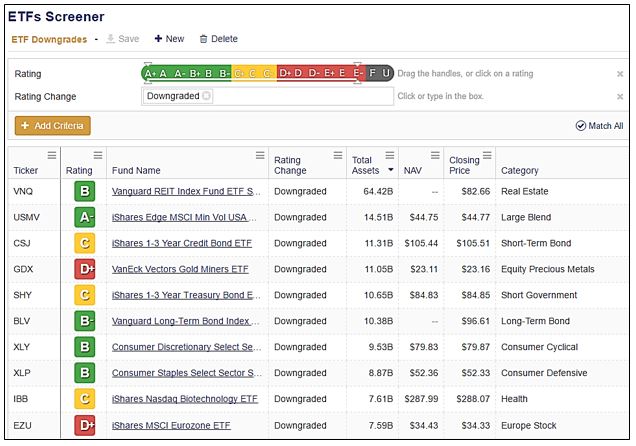

10 Largest ETFs with a Downgraded Rating

The largest ETFs with a downgrade mostly include iShares and Vanguard funds.

iShares Edge MSCI Min Vol USA ETF makes minimum volatility investments in securities comprising the MSCI USA Minimum Volatility (USD) index. It holds an A- investment rating and is the highest-rated ETF on the overall downgrade list. The fund offers above average one- and three-year returns, at 11.3 and 41.8 percent, respectively. It does not show anything for the five-year term, as it is a fairly new fund, founded in 2011.

VanEck Vectors Gold Miners ETF is one of the lowest-rated funds on the list, with a D+ (SELL) rating and $11.1 billion in total assets. The fund has a 68.4 percent year-to-date return and a 43.9 percent one-year return, but doesn’t offer much in the long run with a negative 57.8 percent return over the five-year period.

Click here, for a complete analysis and ratings of over 1,600 ETFs. Get comparison and custom reports on any one of them.