|

I’ve tried the landlord thing — single family, multi-family rental homes and commercial office buildings — and I didn’t like it.

Sure, I made money. But I didn’t like the accompanying landlord headaches. Especially the dog-ate-my-rent excuses. The biggest headache of all was empty buildings that paid me zero rent.

As bad as it was then, I can only imagine how much I’d hate to be a landlord today. Especially in big urban cites on either the East or West Coast.

Take a look at what’s happening in New York and San Francisco.

New York, New York!

People (and businesses) are leaving Manhattan in droves. According to Yated Ne’eman, an orthodox Jewish New York newspaper:

During the last two weekends in August, the streets of Manhattan’s Upper West Side were clogged with moving vans and U-Haul trucks being loading up with the belongings of the neighborhoods long-time, mostly upper middle-class residents. They are abandoning their homes due to fear and disgust over the rapid decline, since the pandemic struck, in the quality of life in the city as a whole and in their neighborhood in particular.

Residential sales plunged by 46% in Q3 and inventory of unsold homes is at an 11-year high. That’s bad, but the office space market is even worse.

|

Before the coronavirus pandemic, about 2 million people (mostly white collar workers) went to work in Manhattan office buildings. But only 10% of are back in the office, according to CBRE Group, Inc. (NYSE: CRBE, Rated “C”), a commercial real estate brokerage firm.

And it is not getting better. The majority, 8% of office workers, only returned in July.

I don’t blame them. Boarded up businesses and in-your-face protestors don’t exactly inspire confidence and security.

San Francisco/Silicon Valley

The San Francisco region is also struggling, with office occupancy in the 15% range.

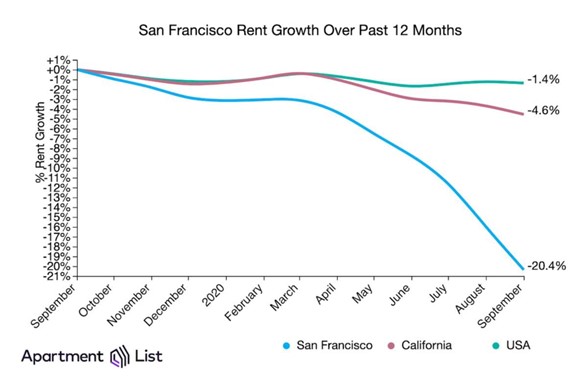

Residential rental prices have dropped for seven months in a row. The median price for a one-bedroom apartment was $2,830, a 20.3% decrease from September 2019.

Like New York, thousands of people are leaving San Francisco. Some are sick of the homelessness, crime and filth, while others are leaving because they can thanks to the work-from-home flexibility that Bay Area high-tech companies are offering.

|

Homes-for-sale inventory is 90% higher than last year and 200% higher than in September of 2015.

If you’re a REIT investor, you need to double check that you don’t own any that are heavily exposed to big urban cities where residents are fleeing and real estate prices are falling, such as these four RETIs:

New York REITs:

• Empire State Realty Trust, Inc. (NYSE: ESRT, Rated “D+”)

• SL Green Realty Corp. (NYSE: SLG, Rated “C-”)

San Francisco REITs:

• Essex Property Trust, Inc. (NYSE: ESS, Rated “C-”)

• Equity Residential (NYSE: EQR, Rated “C-”)

That doesn’t mean you should sell any of those four REITs tomorrow morning if you own it. But I strongly suggest you consider using a protective stop loss strategy to limit your downside risk.

On the other hand, suburban and rural real estate markets are doing very well. All those people fleeing New York and San Francisco need to live somewhere ... and that’s where you want to invest your REIT dollars.

By the way, my most successful real estate investments have been undeveloped waterfront land. No deadbeat tenants and no landlord headaches. However, I really prefer stocks, ETFs and bonds to real estate.

Best wishes,

Tony Sagami