Urgent Message: COVID-19 Impact on Markets

Coronavirus Crisis Impact on Markets

|

I decided to reach out to you today because of all the frightening news, both fake and true, about the coronavirus.

I’m afraid that you may be afraid about what’s happening around you, and I want to do everything I can to help.

I don’t have all the answers. I’m called “Dr. Weiss” because I have a PhD — I’m not a medical doctor. But I do know something about the impact the crisis may have on the economy and your money.

I have my father, Irving Weiss, to thank for that. He was probably the only person in the world who made a fortune in the Crash of 1929 and lived to do it again in the Crash of 1987.

|

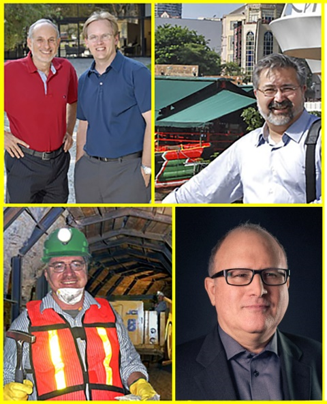

| Martin and Irving Weiss, 1989 |

He taught me how to prepare for the kind of gut-wrenching crisis that takes almost everyone by surprise, which seems to be a pretty good description of this crisis, too.

The first thing Dad taught me about is fear itself. It’s a bad thing if it causes you to make serious mistakes. But if it prompts you to take reasonable steps to prepare for true threats, then it’s not bad at all.

So, let me tell you what I think the true threats are to your financial well-being right now.

It’s not so much the growing fears of a pandemic. It’s the way our society and our industry react to those fears.

That’s the key. But if you want to better understand how this is unfolding, don’t rely on news from social media. Don’t even rely on established media. Instead, if I were you, I’d stick strictly with the most highly respected sources.

Like the Harvard Business Review, for example.

The Harvard Business Review has published a study about what they believe to be the main concern right now:

Disruption in global supply chains will inevitably have a big impact on manufacturing all over the world.

Personally, I also rely on trusted partners, friends and family who are calm, objective and analytical.

We have good business partners in China, which, as you know, is the world’s second largest economy.

They report that Beijing has virtually shut down their entire industrial economy and they are very certain that to get it back up and running is going to be a lot harder than most people think. So, U.S. companies that rely heavily on parts from China will be severely disrupted.

Everyone mentions Apple (AAPL). But it’s also a big problem for electrical machinery, clothing, auto parts, furniture, lighting and more.

Or look at Japan, the third largest economy in the world.

Tony Sagami, whom you probably know, is one of our lead editors at Weiss Ratings. He was born in Japan and still has family there.

He says that, although the virus is not yet widespread at all in Japan, many of the cases are concentrated in Aichi prefecture. And Aichi Prefecture is the home of one of the largest manufacturing complexes in the world, especially the Toyota Motor Corporation.

So now Toyota is also on the verge of shutting down.

My son, Anthony Weiss, lives in Japan. He recently bought a batch of tickets for the Tokyo Olympics. But now he tells me all the years of planning for the Olympics — and all the big bucks invested in the Olympics — are also up in the air.

If Prime Minister Abe has to cancel the Olympics, it will be the first time since World War II. It could be a big psychological shock, and a big financial shock, especially for the Tokyo stock market.

But this crisis is not just overseas. In Southern California, I have good friends who are very worried about the big port facilities there. Long Beach and Los Angeles, for example, have two of the nation’s busiest ports. But it seems the longshoremen are balking at unloading ships from China. That alone could be another point of disruption to supply chains for U.S. industry.

What next? The full effects of this epidemic are still not known. We don’t know how far the virus will spread, which countries will be affected most, or exactly how long it will last. And the CDC says that a vaccine is still 12 to 18 months away.

In the very near term, investors are pinning their hopes on the Fed, and for good reason: The Fed is almost definitely going to slash interest rates — and not just a quarter point! Plus, we’re pretty sure they’re going to crank up their giant money-printing machine. But the Fed’s actions can’t fix the supply chain disruptions. They can’t stop our factories from shutting down.

So, let’s set aside our fears and hopes for a moment and just face the facts:

First, the global economy was already on the verge of a major slowdown even before this crisis. Now, it’s pretty much written in stone. I have no doubt Europe, Asia and probably the United States will slide into recession, at least for a couple of quarters.

Second, it’s unfortunate that this is happening right in the middle of a highly contentious election year. The election was already creating a lot of uncertainty about the future, and now the coronavirus has become a political football, too.

Third, 2020 is going to be a bad year for most stocks, especially stocks that have been pumped up by a lot of hot air and speculation in recent years.

So, here’s what my team and I are doing …

Number 1: I want you to know we’re on top of it.

Our Weiss Ratings analysts and our editors are 100% tuned in to what’s happening and what’s likely to happen.

Starting right at the peak of the market in January, they’ve given you stop-loss orders on your stock positions. They’ve sent you alerts to take profits and build cash. They’ve shifted to more defensive positions. And when the time is right, perhaps after a nice bounce in the market, they’ll do more of the same.

Number 2: Even in a bad market, there are great profit opportunities.

|

| From top left: Martin Weiss and Michael Larson, Tony Sagami, Sean Brodrick, Jon Markman |

And if there’s anyone in the world knows how to find those profit opportunities, I think it’s us. That’s thanks mostly to my Dad’s teachings, which I’ve passed along to our next generation at Weiss Ratings, too.

We will show you how to invest in stocks, bonds and ETFs that are ideal for this environment. I’m not talking just about investments that will hold their value better than others. I’m also talking about special investments that go up despite the crisis … and even a select few that that go up because of the crisis.

Right now, for example, we’re looking at stay-at-home internet stocks, but not necessarily the giant companies like Facebook (FB), Google or Netflix (NFLX) that Wall Street thinks will be the big winners.

Our Treasury bonds and Treasury bond ETFs have gone through the roof.

And don’t forget: There’s also a very special kind of ETF — inverse ETFs — that are actually designed to profit from falling markets.

Number 3: This decline will not last forever.

And it could bring the best buying opportunity of the decade. You’ll have the opportunity to buy stocks that will have some of our highest Weiss Ratings at discounts of 20% … 30% … or even 50%. But here, timing is everything, of course. We’ll help you with that, too.

Number 4: Some unique things like cannabis stocks or cryptocurrencies had already seen big declines before this crisis began.

They were the first to fall. They could also be among the first to bounce back and surge. So, stay tuned. We’ll be sure to let you know when we think the time is right.

Number 5: There are times when less is better than more.

If you’re planning for a comfortable retirement and want to avoid risk, stick with a simple strategy. Aim for solid, consistent income.

And no matter what your goals may be, this is a time to keep plenty of cash on hand. Even if the Fed pushes yields back down to practically zero.

I have much more to tell you, and you probably have a lot of questions to ask. So, I just want you to know that I’m here for you through thick and thin, every step of the way. So is everyone on my team.

Feel free to call or email. We can’t give you investment advice that’s tailored to your personal situation. But we will do our best to answer any questions you may have about the markets, about investments and about what we feel are the best strategies for all investors.

For now, my advice to you today is simple: Stay safe. And be sure to stay in touch.

Thank you so much for joining me here today. I look forward to meeting you in person someday, or if that’s not possible, let’s meet online very soon.

Good luck and God bless!

Martin