Weiss Ratings’ analysis of the second quarter, 2016 data indicates the continued positive change in bank safety ratings from two years ago. In addition, the FDIC’s (Federal Deposit Insurance Corporation) list of problem banks has shrunk.

The trend suggests U.S. banks are continuing to improve slowly, demonstrating the overall stability within the industry.

Based on Q2, 2016 data, Weiss upgraded 593 banks and downgraded 240. There were 1,517 recommended banks this quarter. Those are banks with a Weiss safety rating of B+ or higher.

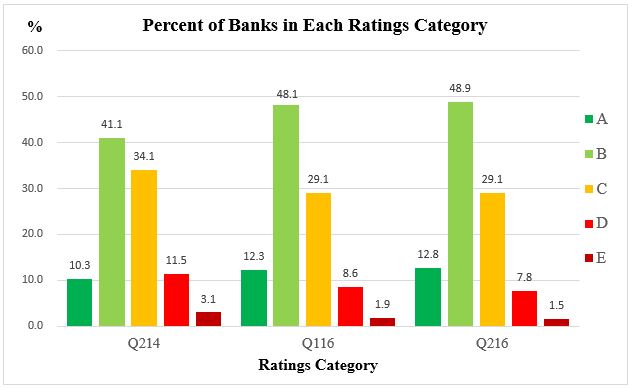

The percentage of A rated banks increased to 12.8 percent in Q2, 2016, from 12.3 percent in the prior quarter, not a significant quarterly change, but a 2.5 percent increase since Q2, 2014 when 10.3 percent of banks were rated A.

D and E rated banks declined from 11.5 percent and 3.1 percent in Q2, 2014, to 7.8 percent and 1.5 percent in Q2, 2016, respectively.

The graph below shows quarter-over-quarter ratings improvement is negligible. But, when compared to ratings from two years ago, there is an increase in the percentage of A and B rated banks, and a drop in C, D, and E ratings.

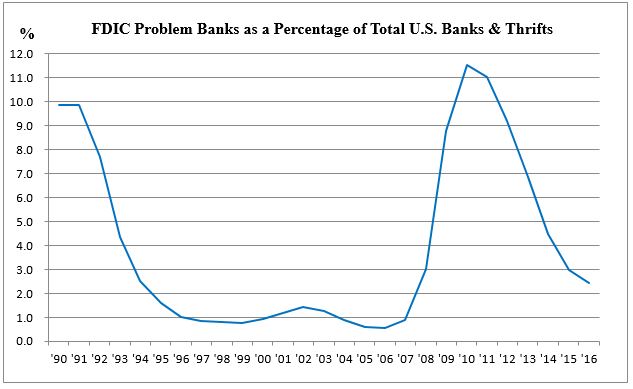

The FDIC, in its June 30, 2016, Quarterly Banking Profile, also indicated a positive change in the banking industry. Each quarter, the FDIC identifies and updates the institutions with financial, operational, or managerial weaknesses that threaten their continued financial viability. Those banks are called “problem banks”.

According to the FDIC, the number of problem banks declined from 165 in Q1, 2016, to 147 in Q2, 2016. This is the smallest number of FDIC problem banks in eight years. The total assets of these problem banks was down to $29 billion from $30.9 billion in the prior quarter. There were only three bank failures as of Q2, 2016, as compared to 5 at the end of Q2, 2015.

According to Weiss, 92 banks held an E (Very Weak) rating in Q2, 2016. This number had gone down over the last two years, from 201 banks in Q2, 2014, to 92 in Q2, 2016. Click here for Weiss Rating Definitions and scroll down to “Ratings Definitions for Depository Institutions” to find more details on E ratings.

The chart above indicates the percentage of the FDIC problem banks has been on the downswing since the high of 11.5 percent in 2010.

Both Weiss Ratings’ and the FDIC’s analysis indicate improvement in the banking industry. If you’re interested in locating a recommended bank near you, visit our Recommended Banks by State page. There you can select a state and all B+ or higher rated banks with branches in that state will appear on the list.