Utility stocks don’t usually create much excitement among investors, or the market, or in the news, but owning them may provide you with stable returns and low volatility … if that’s what you’re looking for, of course.

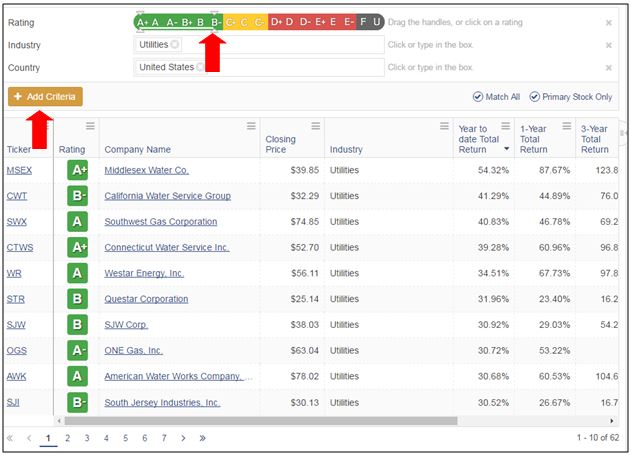

Using the Weiss Stocks Screener, we picked out all Weiss rated U.S. utility stocks in the BUY universe (rated A or B).

Most of these stocks have performed very well in 2016 so far, with year-to-date total returns reaching 20-, 30-, or even 50-percent. One, three, and five-year returns also show solid performance.

And, just to confirm that these are some steady, low volatility stocks, take a look at the beta value--only a few of them have a beta of 1 or more, meaning that most of them are expected to be less volatile than the market.

You can easily adjust the pre-set screener to include all rated stocks. Simply drag the handle on the ratings bar until all letter grades are included. You may also apply additional filters by clicking on “+Add Criteria”.

Be sure to utilize all of our stock tools and analysis to make better financial decisions.

Stocks

LinkedIn (LNKD) got scooped up by Microsoft (MSFT) for $26.2 billion dollars in the largest Microsoft acquisition ever. Now that it’s under the umbrella of a giant, who will be the next stagnant, unprofitable tech company out there that might get picked up by some other front runner like Amazon (AMZN), Google (GOOGL), or Facebook (FB)?

Twitter (TWTR) might be next. Although it just reportedly invested around $70 million in SoundCloud, a Berlin-based music streaming service, their unprofitability and poor returns don’t look promising so far. So, will Twitter be the next acquisition target and shoot up in price like LinkedIn did?

Add Twitter to your Watchlist and get the latest rating updates from us.

ETFs

Weiss rates more than 1,600 exchange-traded funds allowing you to find the ones that fit your investment needs the best.

Whether you’re looking for something risky with high returns or low risk and low return, or maybe a certain combination of both, Weiss Ratings can help you accomplish it with tools and reports on all of the rated funds.

Mutual Funds

The United Kingdom’s decision to either stay or leave the European Union will have a significant impact on the European and global economies. The British pound is expected to be highly volatile in the coming weeks and months, sending ripples all across the financial world. If the British decide to leave, there will be a mountain of economical and social implications, coupled with a steep economic cost.

Here is a quick glance at how mutual funds with heavy focus on European stocks are performing.

From the first look we can tell that they may not be the ideal investment at the time with a negative year-to-date and one-year returns for most of them, and the uncertainty of the European economy should make investors even warier of mutual funds with European investments.

Click here to see all Weiss rated mutual funds.

Banks

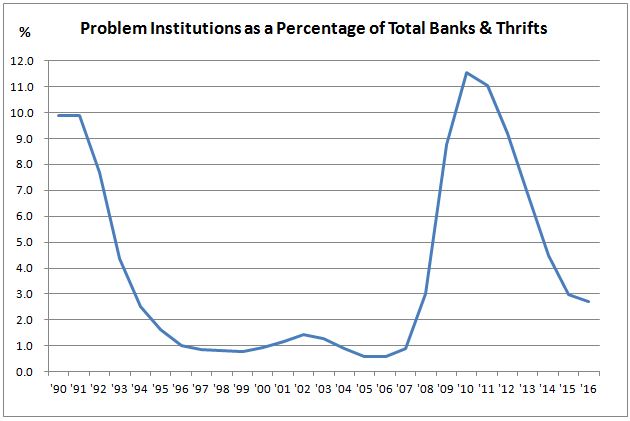

According to the Federal Deposit Insurance Corporation’s (FDIC) Quarterly Banking Profile, the bank “Problem List” continued to decrease in Q1, 2016 dropping to 165 institutions from 183 in the prior quarter. They now represent 2.7 percent of the industry, the smallest number in over seven years and significantly down from the peak of 888 banks in Q1, 2011.

To see Weiss rated vulnerable banks, check out the weakest bank list. It includes all banks with a Weiss Safety rating of D or E.

Credit Unions

Weiss Ratings analyzes over 6,000 credit unions providing you with safety ratings, analysis and custom reports on all of them.

You can also check out Weiss Ratings’ “Credit Union of the Day”, where we feature a different top-of-the-line institution every day along with ratings changes and a ratings distribution chart for all credit unions.

Use the Credit Unions Screener to build your own custom lists.

Insurance

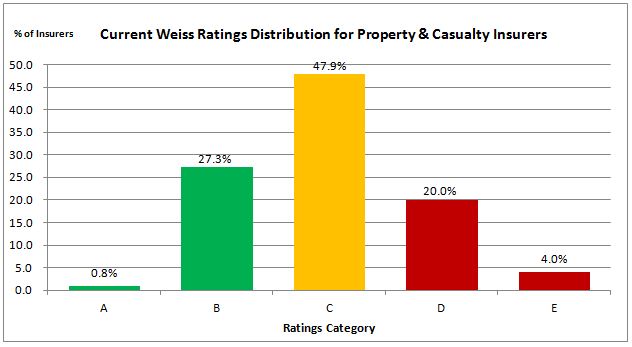

Based on Q4, 2015 data analysis of property and casualty insurers, there were 20 “A” rated companies representing 0.8 percent of the entire P&C industry. This number decreased by three insurers since Q3, 2015.

645 “B” rated companies represent 27.3 percent of the industry and 1,132 P&C insurers fall under the “C” rating representing 47.9 percent.

473 “D” rated insurers and 95 “E” insurers represent 20 and 4 percent of the industry, respectively.

Visit Weiss Ratings website to see safety ratings on all P&C insurers and explore available tools and reports.