‘V’-Shaped Recovery? Not When Half of America is Jobless!

|

She was the prettiest girl in school, so I almost fainted when she handed me an invitation to her birthday party. It was my first boy/girl party, so I was both nervous and excited.

On the day of the party, her mother greeted me at the door and said something like, “everybody is in the back by the pool.”

|

The pool? Not only was the object of my crush the prettiest girl in school, her family was also one of the wealthiest. Only two families in my town had a swimming pool, and I thought those two families were the richest people on the planet, up there with the Beverly Hillbillies, who also had a cement pond.

This was luxury living compared to my reality at the time. My father was a hard-working vegetable farmer. We were definitely one of the lowest income families in town. The only place my siblings and I ever swam at was in an eddy of a sand bar in the river by our farm.

When you’re a kid, some things — like my high school crush’s swimming pool — just scream wealth to you.

I also thought that people who lived in a home with a second floor, a paved driveway, or color TV were filthy rich. I also thought having Dixie Cups in the bathroom, hamburger buns instead of white bread, getting a haircut from somebody other than your mother, owing more than one pair of shoes, going on a summer vacation to anywhere, drinking Coca Cola instead of Kool-Aid and having your own bedroom were luxuries only the upper class enjoyed.

While my father never made much money, he always had a job because he was self-employed. So, though his income wasn’t high … it was consistent.

That’s not true for the millions of Americans today who have lost their jobs because of the coronavirus pandemic.

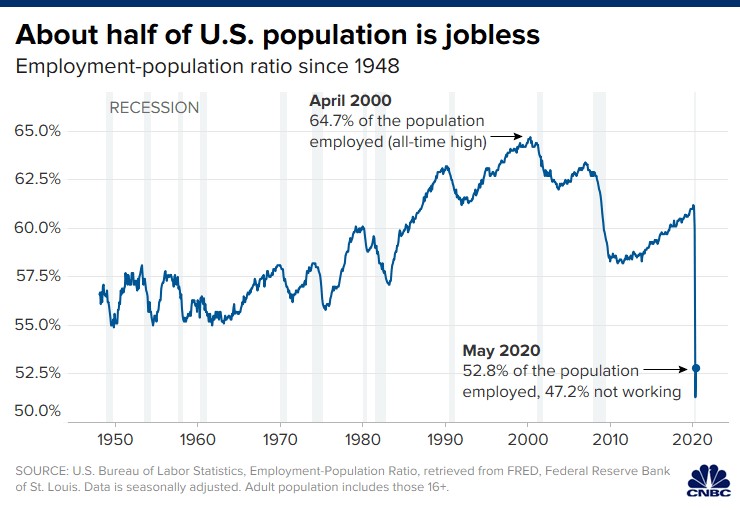

In fact, a whopping 47.2% of Americans don’t have a job!

|

That’s right — roughly half of America is jobless. Out of the 164 million Americans that in the labor force, 78 million of them are not working.

This is called the employment-population ratio, which is different from the unemployment rate, which measures the number of people that are actively looking for a job.

The difference between the two numbers is that Americans that are too discouraged to even look for a job as well as people who could work but are happy doing nothing are not included in the unemployment numbers. They are, however, included in the employment-population ratio.

I know the stock market has been on a roll, but with no end in sight for coronavirus and with almost half of Americans not working, I find it impossible to buy into the “V-shaped” recovery that Wall Street is banking on.

And if the Congressional Budget Office is right, it will take a decade — yes 10 years — for the job market to get back to where it was before the pandemic.

For an economy that is driven by consumer spending, that’s a pretty good reason to take some of your stock market chips off the table.

And if you have some dollars for a potential home run speculative bet on falling stock prices, you should consider inverse ETFs and/or put options that rise in value when the stock price fall.

Even though my family wasn’t the richest, we always had income coming in because of the hard work and sacrifices that we made.

My father was a realist when it came to his livelihood, and it’s about time smart investors like you start viewing the market in the same light.

Best wishes,

Tony Sagami