We Recommend ETFs That Support the Security of Our Country

We reviewed over 1,700 ETFs to find the ones that invest in the U.S. security and defense. There are a number of them that fall under the Industrials Category, but the four below follow indexes related to the U.S. aerospace, rail and road infrastructure, or national defense.

All four are BUY rated with year-to-date returns well above the industry average of -3.41 percent. They are all open to new investors and do not have a minimum initial investment.

PowerShares Aerospace & Defense Portfolio (Ticker: PPA, Weiss Investment Rating: B)

The fund invests in companies that are engaged in development, manufacturing, operation and support of defense, military, homeland security and space operations. It aims to follow the SPADE® Defense Index, has a dividend yield of 1.37 percent, and a year-to-date total return of 10.03 percent.

SPDR® S&P Aerospace & Defense ETF (Ticker: XAR, Weiss Investment Rating: B)

The investment aims to provide returns similar to the total return performance of the S&P Aerospace & Defense Select Industry Index. The fund invests at least 80 percent of its total assets in the securities comprising the index. It has a 0.72 percent dividend yield and a year-to-date total return of 12.02 percent.

Industrial Select Sector SPDR® Fund (Ticker: XLI, Weiss Investment Rating: B)

The fund generally invests in the securities from aerospace and defense, industrial conglomerates, air freight and logistics, transportation infrastructure, and road and rail. It aims to follow the Industrial Select Sector Index. This ETF offers a 2.05 percent dividend yield, which is the highest of the four reviewed ETFs and also has a solid 11.77 percent year-to-date total return.

iShares U.S. Aerospace & Defense ETF (Ticker: ITA, Weiss Investment Rating: B)

The investment aims to track the Dow Jones U.S. Select Aerospace & Defense Index. The underlying index measure the performance of the aerospace and defense sector of the U.S. equity market. The fund has 0.86 percent dividend yield, with a 11.50 percent year-to-date total return.

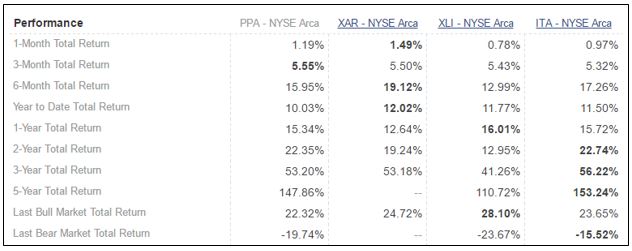

You can compare these four ETFs side by side to determine which is the best pick for you. By using our comparison tool, you are able to clearly see which ETF is the best performer in each category.

The above mentioned ETFs have investments in companies such as, Boeing (C), Lockheed Martin (A), United Technologies Corp (B-), Harris Corp (C+), and Raytheon Co. (A). Check out the ETFs’ listing of top holdings to see where they put your money.