Weiss Ratings Upgrades 223 Stocks, Downgrades 281

Weiss ratings upgraded 223 stocks over the last three business days and downgraded 281.

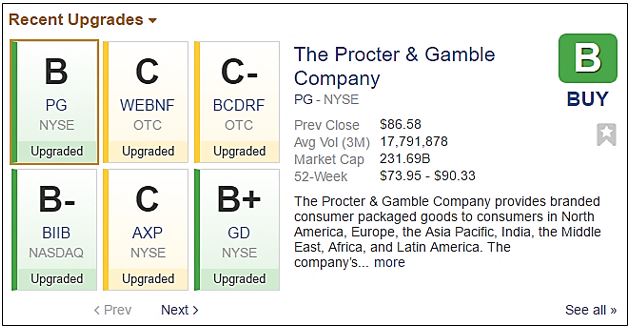

The upgrades include companies such as Procter & Gamble, Papa Johns, and Charles Schwab Corporation.

Procter & Gamble Company (PG) was upgraded to B, from B- due to an increase in growth and the total return. The company’s rating has been improving since the C+ rating it had back in April, 2016.

Papa John’s International Inc. (PZZA) received an upgrade to B from B- due to a decrease in volatility and an increase in the total return index. It had been a buy stock for over two years, with one exception, when it dipped to C+ in March, 2016.

The Charles Schwab Corporation (SCHW) moved to the top of the HOLD range with a newly assigned C+ investment rating. It was previously rated C.

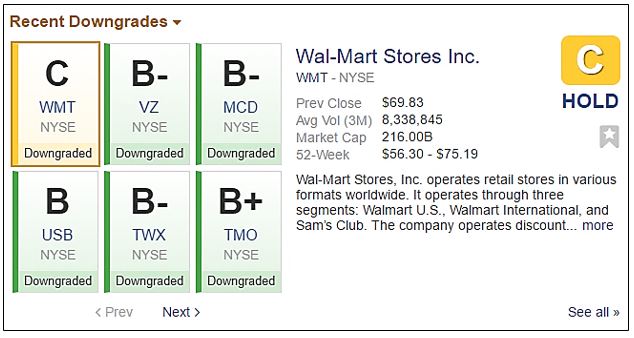

Some of the downgrades include Verizon, Comcast, and Walmart.

Verizon Communications Inc. (VZ) was downgraded to B- from B. The company saw a decline in growth and valuation, and an increase in volatility.

Comcast Corporation (CMCSA) moved down to B from B+ due to a decline in total return and an increase in volatility.

Wal-Mart Stores Inc. (WMT) was downgraded to C from C+ due to an increase in volatility and a decrease in total returns. The company was a BUY at the beginning of September, 2016 but dropped down to a HOLD by the end of the month.

Here’s more detail on how we assign stock ratings and what might influence an upgrade or a downgrade.

We begin by taking thousands of pieces of stock data and, based on our own model, balance reward against the amount of risk to assign a rating. The results provide a simple and understandable opinion as to whether we think the stock is a BUY, SELL, or HOLD.

Our stock ratings are based on two sub-ratings:

Risk Rating - Primarily based on the level of volatility in the stock’s daily, monthly and quarterly returns and on the company’s financial stability. Stocks with very stable returns are considered less risky and receive a higher risk rating. Stocks with greater volatility are considered riskier, and will receive a lower risk rating.

Companies with poor financial stability are considered riskier investments than those that are financially stable.

Reward Rating – Primarily based on a stock’s total return to shareholders over the trailing five years and, based on sales, net income, earnings trends and anticipated dividends, its prospects for future returns.

Additionally, based on the stock’s current price, other important ratios are factored in.

Based on proprietary modeling the individual components of the risk and reward ratings are calculated and weighted and the final rating is generated.