What 30 Years of the Best-Performing Stocks Tell Us

Have you ever owned a stock for 10 years?

How about 20 years? Thirty?

Investors used to buy and hold their mutual funds, index funds and even their stocks for decades. A big reason why was because of fees and broker commissions. Most people preferred to leave their money alone rather than rack up charges.

But in today’s world where it’s easy to find low- or even zero-cost trades, people are trading more than ever. They want to see bigger and faster gains … and they are placing their bets accordingly.

This can backfire if you only place your capital into today’s hottest names. That’s because some of the biggest stock market profits are coming from companies that are on investors’ back burners.

Most People Like Investing in Revolutionary Technology

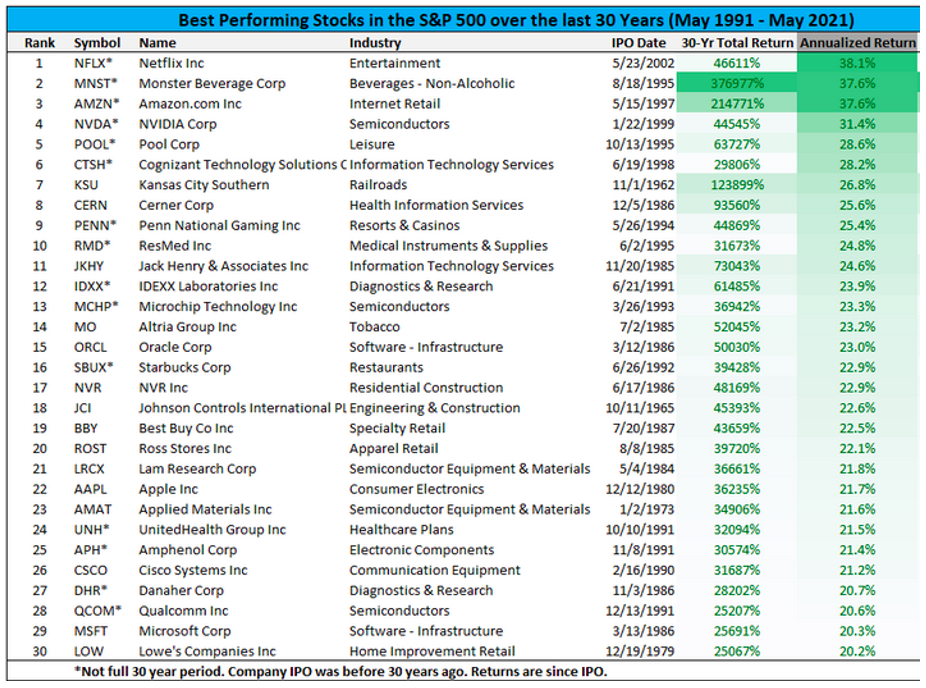

Everyone knows about the FANG+ stocks – Facebook, Amazon, Apple, Netflix, Google (aka Alphabet) and Microsoft. Not surprisingly, they are among the best-performing stocks of the past 30 years.

|

| Source: Compound Advisors |

But it’s not just these revolutionary businesses that have helped investors to fund their retirement accounts.

Some names that have ranked even higher over the past three decades include railroad holdings company Kansas City Southern (NYSE: KSU), banking firm Jack Henry & Associates (Nasdaq: JKHY), tobacco producer Altria (NYSE: MO) and Ross Stores (Nasdaq: ROST).

I’m not opposed to investing in any stock that rises to the top of my proprietary trading models. We are here to make money, after all.

But what makes these stocks stand out above the rest shouldn’t make you scratch your head.

After all, they’ve been in business upward of 30 years. This tells us that their business models are clearly working for them … and for their investors.

Investing in Evolutionary Innovation Also Offers Rewards for Those Willing to Wait

Revolutionary change — like smartphones and streaming video — is fast, disruptive and dramatic.

But most innovation tends to be gradual, incremental and even boring.

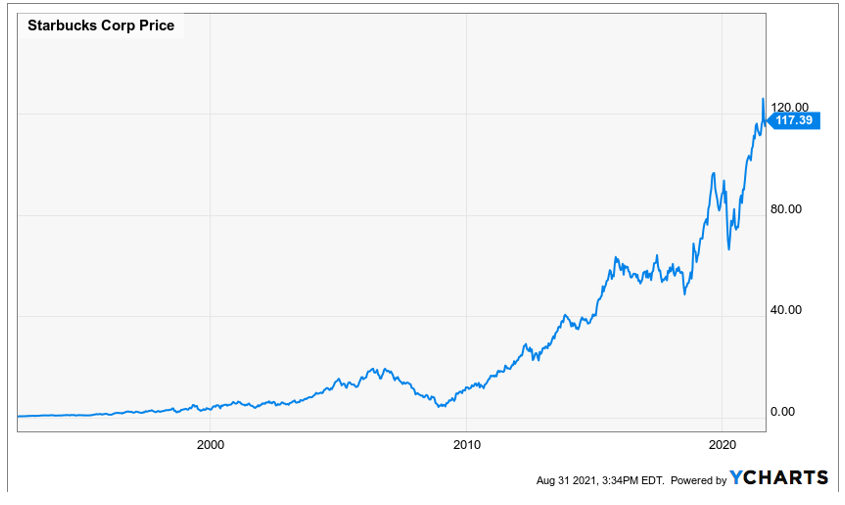

Just look at the following Starbucks (Nasdaq: SBUX) chart, another company included on that list of top-performing stocks over the past 30 years:

|

Gradual, incremental … and boring!

Evolutionary innovation focuses on gradually changing existing fundamentals and business practices.

• In fact, the National Bureau of Economic Research found that evolutionary companies tend to deliver greater stock gains than the original revolutionary disruptors.

That’s right: bigger stock market profits!

Examples of evolutionary innovators that became fabulously wealthy: Sam Walton, Phil Knight and Charles Schwab are just a few examples.

• None of them invented anything — all they did was build a better mousetrap and delivered products/services faster, better and/or cheaper than anybody else.

The reality is that most successful companies simply out-execute the competition with a new twist on an existing product or service.

I expect we’ll see many of these stocks on a similar list 20 years from now. But we could also see some other dark-horse candidates gallop ahead of them.

My recommendation? Look far beyond the headlines when you’re ready to find your next great investment.

Best,

Tony Sagami