What Could Go WRONG for This Market? Here Are My 2 Answers

|

“What could go wrong?”

An investor at the Las Vegas Money Show asked me this on Monday.

It’s a question I ask myself every time I give my subscribers a new trade idea … and again when it comes time to exit the position.

After all, you can lay out what you think is a solid buy or sell thesis. You can back it up with data, charts and whatever else you like. But ultimately, you have to be ready to acknowledge that yes, things can and do go wrong. You have to anticipate those potential snafus ... and be ready to adapt if they strike!

This gentleman wanted to know what might derail my “Money Flood” theory …

What might cause policymakers to change their “low/zero/negative interest rate policy forever” plans …

And what might change the market’s tendency over the last year or so to quickly recover from whatever the world throws at it.

My short answers?

• A big political shift or an interest rate “shock.”

Let’s start with politics. The Federal Reserve’s come under increasing political pressure to keep money cheap and easy. That was true during the Trump administration, and it’s true so far in the Biden administration.

The Fed’s supporters will always claim political pressure doesn’t matter, arguing that the Fed is apolitical. But look at its track record.

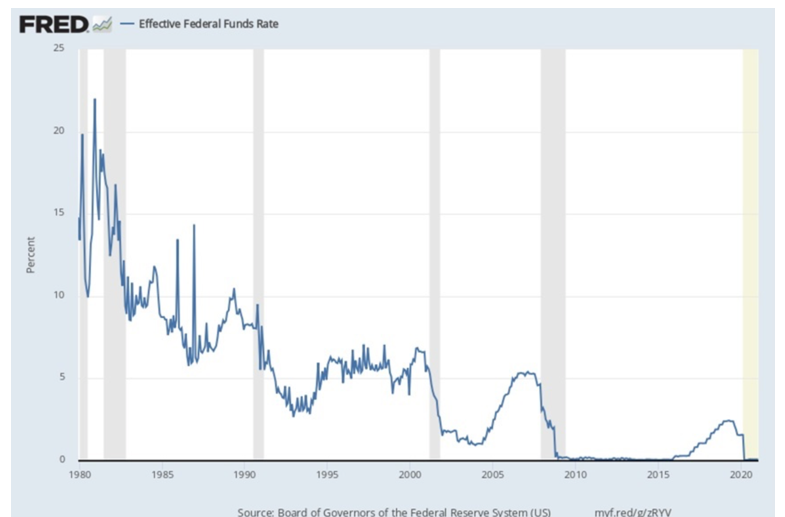

It stopped hiking rates in late 2018 as political and market pressure built. Then, after cutting rates to zero during the worst of the COVID-19 crisis, it moved to the sidelines.

|

| Source: Board of Governors of the Federal Reserve System |

Policymakers have also made it abundantly clear they have no intention of raising rates anytime soon, even as the worst of the pandemic (from a purely ECONOMIC standpoint) is most likely behind us.

Meanwhile, progressives are pressuring the Fed to focus on all kinds of issues that were never in its wheelhouse before. Things like climate change. And they want the Fed to focus more on the employment side of its dual mandate, while putting inflation concerns on the back burner.

• We’d need to see a strong shift in the political landscape for this dynamic to change.

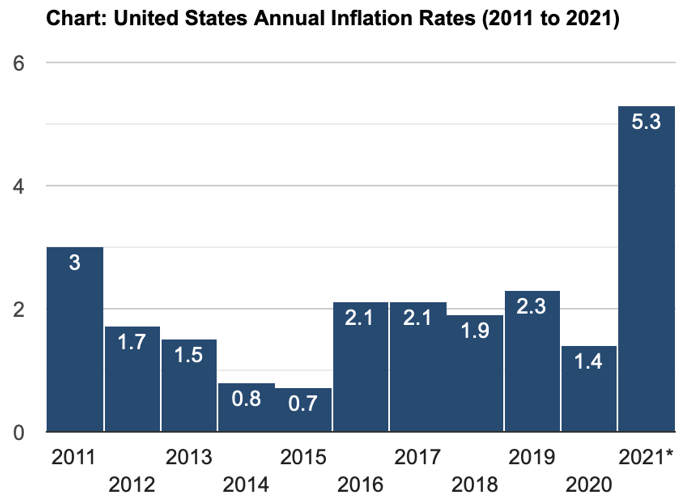

For example, we’d need to see something like inflation getting so bad, politicians practically beg the Fed to crack down and try to get it under control.

|

| Source: U.S. Inflation Calculator |

That chart is staggering … but do you see ANYONE arguing for tighter policy? I sure don’t.

• That brings me to my second catalyst for change: A rate “shock.”

Bond investors could stand up and say they’re not going to take it anymore … show Washington that they’re sick of never-ending budget deficits, skyrocketing debt loads and “real” yields (those adjusted for inflation) mired deeply in negative territory.

How would they do that? Simple. Sell. Sell Treaurys hand over fist. Force change in Washington.

It HAS happened before. So, this is the more likely “What could go wrong?” scenario I always keep in the back of my mind. And I’m always looking for evidence that it’s starting to unfold.

But playing for Money Flood profits has worked out great for investors like you over the past year. Fighting back against paltry yields with key income-boosting strategies has delivered great results.

Unless and until conditions change, I’m going to keep helping you capitalize on those trends ... even as I keep asking myself the same important question that audience member did.

Until next time,

Mike Larson