As Dr. Martin Weiss noted at the top of yesterday's issue, there are now 7,000 cryptocurrencies. They trade on 459 exchanges around the world. Their total market capitalization is $2.37 trillion.

There’s a lot going on in the crypto industry, where a logical endpoint of the primary animating trend right now — decentralized finance (DeFi) — is nothing less than monetary and financial (and perhaps, too, social and political) revolution.

Only heady stuff like that can drive the kind of price action we’ve seen in recent months, weeks and days. It’s typified by Ethereum’s (ETH, Tech/Adoption Grade “A-”) surge past $3,000 last weekend.

As of midday Monday, the world’s second-largest cryptocurrency was trading around $3,260, according to CoinMarketCap.com, up more than 11% in the preceding 24 hours and more than 31% in the preceding seven days.

As our Sam Blumenfeld noted at the top of Friday’s issue of Weiss Crypto Alert, “There is a real debate to be had now about where leadership rests in the rapidly evolving cryptocurrency market.”

Bitcoin (BTC, Tech/Adoption Grade “A-”) remains the King of Crypto, with a market cap on its own of $1.08 trillion. But, as Sam pointed out, its “dominance,” or its share of the total crypto market, recently fell below 50% for the first time since November 2017.

“Price” aggregates an incalculable number of discrete data points — it’s the outcome of millions of decision-makers taking account of their own particular circumstances. Right now, price is telling us a lot about Ethereum, DeFi and, yes, Bitcoin, too.

Primarily, there is a great deal of expectation piling on top of promise right now. As Jim Bianco of Bianco Research has said, this is the biggest thing since the Bank of England invented fiat currency in the middle of the 17th century.

It’s happening fast. And the best way to understand it is to follow along with the Weiss Crypto Alert team: Sam, Alex Benfield and Marija Matic.

Here's how Marija framed last weekend's action:

BTC is losing a critical dominance level to altcoins, as depicted on this chart via TradingView:

On a weekly basis, BTC closed below the 50% support level, and that’s a clear buy signal for Ethereum. Indeed, the previous altcoin rally on Dec. 18, 2017, when BTC closed its weekly dominance candle below 50% for the first time in history.

That happened exactly the day after BTC reached an all-time high. Now, we can’t say that BTC is done this time — far from it. But we sure can see that the outlook for ETH is extremely bullish.

ETH has strung together seven consecutive positive months for the first time in its history. It gained the most value in January (78%). But there’s a strong possibility May will outshine those gains.

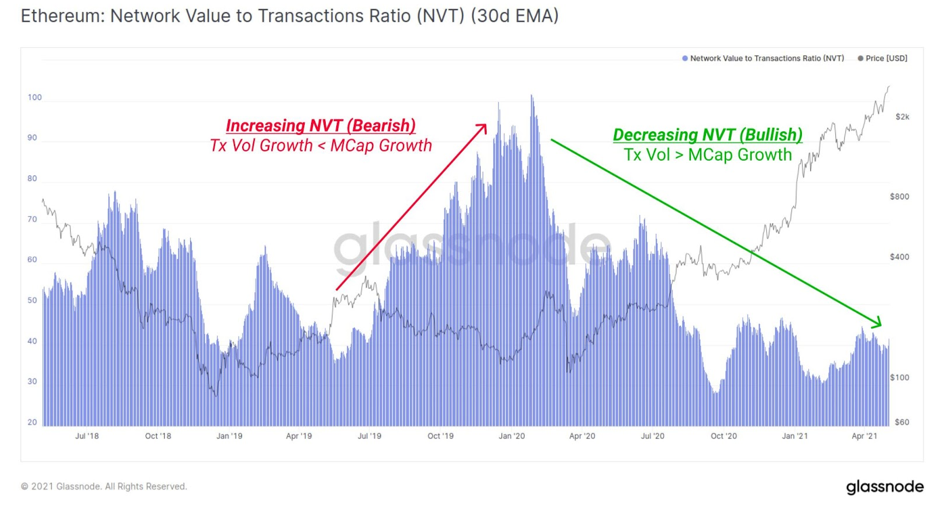

As usual, Ethereum — the first alternative to Bitcoin — is leading the altcoin rally. The use of Ethereum reached an all-time high in April. In fact, the growth of transaction volume on the network was higher than the growth of its market cap. The network value-to-transaction (NVT) ratio reflects this, as it’s significantly decreasing over time.

In other words, the usage of Ethereum is growing faster than its price. We like that kind of action, and we expect to see the ETH price catch up.

Part of the reason why Ethereum’s outlook is so bullish is due to its layer 2 solutions exploding in usage, especially Polygon. Cheaper and faster transactions are already being realized.

On top of that, the European Investment Bank (EIB) has issued its first-ever bond on Ethereum.

The use of ETH — and BTC, too — exploded in April, reaching all-time highs. ETH has reached $346 billion in on-chain monthly volume, while BTC reached $447 billion. (You read that right: Almost half a trillion dollars of BTC volume, in just one month; it’s still the King…)

Click here to follow Weiss Crypto Alert for daily updates on Ethereum, Bitcoin, altseason and the rapidly unfolding DeFi revolution.

Best wishes,

David Dittman