The novel coronavirus continues to test the limits of all sorts of institutions, most obviously governments and their agencies.

It is exposing weaknesses and ruining long-held plans, rewarding the prepared and creating new opportunities — all at the same time.

We’ve talked about a great “transformation” that Jon Markman continues to chronicle, a real-time separating of the traditional brick-and-mortar economy, which is in shambles, and the modern digital world, which is soaring.

We’ve also discussed the compelling narrative for the rise of gold, guided by Sean Brodrick, who only yesterday noted that the “smart money is starting to see we’re at the beginning of a bull market in precious metal.”

This pandemic has, most notably, exposed the U.S. government’s three branches as not much more than the “money, television, and bullshit” P.J. O’Rourke saw them for 30 years ago.

And that has potentially profound implications for the global political, economic and financial system it centers. That includes the demise of the U.S. dollar.

It’s this bundle of worries about systemic stability — not to mention equity and fairness — that inspired Satoshi Nakamoto’s publication of “Bitcoin: A Peer-to-Peer Electronic Cash System” amid the Great Recession back in October 2008.

Well, the emergence of an entirely new system built on blockchain technology and cryptocurrency seems an ever-brighter prospect with each passing day, no?

The crypto industry has indeed come a long way since its “founding” nearly a dozen years ago. But set aside the “Utopia” stuff; In the here and now, we have Juan Villaverde and Bruce Ng of Weiss Crypto Ratings to explain what could potentially turn out be the foundation of the 21st century global financial system.

Here’s their recent report on a serious crypto trend with real legs, including a specific name to watch:

DeFi stands for Decentralized Finance. Basically, it's borrowing, lending and trading financial assets on the blockchain.

With no traditional intermediary — bank, broker or stock-exchange — standing in the middle and taking a slice of every transaction.

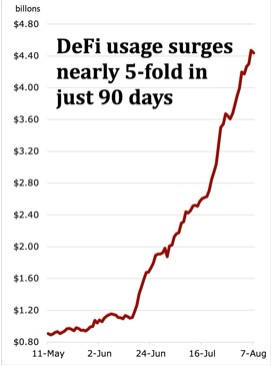

DeFi is growing like crazy, because the services it provides cost far less and require far less time than those from legacy providers ... like brick-and-mortar banks, or human brokers.

Over just the last three months, TVL has surged from about $900 million to $4.4 billion.

A Coin at the Heart of Crypto's

Booming DeFi SectorSynthetix (SNX) is a decentralized exchange where you can trade just about any asset with vastly lower transaction costs and far less time for settlement.

Take stocks, for example.

When you buy shares the old-fashioned way, a parade of intermediaries — brokers, dealers, market-makers and custodians — typically stand between you and the seller.

Why are they there? Largely to guarantee the fairness and integrity of the transaction.

Synthetix dispenses with these intermediaries, but still allows traders to do business with folks they don’t know and have no reason to trust — with no fear of getting cheated. That's because the blockchain automatically ensures the integrity of every transaction — and at a fraction of the cost of the customary army of middlemen.

Because of this, traditional asset brokers, banks, and other intermediaries increasingly face an existential threat to their business model. DeFi platforms like Synthetix are going to eat their lunch!

And it’s not just traditional stockbrokers who're at risk. You can trade just about any asset under the sun on Synthetix including gold, fiat currencies, all manner of crypto assets, and theoretically, even real estate.

The only “certainty” right now is “uncertainty.” Confidence in the things that have guided us for literally decades is ebbing.

The United States faces, once again, “the most important election of our lifetimes.”

And the threat of COVID-19 is still looming large.

Could the federal government's response have prevented all this? Who knows.

What is certain is that Bitcoin, blockchain technology and cryptocurrency have a place in the now ... and they could very well be the future of our financial system.

Best wishes,

David Dittman