What Is ‘Disruption’? (And How to Profit from It?)

|

“Are you serious?!” I howled at my son.

It was about three years ago. He’d just told me he’d invested half of his college fund into cryptocurrencies.

That money was for tuition. It was not for speculating in digital-ledger/blockchain “technology.”

|

By now, you know the rest of the story ...

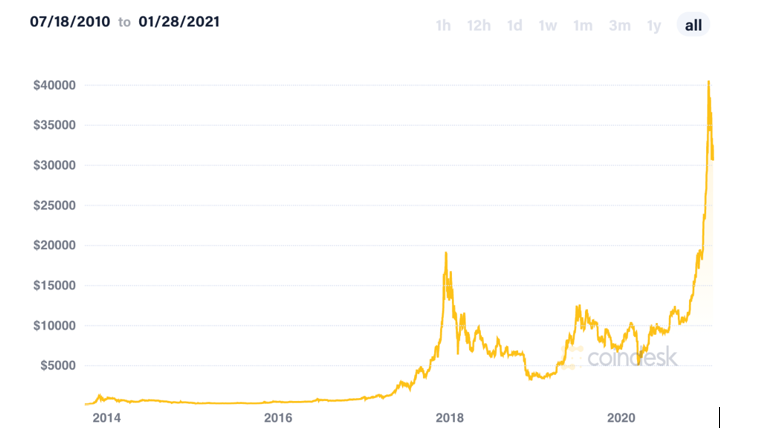

Cryptocurrencies, such as Bitcoin, have been on fire. And the value of my son’s crypto account has increased by roughly seven times over. His digital wallet is fat enough to cover not only tuition, but a nice used car as well.

I sure wish crypto existed when I went to college.

OK … I’ve been wrong about crypto, maybe, being kind, a little late. I’m still not a cheerleader. But its rapid impact does give me pause to ponder how technology has changed our lives.

Think about some things that didn’t exist 20 years ago ...

Social Media: Facebook, Inc. (Nasdaq: FB), YouTube, Twitter, Inc. (NYSE: TWTR), TikTok, Instagram, Snapchat, WhatsApp, LinkedIn ...

Personal Technology: iPhones, iPads, Netflix, Inc. (Nasdaq: NFLX), Facetime, Zoom Video Communications, Inc. (Nasdaq: ZM), Google Maps, Skype, Xbox ...

Companies: SpaceX, Tesla, Inc. (Nasdaq: TSLA), Airbnb, Inc. (Nasdaq: Unrated), Uber Technologies, Inc, (NYSE: UBER) ...

And, of course, cryptocurrencies, like Bitcoin and Ethereum.

I’ve been investing in disruptive technologies for most of my adult life, and I’ll continue to do so until the day I die.

I’m able to get my head around Facebook. Human beings are social creatures, and they like being able to “connect” across whatever time or distance there is between them.

CEO Mark Zuckerberg and his minions are monetizing that impulse. Good for them; there’s some “evolutionary innovation” going on, folks. And I don’t mind owning that.

(In fact, next month, I’ll debut a new monthly service devoted to identifying “dominators and disruptors” well placed to profit based on their command of 21st century technologies. I’ll have more information for you soon, so keep an eye on your inbox.)

A share of stock in a company of that nature gives you ownership of a living, breathing, operating business. A bond is a loan to a company or government.

In both cases, there’s something physical and tangible behind the investment.

This gets to the heart of why I howled at my son. And it’s the no. 1 reason I haven’t invested in cryptocurrencies: I only invest in things I understand.

And I still can’t explain what’s behind Bitcoin and other cryptocurrencies. I’m not sure it’s evolutionary innovation (it’s just a digital ledger ...). But I feel pretty good underselling its “revolutionary” aspects.

There’s no denying prices for many cryptocurrencies have increased substantially and, in the process, cryptos as a whole have become much more popular. I hear people in coffee shops and at the grocery store talking about Bitcoin.

I’ve also listened to folks like Warren Buffett.

The Oracle of Omaha said, “I don’t have any cryptocurrency and I never will.” He also described Bitcoin as “probably rat poison squared.”

At the same time, I’m well aware of all the arguments crypto fans cite in favor of crypto ownership. I happen to think those same arguments favor precious metals as well — and without the volatility.

Indeed, I believe the macroeconomic setup for precious metals is as positive as I’ve seen during my investing career.

Central bankers have gone berserk with “ZIRP” (zero interest rate policy), “NIRP” (negative interest rate policy) and “quantitative easing” (money-printing). Politicians are borrowing, spending and giving away money like never before.

The Federal Reserve has been crystal clear that it will keep interest rates at zero and continue to buy every bond in sight for a long, long time.

President Biden announced a new $1.9 trillion relief package and promised that it’s just a “down payment,” with even more debt-financed stimulus to come ...

Don’t You … Forget About Jay …

The Fed under Chair Jay Powell has made an important change to allow for higher inflation than its previous 2% target.

“The ingredients for higher inflation are in place. You have very powerful fiscal policy in place and perhaps more to come,” said St. Louis Fed President James Bullard.

Philadelphia Fed President Patrick Harker recently said, “We are looking at a long period where the fed funds rate will stay at essentially zero.”

How long of a period? “It would not be unreasonable for the Fed to wait until mid-2024 before raising short-term rates from their current near-zero levels,” said Chicago Fed President Charles Evans.

Powell had this to say:

A lesson of the Global Financial Crisis is be careful not to exit too early, and by the way try not to talk about exit all the time ... because the markets are listening. The economy is far from our goals ... and we are strongly committed ... to using our monetary policy tools until the job is well and truly done.

The next interest rate increase? “No time soon,” said Powell.

How about a QE taper? “Now is not the time to be talking about exit,” from the $120 billion monthly bond purchases.

Government debt increased by more than $4 trillion last year, and our total national burden now stands at $27 trillion.

Those are reasons to own crypto. They’re also reasons to own precious metals.

My son says buy cryptos; I say buy gold and silver. Perhaps it’s down to a generational thing. I’d love to hear your thoughts on the issue.

And remember to keep your eyes out for Disruptors & Dominators, my new service that will explore issues (and profits!) related to revolutionary and evolutionary — and generational — innovation.

Best wishes,

Tony