How many times have you heard people say they can’t wait for 2020 to be over? LOTS!

I know the feeling. The coronavirus pandemic made it impossible for me to see my three precious grandchildren, including my October-born twin grandsons.

|

The Grinch really did steal Christmas this year. Of course, 2020 has been traumatic in many ways. But it’s been a very productive year for the stock market.

Through the close of trading on Dec. 29, the S&P 500 Index is up 15.4%, and the Nasdaq Composite has added an amazing 43.2%.

Perhaps because of the furious run that stocks have been on since the March lows, many of the investors I talk to expect the stock market to struggle in 2021.

Wrong!

I expect 2021 to be another year of solid stock-market profits. I say that for three reasons ...

Reason No. 1: Light at the End of the Coronavirus Tunnel

Seven vaccines have been approved for limited use, and 13 more are currently in final testing. The time will soon come when the majority of Americans will receive them, and the numbers of vaccinated are going to steadily increase.

It won’t happen immediately. But the stock market is a forward-looking mechanism. Wall Street anticipates that widespread vaccination will rejuvenate our economy, employment will soar, consumer and capital spending will surge and corporate profits will blast off.

The release of a year’s worth of pent-up demand will drive a stronger-than-expected recovery. That’s why the Federal Reserve increased its forecast for 2021 gross domestic product growth from 4.0% to 4.2% and predicted the unemployment rate will drop to 5%.

Reason No. 2: Congressional and Fed Stimulus

Congress screws up just about everything it touches. But it is very skilled at spending our money.

Last week, our representatives in Washington passed another multi-trillion-dollar pandemic relief bill, including support for small businesses. They also agreed on direct payments of $600 to qualifying individuals — though whether that will increase to $2,000 is yet to be seen as that amendment waits for a vote in the Senate.

|

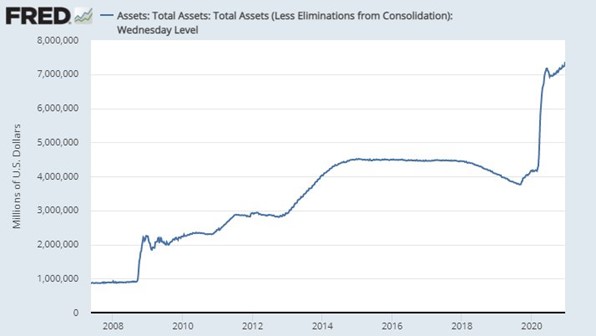

Plus, our central bankers will more than do their part. The Fed made it quite clear last week that it will keep buying bonds — $80 billion of Treasuries and $40 billion of mortgage-backed securities per month — for the foreseeable future.

Indeed, last week, the Fed’s balance sheet had its biggest one-week increase since May, rising $119.9 billion to a record $7.36 trillion. The stock market has marched higher in near lockstep with the Fed’s balance sheet, which is why the stock market is enjoying such a strong year-end finish.

At the same time, according to Fed Chair Jerome Powell, “The concerns that we had at the very beginning of really serious, deep shortfalls and massive budget cuts on the part of state and local governments have not yet occurred.”

Don’t forget: The Fed has control of the gas pedal and is still pressing it hard.

(By the way, the Fed also removed its prohibition on banks buying back their own shares. With buybacks in full swing, bank stocks are going to act a lot better. That is very good news for the stock market.)

Reason No. 3: Disappearance of China Trade Tensions

Despite President Trump’s efforts, I expect President-elect Joe Biden to be inaugurated on Wednesday, Jan. 20, 2021.

A lot of things will change. And one of the most important economic shifts will be a dramatic reduction in the noise level between the U.S. and China, one of the central themes of the Trump administration.

|

| Source: Ca-times.brightspotcdn.com |

Look for the Biden administration to relax trade barriers and to roll back (if not eliminate) Trump’s tariffs on Chinese imports. Here’s what Biden has promised:

The best China strategy is one which gets every one of our — or at least what used to be our — allies on the same page. It’s going to be a major priority for me in the opening weeks of my presidency to try to get us back on the same page with our allies.

Think back to the latter half of 2019, when the stock market was obsessed with a Chinese trade deal. The stock market will enjoy an undeserved but similar boost.

I’m not promising a smooth ride — 2021 will be plenty bumpy. But, given the implications of these three catalysts, your best move is to stay invested.

Best wishes,

Tony