What’s the Correlation Between Gold and Cloud Computing?

The thing about Twitter is that it holds a lot of good stuff.

On the other hand, the social media platform holds a lot of bad stuff, too.

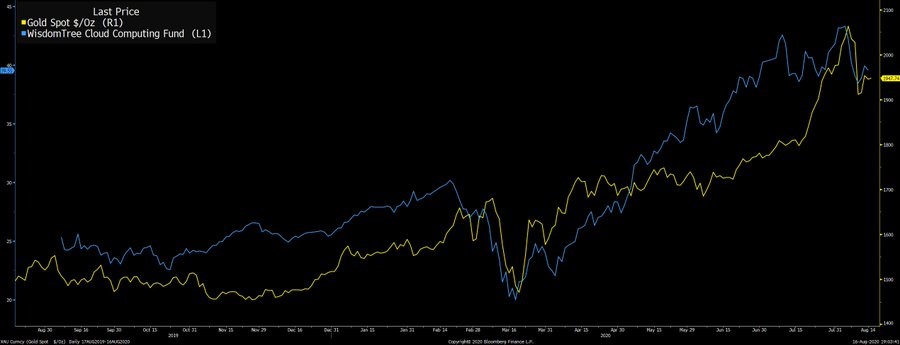

Well, this is good Twitter, because it’s a solid question/challenge posed by Bloomberg’s Joe Weisenthal: “If you’re bullish on gold, are you also bullish on cloud computing stocks?”

Here’s the chart Joe used to get to what he’s driving at …

|

| SOURCE: Twitter |

I don’t think there’s quite the dissonance Joe perceives here. As one reply to his tweet noted, “If they’re both a bet on low real rates, sure.”

Another way to put it is, “If they’re both a bet on the response to COVID-19, sure.”

Indeed, the pandemic has accelerated a process that was already well underway before February 2020 — a “great digital transformation,” as Weiss’s own tech guru Jon Markman has described it, that’s fueling the rise of the WisdomTree Cloud Computing Fund’s (Nasdaq: WCLD, Unrated) price.

And the Federal Reserve’s response to the novel coronavirus is to do whatever it can to keep asset prices rising, with the hope that “wealth effects” will find their way to the main street economy.

We’ll see about that.

But market participants see the central bank’s treatment of the world’s reserve currency, and they’re beginning to wonder about things like inflation. They’re getting more interested in assets they perceive to be better holds of value.

(Others, meanwhile, including China Banking Regulatory Commission Chairman Guo Shuqingare, are beginning to wonder about the world’s reserve currency, period, in an ominous way that only increases uncertainty …)

So, yes, there is a world in which that graphic can exist. This one …

Sean Brodrick — our go-to gold guy — is as bullish about the recent metals rally as Jon is to the “great digital transformation.” And he’s been on it from the start; just take a look at what he wrote about it over the weekend for Wealth Wave subscribers.

Here’s Sean …

What a wild couple of weeks it’s been for gold.

First, the yellow metal pushed over its previous all-time high of $1,923, and, on Aug. 7, it clocked an intraday high of $2,089 per ounce. Then gold folded its wings and swan-dived back below $1,900 before finally closing above $1,940.

New highs are bullish. Big swoons scare the gee-willikers out of the market. What are traders supposed to think?!

Here’s what I think: Gold is still in a big, snortin’ bull market. But we could see more downside in the short term, especially in gold and silver miners, developers and explorers. And that might be the best buying opportunity in a long, long, time.

Let me show you a couple charts to make my point …

This first chart shows gold with Fibonacci retracements. Fibonacci was a medieval Italian mathematician who discovered ratios that recur in nature over and over. They’re useful in trading because “Fib” numbers show where support and resistance are likely to occur.

Even if you think Fib numbers are a bunch of hokum, plenty of other technical traders are watching them. So, Fib numbers become self-fulfilling targets.

I sent a version of this chart to Gold & Silver Trader subscribers on the day of gold’s big plunge this past week — the biggest plunge in seven years — showing likely targets for gold.

You can see why people like this. It shows gold tested one level of Fibonacci support then dropped the next day to test the next level before recovering.

Some people see this as bullish. Maybe.

On the other hand, it also shows the potential for a bear flag, which is more pronounced on the chart of the Van Eck Vectors Gold Miners ETF (NYSE: GDX, Rated “B-”), the big gold stock fund.

That would be about a 30% drop from the high. Quite nasty, eh? Remember, “flags fly at half-mast.”

What’s more, the lower target would also be close to the lower end of gold’s range AFTER it recovered from the March liquidity event and BEFORE it took off in July. And that line of support lines up with the rising 200-day moving average.

Now, there is no law that gold miners, as tracked by the GDX, MUST go down and tag either of those support levels. But, if the GDX does tag support, even slap-and-tickle briefly, it would be a heck of a buying opportunity.

So, back to the original question: What’s the correlation between gold and cloud computing? The pandemic has sent both markets surging. Investors should keep their eyes out for opportunities.

Best wishes,

David Dittman