|

|

In the first wave of the coronavirus crisis, Americans suffered three devastating blows to their income:

Over 40 million were thrown out of work.

The interest they could earn on their savings was cut to nearly zero.

And a long list of supposedly reliable stock dividends were cancelled.

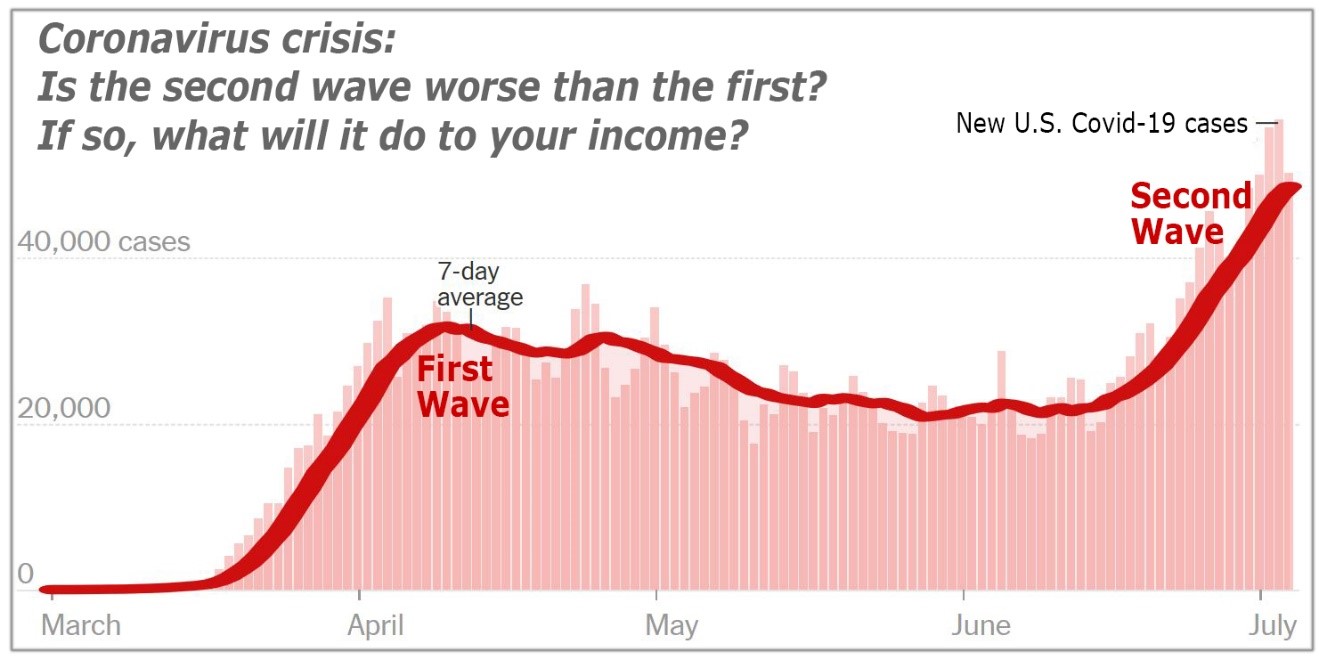

Now, a second wave is upon us.

Already, the number of COVID-19 cases has surged far beyond the peak of the first wave.

And already, most states have paused or backtracked on reopening their economy.

But there’s a whole series of urgent questions that remain unanswered about how this new phase will affect your finances …

Lockdowns: Will most of the nation’s governors revert back to stay-at-home orders? If so, what will that do to your income?

If not, how safe will it be for most people, especially retired Americans, to leave their homes? And how will THAT impact your future income possibilities?

Government rescues: Will Democrats and Republicans in Congress promptly agree again to trillion-dollar rescue programs? Or will they continue to bicker and drag their feet?

Federal deficit: The expected federal deficit has already quadrupled from $1 trillion to nearly $4 trillion. What will happen to the deficit if they start spending again like crazy?

Economy: Despite the government’s massive first-wave rescues, the U.S. GDP has suffered its worst decline since the Great Depression.

How far will the economy fall if the government’s second-wave rescues are weaker or delayed?

Stock market: In the first wave, the Dow fell more sharply than in the first months of the 1929 bear market. But then it rallied back in response to massive federal intervention and the end of the national lockdown.

This morning, based on false hopes of an economic recovery overseas, stocks are up again. Can they continue to rally into the second wave?

Your income: In the first wave, the income of most American workers, savers and investors was gutted like never before.

In the second wave, will the impact be the same? Worse? Not as bad?

Clearly, No Matter What the Final Answers

May Be, Your Income Is Under Siege

If governors go back to lockdowns, the impact will be severe in the near term. If they don’t, the impact could be severe in the long term.

Either way, we’ve got a serious problem.

If Washington spends as much as in the first wave, the deficit will surge to $7 trillion, with potential consequences that could make the banana republics proud by comparison.

If it doesn’t, most unemployment benefits will run out and millions of small businesses will close.

Either way, we’ve got a serious problem.

And either way, the steps I recommend have not changed by one iota …

Build cash: If you hold stocks — in your regular brokerage account, in your 401(k) or in your IRA — use strong rallies to sell the most vulnerable.

Which ones are they? To find out, set up your free Weiss Ratings Watchlist.

Then add your stocks to the list. If the rating is “D+” or lower, it means “sell.” And if the rating changes, we will automatically send you an email alert.

Hedge: If you have vulnerable investments that you’re unable or unwilling to sell, allocate some portion of your cash to buy hedges. The best ones are those that are roughly matched to the assets you’re seeking to protect.

But if you’re concerned about exposure overall, consider the ProShares Short Dow 30 ETF (DOG). For every 10% decline in the Dow Jones Industrial Average, this exchange-traded fund is designed to go up 10%. (And needless to say, if the Dow continues to rally, this ETF will decline in value.)

Put your money strictly in the strongest. I’m not talking just about your investments. This rule also applies to where you keep your savings.

That’s why, in addition to investment ratings on your stocks, ETFs and mutual funds, we also give you SAFETY ratings on the nation’s banks, credit unions and insurance companies.

Until now, we charged a small fee for folks to access our ratings. You see, we’re not like Standard & Poor’s, Moody’s and Fitch. Because when they issue a rating to a company, they get paid by that company for the rating.

Many smart people think that’s a serious conflict of interest, and I agree. Plus, it’s one of the reasons why millions of people who followed their ratings lost so much money in the last debt crisis.

We never do business that way. We have never taken — and never will take — a dime from the companies we rate. Our only source of revenues has been the end user of our information, average people who want to get safe and make some money, too.

But because of this crisis, I don’t want any barriers between our ratings and your safety. So, for Weiss subscribers, I’ve opened up access to our bank ratings here and our insurance company ratings here.

Boost your income immediately. I recently introduced a revolutionary strategy, based on the Weiss Stock Ratings, to reliably give you extra weekly income of $1,000 (or multiples of $1,000).

|

That adds up to additional yearly income of $50,000 ... $100,000 ... or even $200,000.

I explain all the details in this video.

If you watch it now, you can pull down your first $1,000 (or much more) in extra income THIS week.

Good luck and God bless!

Martin