When Do Rising Interest Rates Become a Real Problem?

|

Interest rates are on the rise again.

The yield on the 30-year U.S. Treasury bond just breached 2%. That’s more than double its March low and the highest level in a year.

The yield on the 10-year note is around 1.29%, nearly two-and-a-half times its COVID-19 lows. The five just topped 55 basis points, or 0.55%.

This is all happening despite ongoing Federal Reserve commentary reinforcing its commitment to a “ZIRP and QE Forever” policy.

That means the central bank will do what it must to keep its benchmark interest rate at zero, and that includes buying government bonds on the open market.

So, are these moves cause for panic? Will higher rates tank stocks? What about cryptocurrencies, precious metals and commodities? Are they toast?

In one word ... no.

It all goes back to a rule I’ve developed over the quarter century I’ve been following the interest rate markets. I call it the “Three ‘F’ Rule.”

We all know interest rates are important. They represent the cost of money to borrowers on all kinds of debts, from government and corporate bonds to credit cards and mortgages.

The higher rates are, the more expensive it is to borrow. The more expensive it is to borrow, the less money consumers, corporations, even sovereign governments, have to spend elsewhere.

Naturally, that acts as a governor on the economy. It slows growth down. That, in turn, hurts revenue and earnings growth — and investors can react by selling stocks, commodities and other assets.

So ... panic time then? Again, no.

Rates haven’t rose FAST enough, FAR enough and FOR LONG enough to cause chaos. That’s the “Three ‘F’ Rule” in a nutshell. It’s all about speed, magnitude and duration.

In other words, borrowers and investors can adapt if rates rise gradually, gently and for a limited time. They only freak out when the moves get out of control.

So far, this move simply doesn’t qualify. If anything, investors are viewing it as confirmation of a gradual economic recovery and an accelerating vaccination effort. That’s why we’ve seen the stock market continue to rise right alongside interest rates.

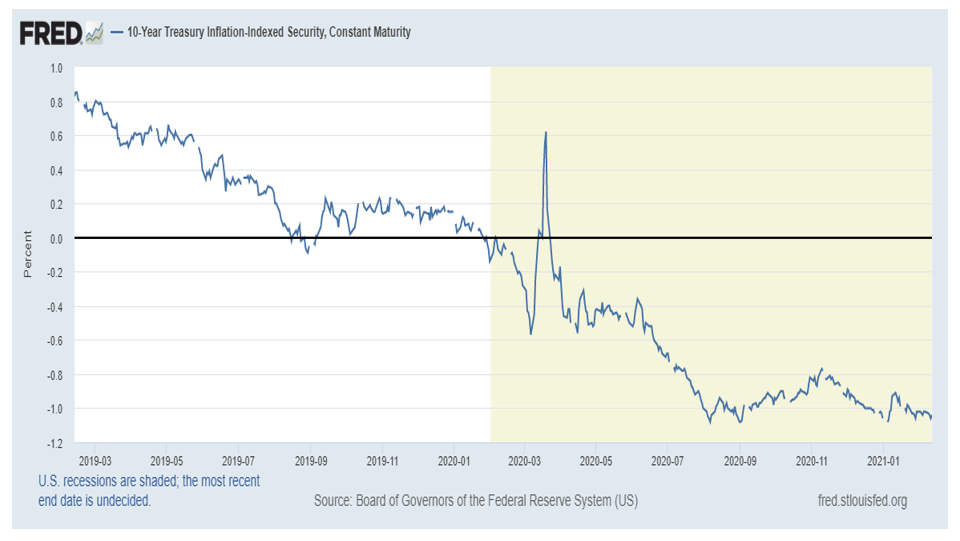

One more thing to keep in mind: “Real” interest rates remain extremely low, even as nominal rates are rising.

Without getting too deep in the weeds here, real rates are simply normal rates minus the rate of inflation. Extremely positive real rates can be bad for the markets, while deeply negative rates can be the opposite.

Right now, the bond market is pricing in negative real yields at every major maturity point. Ten-year real yields are trading around negative 1.01%, as you can see in this chart that goes back two years. That means money is still effectively very cheap.

|

Could things change? Sure.

If bond investors really start worrying about the size of the Biden administration’s stimulus program, or if inflation data gets much worse, we could see this interest rate move get unruly.

But don’t dump your stocks. “Safe Money” strategies are still the way to go, and that includes maintaining course until the interest rate move accelerates, intensifies and/or endures for too long.

That’s how we protect our wealth and maximize our profits.

Until next time,

Mike Larson