When Investing in Musk Just Smells Bad

[image Maurizio Pesce via CC2.0]

SolarCity and Tesla are trying to make things work together and have announced their merger plans but, based on the latest data and ratings, Tesla’s investment doesn’t look too promising as both companies struggle to make ends meet.

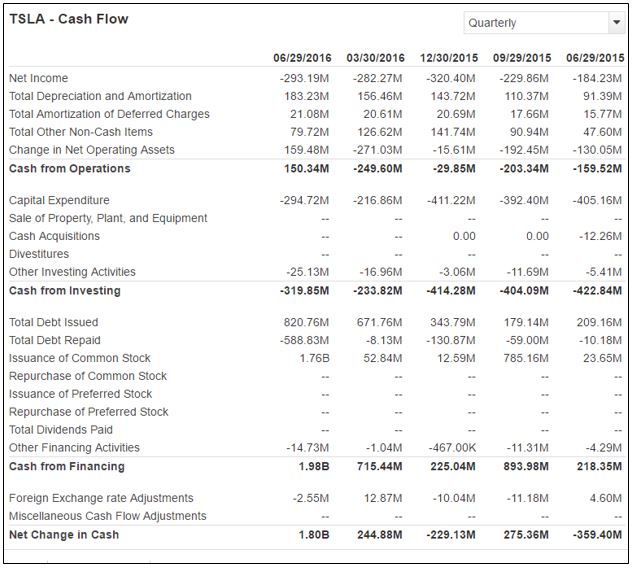

Tesla reported a $293.2 million loss in Q2, 2016, and the previous four quarters don’t look any better, with hundreds of millions of dollars in losses. SolarCity is in the same profitless pit, with $55.5 million in losses in the second quarter and only one profitable quarter in the prior four.

Tesla’s $1.98 billion in cash from financing in Q2, 2016 is way out line with the prior periods, reflecting the company’s efforts to raise capital to deliver the promised Tesla 3 vehicles.

Borrowing, just to burn through the cash, has to have an ending. There are $422 million in cash payments due in Q3 to 2018 convertible note holders.

This move from former backers of Elon Musk’s dreams may indicate cracks appearing in the supporter’s club at investor level. Question is, how much longer can Tesla go to the well before really hard questions get asked.

Our ratings indicate neither company’s stock has ever received a higher investment rating than a C-. In recent months, primarily due to poor returns and an increase in debt to equity, SolarCity was downgraded to a D from D+. Tesla received a downgrade in June, 2016, also to a D from D+, due to a decrease in total returns.

Last Thursday’s explosion of SpaceX’s Falcon 9, although the company is not directly affiliated with either Tesla or SolarCity, sent the shares of those two companies tumbling down.

On Thursday alone, Tesla dropped 5.3 percent ending the week down 8.1 percent at $197.78 per share. SolarCity took a hit too, dropping 9.1 percent on Thursday, and closing the week down 13.9 percent, trading at $18.48 a share.

The idea behind Tesla’s acquisition of SolarCity is to create an energy company that can provide a one-stop shop for the customer. Buy an electric car and get solar panels installed in your house from the same company. Sounds pretty good, but Elon Musk might have bitten off more than he can chew.

Promises of fulfilling orders for hundreds of thousands of Tesla vehicles within Musk’s delivery schedule with his previous history of multiple failures to meet deadlines, coupled with building massive factories while acquiring other companies, sounds like a bad idea. The company is also starting to dabble in the auto insurance business, offering insurance for Tesla vehicles in Australia and Hong Kong underwritten by third parties..

But Elon relies on his fan club to keep his endeavors alive. Unfortunately, although hope springs eternal, companies require cash to operate and, indeed, survive.