When Other Investors Lose Their Minds, YOU Don’t Have to!

|

How do you know when investors have completely lost their marbles?

J.C. Penney (OTC: JCPNQ, Rated “D”) jumped 96%.

Hertz Global Holdings (NYSE: HTZ, Rated “D-”) soared 114%.

And just for good measure, Chesapeake Energy (NYSE: CHK, Rated “E+”) rocketed 175%.

What’s the common thread? They’re all either BROKE already — or about to be!

J.C. Penney filed for Chapter 11 on May 15. Hertz filed on May 22. And after its shares almost tripled on Monday, news broke that Chesapeake was preparing its own imminent bankruptcy filing.

As you may know, debtholders and others higher up the financial food chain get first dibs on a company’s assets in a Chapter 11 reorganization. Shareholders who hold equity “stubs” like JCPNQ or HTZ almost always get nothing

Then again, it wasn’t just bankrupt stocks racking up huge gains earlier this week. Newly public Nikola (Nasdaq: NKLA, Unrated) surged 104%, giving it a market capitalization of more than $26 billion.

If you haven’t heard of Nikola, it’s a Tesla (Nasdaq: TSLA, Rated “D”) knock-off— get it with that name?

The company claims it will roll out battery-electric and fuel cell-powered trucks … someday. For now, it doesn’t just have any profits … or any revenue. It literally isn’t selling anything ... except for dreams, maybe.

This all happened the same day the National Bureau of Economic Research (NBER) confirmed what we all suspected.

The record-long expansion that began in June 2009 ended in February 2020. The U.S. economy tumbled into a recession. The NBER is our nation’s “official” arbiter of expansions and contractions, with a database of information that goes back to 1854.

I don’t know about you, but when I see stuff like this going on, I can only shake my head. Why? Because we know how this movie ends.

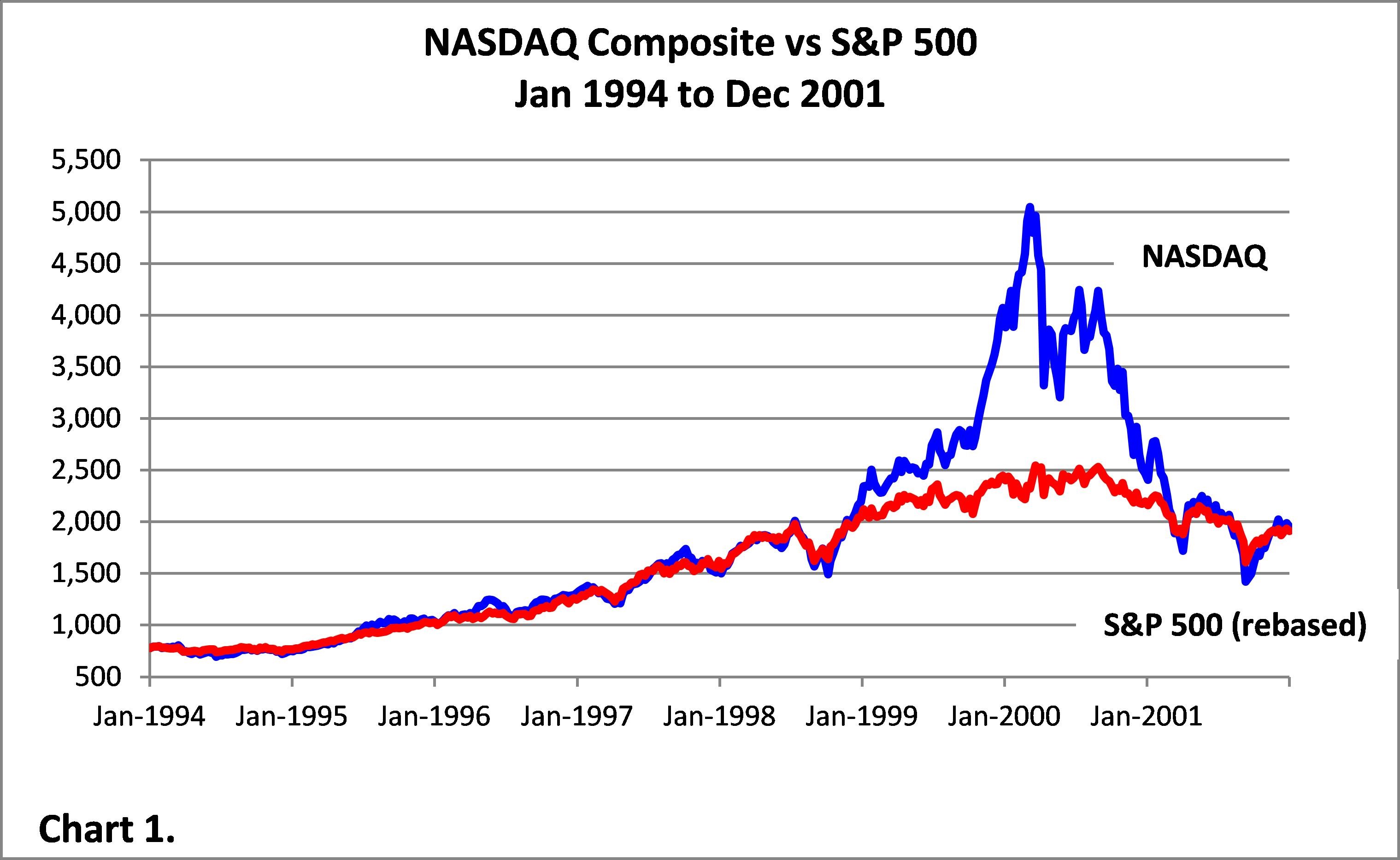

With everything else getting a remake recently, seems fitting the economic bust from the late ’90s would, too.

I graduated from college in the midst of the dot-com bubble. Everyone thought they’d strike it rich putting the kids’ college money into shares of Pets.com and Webvan.

Then tech stocks crashed and burned.

|

|

SOURCE: Greenmangotrading |

Or how about the repeat performance a half-decade later?

That’s when every Tom, Dick and Harry decided they’d flip houses and condos. Then, the housing market crashed and burned.

Now, so-called “investors” have decided that since the Federal Reserve has their backs and liquidity is raining down on Wall Street, they might as well get their piece of the action.

They’re manically trading shares that are in all likelihood completely worthless, hoping they’ll be able to get out the “exit” door before everyone else does.

I approach the markets in a completely different manner. I’m a “Safe Money” guy through and through.

I believe that if you want to build your wealth in a SUSTAINABLE fashion over the longer term, you have to adhere to certain principles.

If you do, I believe you’ll come out ahead of the misguided masses speculating in junky, bankrupt stocks.

Speaking of which, I’m about to roll out my June issue of the Safe Money Report with new ideas and new recommendations. Click here to subscribe if you want to get the full scoop.

Until next time,

Mike Larson