|

A funny thing happened on the road to soaring internet rates ...

Lower interest rates.

Yes, it’s true. Despite extraordinarily hot readings on inflation ... news that the COVID-19 recession “officially” lasted only two months and ended last April ... worries about the Federal Reserve “tapering” its bond purchases ... and more, rates have stopped rising. In fact, they’ve started falling again.

The yield on the benchmark 10-year U.S. Treasury note peaked at 1.76% in late March. It fell to as low as 1.13% last week and was recently 1.24%. The 30-year Treasury bond’s yield tanked more than 60 basis points, or 0.6 percentage points, recently hitting a six-month low.

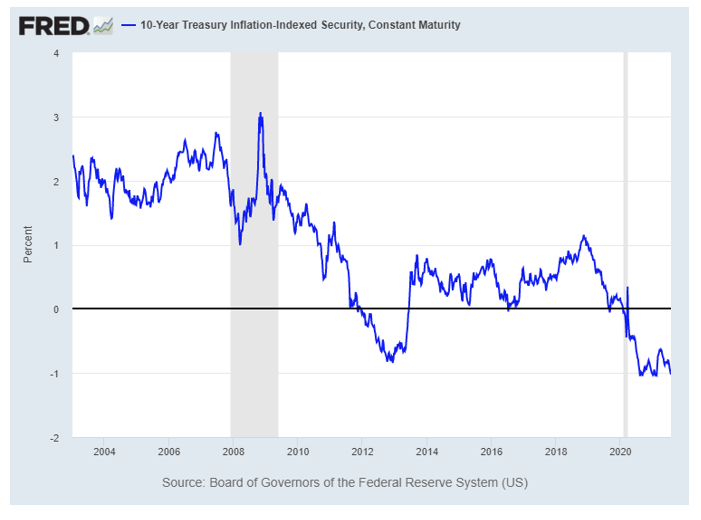

And that’s not the half of it. “Real” yields — or what you get when you take the nominal yields on Treasury notes and adjust them for inflation — are deeply in negative territory.

|

In fact, real 10-year yields are running around minus 1.1%. That’s the most negative they’ve ever been, as you can see in the above chart showing one measure of real yields derived from Treasury market trading activity.

So what the heck is going on? And what should you do about it? I’ve analyzed interest rate markets for roughly a quarter-century now, and here are my best answers ...

First, investors are growing increasingly concerned that the combination of the Delta variant and the foot-dragging on President Biden’s stimulus plans will hurt the economy — not plunge us back into recession, but take some steam out of the recovery.

Second, many market participants are buying the Fed’s party line, namely that inflation will prove “transitory.” They figure today’s red-hot inflation data will turn into tomorrow’s more palatable results.

Third, they’re reading and hearing comments from top Fed policymakers — and from foreign counterparts, like those at the European Central Bank — and they’re reconsidering their previous views.

They’re thinking that maybe, just maybe, their friendly neighborhood central bank will keep buying hundreds of billions of dollars worth of bonds right alongside them for longer than they once thought. After all, they keep talking down inflation risk and talking up the need to boost employment.

So what should you do in response?

• For starters, don’t go out and buy a bunch of bonds or bond funds that pay less than the inflation rate! Instead, focus on income-oriented strategies and investments that help you beat inflation.

• Buy higher-yielding, higher-rated stocks that provide nice dividends and also offer capital gains potential.

• Consider selling options on high-quality stocks and exchange-traded funds (ETFs) you wouldn’t mind owning.

• Invest in assets like real estate investment trusts (REITs), gold, silver and mining shares to hedge against rampant asset inflation and potential profits from overzealous money printing.

These strategies have worked tremendously for my subscribers for a while now — and I have every reason to believe they’ll continue to do so.

If you want to join them and get more specific guidance and recommendations, just click here.

Until next time,

Mike Larson