Nobody here will accuse CNBC’s Smart Money of being the “smart money.” But their social media managers did tweet something of considerable interest this past Friday.

For the most part, Bitcoin (BTC) has traded much like a typical “risk-on” asset. When, for example, the Nasdaq Composite has been rising, so too has the King of Crypto.

There hasn’t been much diversion.

Until now …

As Fast Money noted on Oct. 8, “Bitcoin's up almost 11% this week as the alternative hedge gains ground.”

The Nasdaq, meanwhile, was basically flat last week.

|

One driver, as Bitcoin maximalist and MicroStrategy (Nasdaq: MSTR) CEO Michael Saylor surmised, is continuing institutional uptake. And institutions now seem to favor Bitcoin over gold.

Sam Blumenfeld of Weiss Crypto Alert touches on a recent research report from a JPMorgan (NYSE: JPM) cross-asset strategist detailing that very dynamic. Here’s how Sam framed recent price action heading into the weekend:

Bitcoin is extending its recent gains today. The King of Crypto has led the market higher over the past two weeks, topping its September high of about $53,000. And its market dominance has increased over 2% in the same period, even briefly topping 45% for the first time since mid-August.

The crypto market can be volatile, so it wouldn’t be surprising to see a minor correction after such a strong past two weeks of trading.

Still, Bitcoin is well above its 21-day moving average, and we’ll be looking to see if it can establish strong support at $53,000.

Here’s Bitcoin’s price in U.S. dollars via Coinbase Global (Nasdaq: COIN):

Ethereum’s chart has managed to log green candles in nine of the past 10 trading days. But unlike Bitcoin, it has not yet passed its early September highs.

We could easily see a brief pullback given that ETH is right at a key resistance level near $3,700. If we don’t, the next important level is $4,000, which was ETH’s short-term top in early September. If Ethereum manages to eclipse this psychologically important price level, it’s blue skies ahead.

On the other hand, if we see a substantial pullback, ETH’s 21-day moving average could provide support.

Here’s Ethereum’s price in U.S. dollars via Coinbase:

And the big picture continues to look better and better:

Institutional appetite for Bitcoin is expanding, and JPMorgan analysts see it as a major factor contributing to the crypto’s recent positive movements.

The bank also cited how three other developments — the significant potential for scalability through Layer-2 payment protocols increased legitimacy from adoption in El Salvador and assurances that the U.S. government won’t ban Bitcoin outright — greatly improved sentiment toward it.

Bitcoin’s fundamentals are stronger than ever, and it has shown that it can easily bounce back from negative headlines. The recent series of positive developments along with improving market sentiment have sent prices barreling to new monthly highs.

Where Bitcoin goes, altcoins follow. And with the King of Crypto at the helm, this bull market looks healthy and sustainable.

The money quote is, “Where Bitcoin goes, altcoins follow.”

And, folks, that catch-up rally could be quite something to behold.

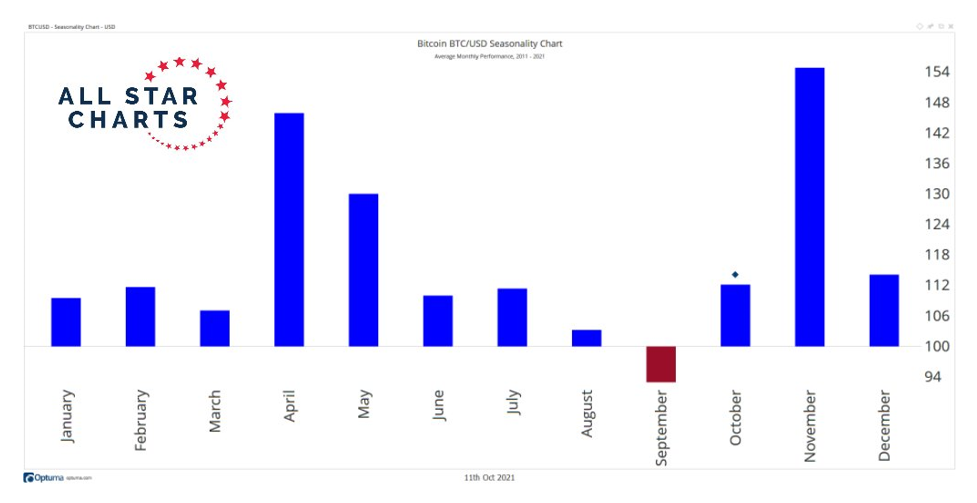

Indeed, as my friend J.C. Parets noted on Sunday, the “hottest time of the year for crypto is coming.”

|

Now, imagine being a part of it …

You could look into investing in bigger and more well-known coins like Bitcoin or Ethereum, or you could delve into smaller undiscovered avenues.

One possible way is with Dr. Martin Weiss’ Undiscovered Cryptos service.

The service targets a small group of rare cryptocurrencies ready to burst out of the digital shadows.

To learn more, which I highly suggest you do, click here.

Best,

David Dittman