Why Jim Cramer Is Right, and How Weiss Ratings Can Help You Profit in Any Market

I don’t always listen to Jim Cramer. If you saw my interview with our very own Jessica Borg over the weekend, you know that by day I’m an analyst, but by night I’m a yoga teacher … and I need a yoga class after Jim Cramer’s rants get me all riled up about the markets.

But an article about his Tuesday Mad Money segment pulled me in.

The headline: “Jim Cramer Says He Sees Few Reasons to Buy Stocks Right Now and is Staying Cautious on the Market.”

So, I clicked to watch the three-minute video clip.

He looks right into the camera and inquires, “Let me ask you something then, how the heck do you come up with conviction to buy?”

The answer is simple: When you feel like you’d be willing to buy more on the way down instead of cut and run, because you never had something to hang your hat on to begin with. All while tossing hats from behind his desk onto a hat rack.

I couldn’t agree more with this whole sentiment. In my personal portfolio, I do not mind down days. My portfolio is also chock-full of dividend payers. That means a down day allows me to grab more shares at a better dividend yield. I just can’t help getting a good deal.

But the stocks that I have in my portfolio are all ones that I am willing to hang my hat on. I have analyzed the fundamentals. I understand what the company does. I know that there is an ongoing market for the company’s goods and/or services.

But this is where we have something that most investors don't … the Weiss Safety Ratings.

We can head on over to the stock screener and easily see which companies have the fundamentals that signal “Buy.”

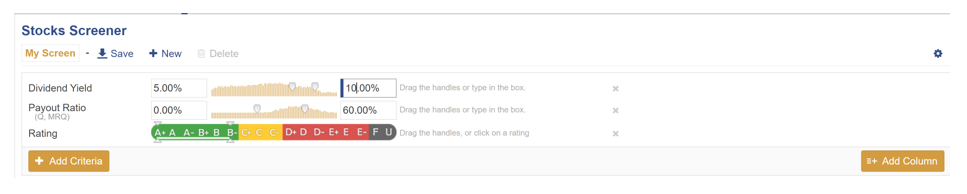

So, I ran a quick screen to see the highest rated stocks paying a dividend of 5% to 10% with a dividend payout ratio under 60%.

|

The result was 36 stocks. You could easily have come up with more by lowering your dividend threshold to 3%, which is still great.

I like to get 5% if I can. Let’s look at the top three that fit that bill:

1. Canadian Imperial Bank of Commerce (NYSE: CM)

Headquartered in Toronto, the Canadian Imperial Bank of Commerce was founded in 1867. It provides services to clients in Canada and the United States.

The bank has seen both adjusted net income and earnings per share (EPS) increase throughout the tough times of the pandemic. And it continues to increase its dividend.

The Weiss Ratings system upgraded CM out of the “Hold” range in March and it now holds a “B” rating. It currently pays a dividend of 5% and shares are up 40% year to date.

2. The Bank of Nova Scotia (NYSE: BNS)

Also known as Scotiabank, The Bank of Nova Scotia provides various banking products and services in Canada, the U.S., Mexico, Chile, Columbia, the Caribbean and Central America. Its network consists of over 2,300 branches and 8,800 ATMs.

The company is seeing great recovery this year. At the end of last month, Scotiabank reported third quarter net income of $2,542 million compared to $1,304 during the third quarter last year. Diluted EPS was up 91% for the same time comparison.

The management also pointed out that the bank was recognized as the Most Innovative in Data by The Banker’s Global Innovation in Digital Banking Awards 2021. I’m not exactly sure what all that means exactly, but I like the sound of it. We know data is key, but only if the organization is using it.

The stock climbed out of “Hold” range in April and is now sitting at a solid “B.” It currently pays a 5.8% dividend. Shares are up 19.6% so far this year and up 55% in the past year.

3. Sunoco LP (NYSE: SUN)

This is a name you might recognize. Sunoco distributes and retails motor fuels in the United States. The company operates in two segments. Its Fuel Distribution and Marketing segment purchases motor fuel from refiners and supplies it to independently operated dealer stations and distributors. The All Other segment operates the Sunoco retail stores that you’re probably familiar with.

Sunoco was upgraded from its “Hold” status in May when it saw significant increases in many of the ratings indexes. Operating cash flow increased 280%, EPS nearly doubled and net income increased 85.5%. It’s currently rated a “Buy” with a “B” rating.

SUN pays a hefty 8.9% dividend, but it could arguably see more fluctuation in stock price due to fluctuations in gasoline prices. Shares are up 39% year to date and 59% over the past year.

And, of course, if none of these picks look interesting to you, I highly recommend you head on over to the stock screener and see what other companies might. There were 33 others in my screen, but you can easily customize that to your liking.

Or, if you’d rather not do the legwork yourself, I highly recommend you check out the research from my colleague Mike Larson.

His Safe Money Report is just as it sounds … he targets safe, money-making companies. If you haven’t checked it out, I suggest you click here now.

Best,

Kelly Green