Worth a Look - Weiss Selects 4 Recently Upgraded ETFs to BUY

We upgraded 1,005 ETFs and downgraded 606 over the last two weeks. Out of all the upgrades, using the ETFs screener, we narrowed down to three funds we think are truly worth your consideration.

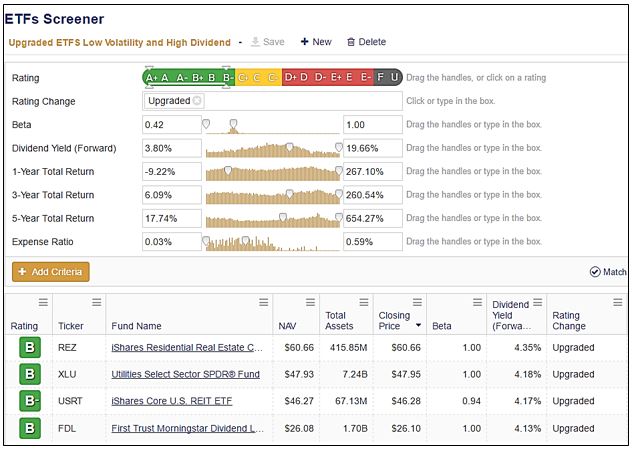

We used a strict set of criteria to come up with the final four.

All four funds:

- Were recently upgraded

- Have a beta of 1 or lower

- Have a 3.8 percent or higher dividend yield

- Have at least an average one-, three-, and five-year total returns

- Have an expense ratio of 0.59 percent or lower

iShares Residential Real Estate Capped ETF (REZ) seeks to track the FTSE NAREIT Residential Capped Index, which is composed of U.S. residential, healthcare, and self-storage real estate equities. The fund pays a 3.97 percent dividend, has an expense ratio of 0.48 percent. It offers a 3.8 percent, 35.8 percent, and 67 percent total return over the one-, three-, and five-year periods, respectively. It currently holds a B rating from Weiss.

The fund’s top three holdings include Public Storage (PSA), with 11.1 percent of assets invested in the company, Welltower Inc (HCN) takes up 9.1 percent , and Ventas (VTR) 8.5 percent.

Utilities Select Sector SPDR® Fund (XLU) aims to provide similar investment results as the Utilities Select Sector Index. The fund has an expense ratio of 0.14 percent, pays a 3.32 percent dividend. The total returns for one-, three-, and five-year periods are 13.3 percent, 37.1 percent, and 65.1 percent, respectively.

It invests 9.6 percent of its assets in NextEra Energy (NEE), 8.2 percent in Duke Energy (DUK), and 8.1 percent in Southern Co. (SO)

iShares Core U.S. REIT ETF (USRT) tracks investments in the FTSE NAREIT Real Estate 50 Index composed of 50 of the largest U.S. real estate equities. It is the cheapest find on the list, with 0.08 percent expense ratio and pays a 3.92 percent dividend.

The fund invests 8.6 percent of its assets in Simon Property Group Inc (SPG), 7.3 percent in American Tower Corp. (AMT), and 4.5 percent in Public Storage (PSA).

First Trust Morningstar Dividend Leaders Index Fund (FDL) aims to track the Morningstar® Dividend Leaders Index (SM). The fund usually invests at least 90 percent of its net assets in common stocks that comprise the index. The fund invests 10 percent of its assets in AT&T (T), 8.2 percent in Verizon Communications (VZ), and 6.6 percent in Procter & Gamble Co. (PG).

The fund pays a 2.91 percent dividend, has a 0.45 percent expense ratio, and an 83.8 percent five-year total return.

Both iShares funds invest in real estate, the Morningstar fund focuses on the large value investments, and Utilities Select invests heavily in the utilities companies. You can add them to your Watchlist and we will let you know when a rating change takes place.