When Banks Tank and Miners Surge, Sit Up and Pay Attention!

Maybe it’s because I’m an interest rate guy. A guy who focuses on what’s happening to the cost of money, as well as all the banks, brokers, insurers, and other financial companies that depend so much on it.

Whatever the reason, I can’t help but notice the financials are acting like spoiled children these days. They’re “taking their ball and going home,” and have been doing so all earnings season long.

Just look at what happened last Friday. The breathless anchors on CNBC couldn’t stop crowing about a trio of “fantastic” first-quarter bank earnings results from the likes of JPMorgan Chase (JPM), Citigroup (C), and Wells Fargo (WFC). But even as those megabanks “beat” expectations on earnings and sales, their shares rolled over and tanked on the day. The same thing happened earlier this week to Goldman Sachs Group (GS), another sector bigwig.

On the flip side, we’ve seen nothing but positive action in key precious metals and the companies that mine them. We’ve seen a Yuuuugggee run up in silver and gold, for instance, and the VanEck Vectors Gold Miners ETF (GDX) just hit its highest level since February 2.

How can that be? How could “better-than-expected earnings and revenue” for the financials result in such lousy market action? And what does the combination of that activity and the bullish behavior in precious metals “mean”?

Here’s my take: It’s the market’s way of saying the best days are BEHIND the banks! The big-picture trends they were benefiting from, including improving credit quality and positive interest rate movements, are kaput.

Start with this indisputable fact: Interest rate “spreads” are collapsing! Take a look at the lower left-hand panel of this graphic. It shows the 5-year/30-year Treasury spread, or the difference between yields on the 5-year Treasury note and 30-year Treasury bond:

You can see it has collapsed recently, with very sharp, persistent, non-stop declines. That’s just like what we saw happen as the housing bubble was starting to pop.

As a matter of fact, the 5-year/30-year spread is now the lowest since July 2007 — right as the Financial Select Sector SPDR (XLF) was topping out. It subsequently collapsed from around $30 to less than $5!

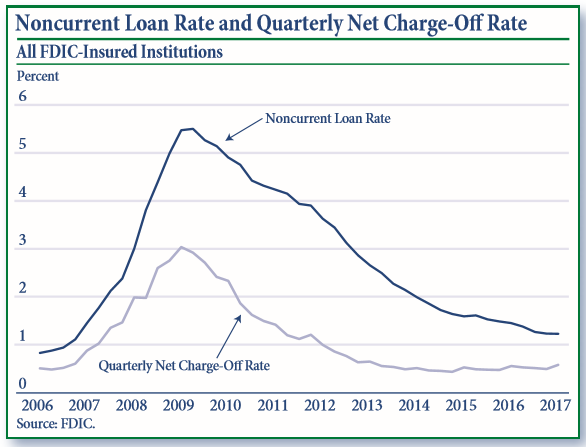

Then there’s the issue of credit quality. This chart from the FDIC shows the progression of loan delinquency rates and loan charge-off rates for the past 12 years. You can see that they both surged when the housing market collapsed, then dropped sharply after the Great Recession ended.

But look at the far right of the chart. You can see that the decline in noncurrent loan rates is flattening out, while the charge-off rate is actually starting to climb.

This is precisely what you see at the early stages of every major turn in the credit cycle! It foretells a coming stretch of rising bad debt provisions, increased charges against bank earnings, and tighter lending standards for new borrowers.

Moreover, when you see financials suffer and gold miners surge, you should sit up and pay attention. They’re both plays on sentiment about economic growth and financial stability … only on opposite signs of the spectrum! The latest action suggests investors have a lot of reasons to be concerned about lurking market problems. So, I continue to recommend you get more defensive with your stock market investments.

Until next time,

Mike Larson

P.S. My colleague Sean Brodrick is “Yuuuugggeely” bullish on the metals right now. So why is he telling readers to “sell their gold”? I’ll give you a hint … it’s to make way for profits of a different sort.