See-Saw Action, Record One-Day Wipeouts Signal Tougher Times Ahead for Stocks

Have you ever seen a stock market as confused as this one?

One day, you can’t give financial stocks away. The next day, they’re soaring.

One day, transportation shares are on fire. The next day, they’re circling the drain.

It’s the kind of increased volatility we haven’t seen in stocks for many years. But the most volatile action is in technology, the sector investors have gone gaga over.

Take Facebook (FB). The social media company has been growing like a weed for years, and its shares have been virtually indestructible. But that all came to an abrupt end on July 26.

Thanks to a warning about weaker sales growth in the future, and a downturn in user activity in the present, FB shares were absolutely crushed — to the tune of almost $120 BILLION in a single day.

Just how much money is $120 billion?

It’s roughly equal to the entire annual economic output of Kuwait — or Uruguay and Panama combined, if you prefer.

It’s enough to buy 433,300 existing U.S. homes, even after median prices hit an all-time high of $276,900 in June.

If the U.S. Navy scored that kind of windfall, it could buy nine of the newest, most technologically advanced Ford-class aircraft carriers — despite all the cost overruns that program has suffered.

Feeling charitable? Then you could buy 16.2 billion Meals on Wheels for needy seniors with the money, given their average cost of $7.39.

Or think of it this way: The largest Powerball jackpot in history was $1.59 billion in January 2016. Now imagine winning that prize 76 times over. Yep, that’s about $120 billion.

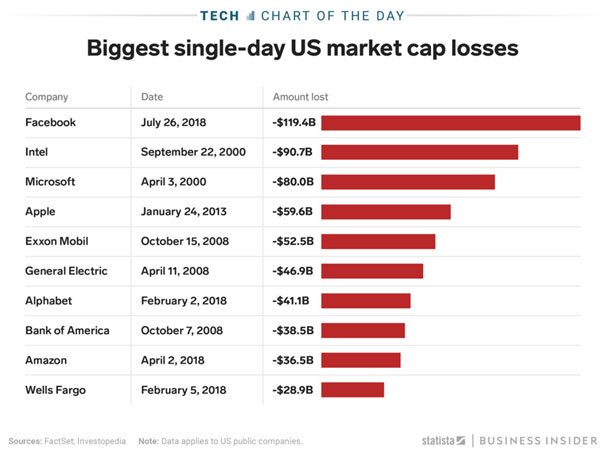

In pure stock market terms, the market cap loss of almost $120 billion was also the worst we’ve seen in ANY stock in ANY sector EVER.

It was worse than anything seen during the dot-com bust. The “honor” in that collapse goes to Intel (INTC), which lost $90.7 billion in one day back in September 2000.

It was worse than anything seen during the Great Financial Crisis. That “award” goes to ExxonMobil (XOM) thanks to its $52.5 billion, single-day loss in October 2008.

And more importantly, it signals an important trend change to me. Specifically, it signals that investors are starting to realize valuations matter. Sentiment matters. Price matters. And concentration risk matters.

When investors are dogpiling into a smaller and smaller group of overhyped stocks … with little regard to their valuations or risks … And when that is accompanied by a surge in IPOs from scores of “Me Too” companies taking advantage of the easy money mania … It’s a recipe for trouble.

That’s why I warned about the dangers of a few “sled dogs” pulling the entire market — literally days before Facebook and its cohort collapsed. I hope as many investors as possible … including you … dodged that historic $120 billion bullet.

What about the future? I believe the meltdown at Facebook is just another indicator that the character of the stock market changed in January. Along with the “VIX-splosion” in February … the increased divergence in sector performance … the general rise in interest rates … and more, it signals that you need to change your approach to investing.

My recommendations: Carry higher cash allocations. Focus on safer, less-volatile companies with sustainable, growing dividend yields. And stay away from overloved, overhyped, overowned names that can blow up like Facebook in a blink of an eye on even the slightest disappointment!

Until next time,

Mike Larson