Large Property Insurers in Florida Fail to Pay Nearly Half of Homeowner Claims

PALM BEACH GARDENS, Fla., June 25, 2024 —Weiss Ratings, the nation’s only independent insurance company rating agency, revealed today that three large providers of homeowners insurance in Florida closed nearly half of their claims last year with no payment whatsoever to policyholders.

Dr. Martin D. Weiss, founder of Weiss Ratings, commented, “In the wake of increasing property damage from storms and record insurance company bankruptcies, this high rate of claims denials is severely compounding the hardships for Florida homeowners.”

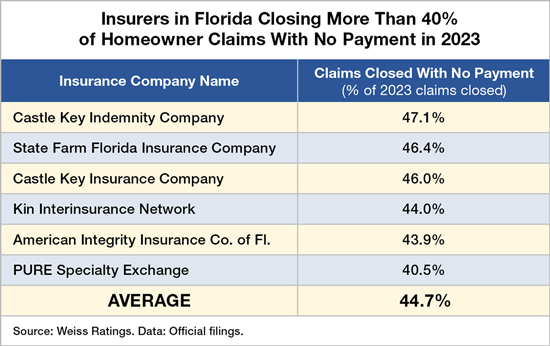

Among the large providers of homeowners policies in the state, Castle Key Indemnity Company denied 47.1% of the claims it closed last year, State Farm Florida Insurance Company denied 46.4%, and Castle Key Insurance Company denied 46%.

In addition, three smaller providers of homeowners policies also failed to make any payment on over 40% of their claims closed in 2023: Kin Interinsurance Network (denying 44%), American Integrity Insurance Company of Florida (43.9%), and PURE Specialty Exchange (40.5%).

Click here for full list of insurers in Florida with their denial rates on homeowner claims.

“Aggravating the crisis, both the insurers and authorities have hidden critical data that consumers urgently need to make informed decisions about which companies to rely on,” Weiss added. “At the same time, most insurance company ratings are bought and paid for by the insurance companies themselves, biasing the grades and painting lipstick on a pig, while keeping the public in the dark.

“But what’s most surprising of all is that some of the companies in Florida with the highest denial rates do have the financial strength to afford to pay a much larger portion of their closed claims.”

The 2022 MCAS national survey of claims payment problems, published by the National Association of Insurance Commissioners, validates Weiss’ findings. It shows that, among the 50 states, insurers in Florida not only denied the largest percentage of unpaid claims, but also had the nation’s largest percentage of unprocessed claims and the second largest percentage of claims paid only after a 60-day delay. However, the NAIC reports only state-by-state averages and does not disclose its MCAS data on individual companies.

Weiss concludes, “The public can’t even begin to cope with the property insurance crisis until both the industry and the government provide full transparency. Strong truth in insurance legislation is urgently needed.”

To check their insurers’ current Weiss Safety Rating, reflecting each company’s financial strength, consumers can go to https://weissratings.com/en/insurance.

About Weiss Ratings: Weiss covers 53,000 institutions and investments, including safety ratings on insurers, banks and credit unions as well as investment ratings on stocks, ETFs, mutual funds and cryptocurrencies. Since its founding in 1971, Weiss Ratings has never accepted any form of payment from rated entities for its ratings. All Weiss ratings are available at https://weissratings.com.

The U.S. Government Accountability Office (GAO) reported that the Weiss ratings of U.S. life and health insurers outperformed those of A.M. Best by 3-to-1 in warning of future financial difficulties, while also greatly outperforming those of Moody's and Standard & Poor's. The New York Times reported that Weiss “was the first to warn of the dangers and say so unambiguously.” Barron's called Weiss Ratings “the leader in identifying vulnerable companies.”