Last week, we sent you a list of three newly minted “Buy”-rated stocks.

Each had just received a rating upgrade from our Ratings system. This earned them a spot on your Hidden “Buy” Signals special screener list.

If you missed it, those three tickers were:

- Virtu Financial (VIRT) “B-”

- Kamada (KMDA) “B-”

- Palantir Technologies (PLTR) “B-”

A “Buy” rating is a top reward in terms of the Weiss Ratings.

That’s a great jumping-off point to do your own research into which buys might be best for you.

Our team did a deep dive into these three names for you.

And they found that one offers a one-two punch in terms of both growth and value that signals it’s worth a second look.

***

Virtu Financial (VIRT) was never rated as a “Buy.” Not even if we go all the way back in time to its IPO on April 16, 2015.

But that changed with its May 29 upgrade from the Weiss stock ratings system.

Why did it finally award Virtu the elusive “Buy” rating?

Well, all our ratings are based 100% on data. Our systems have the luxury of making decisions based on numbers, not headlines.

And Virtu, a market marker and execution provider, is in the numbers business.

Big numbers, in fact. It’s a multibillion-dollar trading firm.

Specifically, Virtu provides liquidity to global financial markets. It plays in several asset classes like equities, fixed income, currencies and commodities.

With a foot in both the traditional and crypto markets, with asset prices at or near all-time highs in both, Virtu’s well-positioned to take advantage of the current trading boom.

Yet, VIRT currently trades at just 12.1x earnings.

That’s less than half at which the rest of the market is trading.

For comparison, the average S&P 500 company has a price-to-earnings of 28.6x!

Since April 8, VIRT shares are up 27%.

Lastly, VIRT is shareholder-friendly. It buys back shares and dishes out a solid dividend, currently yielding 2.29%.

That’s more than you’ll find anywhere else — deep value, high growth and reliable income.

Its next dividend payout is June 16 to shareholders of record as of May 30. But it pays every quarter.

If you haven’t added VIRT to your portfolio yet, it may be worth giving it another look.

Use Your Ratings Plus Tools to Find the Best Tiny Stocks

While many investors tend to put their attention on large market-movers, we’ve got our eye on some rock-solid micro-cap and nano-cap gems.

But before we dive into what those opportunities are, let’s clarify what micro-cap and nano-cap mean and how these can present huge opportunities for investors.

Micro-caps have a market value between $50M and $300M. Nano-caps are even smaller — typically anything under $50M.

These types of stocks have their risks, which is why it’s crucial to make sure they have a Weiss safety rating of “B-" or above.

But oftentimes, with inherent risks also come big opportunities.

For example, Monster Beverage (MNST) had a market cap of a mere $42M in April 2003 — along with a Weiss “Buy” rating. Today, the stock is worth $62B — a total return of over 147,000%. And, during that period, MNST never dropped below a “Hold” rating.

Another great example is HEICO (HEI), which was worth ~$160M in 2003. Now, HEICO’s market cap is $36B, a return of nearly 18,000%.

Weiss Ratings Plus users looking to find these stocks can go to Weiss’ Stock Ratings page, then click the hourglass to filter on scores of fields.

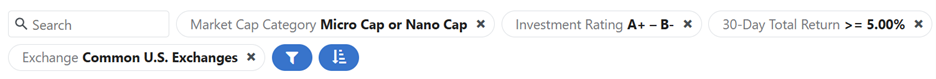

We screened for “Buy”-rated, U.S.-listed, micro-cap and nano-cap stocks with solid momentum by selecting the following fields and criteria:

- Investment rating: “A+” to “B-”

- Market Cap Category: Micro-cap or Nano-cap

- 30-Day Total Return: >=5%

- Exchange: Common U.S. Exchanges

Here Are 13 Tiny Stocks That Passed Our Screen.

The stocks on the list have a +25% average 30-day return and market caps ranging from ~$30M to $230M.

Remember, microcap stocks can be risky investments — but the right ones can also carry huge upside potential.

As a Weiss Ratings Plus member, you have exclusive access to special screeners designed to help you stay up to date with the best stocks to invest in.

And if you ever need a visual refresher on how to navigate the Ratings, our Video Tutorials are a useful resource available to you any time you need them.

We’re always working on adding more videos and resources to keep you on the leading edge of what is going on in the market.

Until next week,

Dallas Brown

CEO, Weiss Ratings