|

| By Mike Larson |

The stock market sure doesn't like the Federal Reserve's interest rate hikes. After all, the SPDR S&P 500 ETF (SPY) has slumped nearly 20% year to date.

The bond market? Same story.

The iShares Core U.S. Aggregate Bond ETF (AGG) has shed just over 10%.

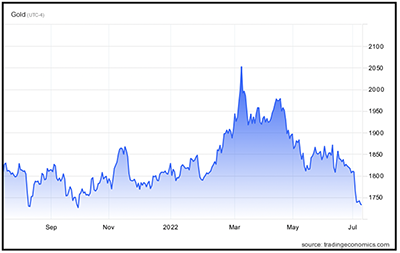

Gold? After holding up well earlier this year, the SPDR Gold Shares (GLD) has started losing ground. It was recently down 5% on the year, which is indicative of the larger struggles gold is facing.

And don't even get me started on Bitcoin (BTC). It's dropped over 58% since the start of 2022!

But there is one investment that LOVES what Fed Chair Jay Powell and his fellow policymakers are doing:

- It just had its best month since 2015.

- It just hit its highest level in 20 years.

- And it's on an absolute rampage against alternatives in many parts of the globe.

It's ...

The U.S. Dollar!

In fact, for the first time in 20 years, the U.S. dollar and the euro are at parity.

As MoneyWatch's Megan Cerullo noted, it's a good time to be an American in Europe.

"Everything from croissants to taxi rides to luxury goods will be cheaper than they have been in decades, thanks to a strong U.S. dollar."

The U.S. Dollar Index just punched through overhead resistance to hit 108.5, its highest level in 20 years!

So, what does the Fed have to do with the dollar?

Relative interest rates are a key driver of currency values. If one central bank's benchmark rate is, say, 3%, while another's rate is 1%, global capital will tend to flock toward the former's currency and away from the latter's.

Right now, the U.S. Fed has been hiking rates aggressively. That includes last month's 75-basis-point move, the biggest increase since the mid-1990s.

Powell & Co. have made clear that they plan to keep hiking rates as the year goes on, too. That potentially includes another 75 bp move at the Federal Open Market Committee meeting that ends July 27.

But the Bank of Japan has vowed not to hike at all for now. Meanwhile, the European Central Bank is only planning its first increase later this month ... and it's expected to be just a 25 bp move.

That will put U.S. rates well above rates in other, major developed-economy nations. And THAT is pumping up the dollar's value.

What Investors Can Consider

Well, a rising dollar tends to:

- Put downward pressure on commodities and precious metals.

- Hamper multinational U.S. corporations by making sales earned in foreign markets and currencies less valuable in dollar terms.

- Hurt the value of mutual funds and exchange-traded funds that track foreign markets.

So, if you're overloaded with exposure to commodity producers, multinationals or foreign exchange-traded funds, it might be a good time to dial that down.

Instead, you could focus on more defensive companies with recession-resistant businesses and significant domestic operations.

Utilities, consumer staples and healthcare are the three top-performing S&P 500 sectors over the past three months. Many companies in those sectors are seeing outsized performance as the broad market continues to correct.

Finally, if you're planning or departing on a European vacation, rejoice!

The strong dollar means your greenbacks will go further the second you touch down in Frankfurt or Rome.

Until next time,

Mike Larson

P.S. On Tuesday, July 19, Dr. Martin Weiss will reveal an opportunity that's been off-limits to the public for nearly 100 years. Claim your free spot for this historic event and get first access to an amazing private deal!