|

| By Jordan Chussler |

No matter where you turn these days, you’re going to hear about inflation. And there’s a lot of finger-pointing accompanying it:

- Conservative media is blaming President Biden’s policies, but that fails to account for inflation being a global issue. Look no further than Sri Lanka enduring food inflation at 80.1%.

- The White House is implicating Putin and the war in Ukraine, but the Russian invasion occurred after inflation was already on the rise in the U.S.

- And everyone in between is accusing corporate America of profiteering while deepening the crisis. For example, as gas prices soared this year, Exxon Mobil (XOM) and Chevron (CVX) were generating record-setting profits.

The truth is there’s no single culprit. The inflation we see today is the culmination of multiple factors, including federal stimulus, pandemic-induced supply-chain complications, corporate exploitation and a global energy squeeze.

Nevertheless, it’s a pressing issue to American consumers and retail investors alike who are witnessing the dollar’s purchasing power diminish.

We recently polled our readers, and among the questions was: Which issue worries you the most in 2022?

The prevailing answer was telling: Over 30% of respondents listed out-of-control inflation as their foremost concern.

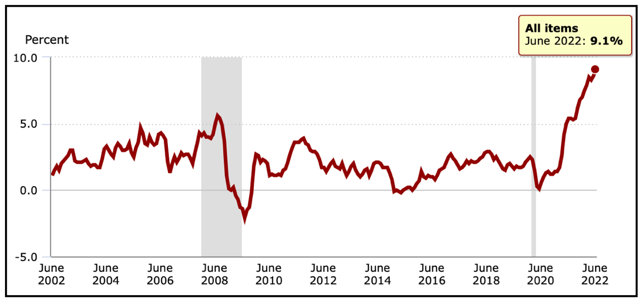

Given the Consumer Price Index shows inflation at a 41-year high of 9.1%, our readers’ distress is validated.

It isn’t going away, either. At least not any time soon.

Since May 2020, when the CPI sat at just 0.1%, it’s risen 9%. And even if inflation’s peaking — as some economists speculate — it could remain elevated for the foreseeable future.

The CPI hasn’t been this high since 1981, which comes as no surprise to anyone who’s paid an electric bill, filled their tank or gone grocery shopping at any point since.

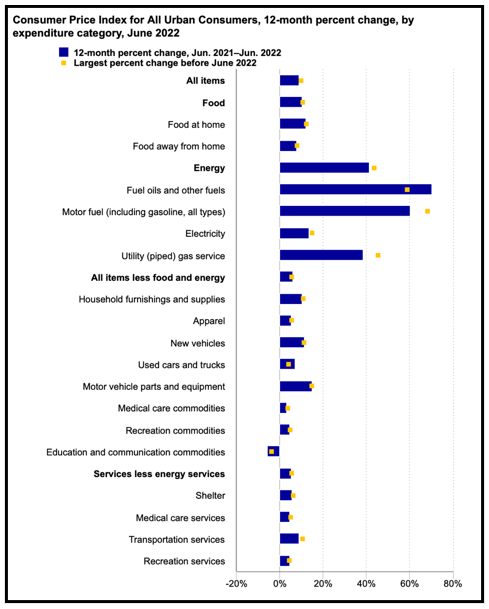

According to the U.S. Bureau of Labor Statistics, the 12-month change in CPI for food is 10.4%, 13.7% for electricity and a staggering 41.6% for energy.

It doesn’t stop there. For the first time ever, the average price for a new car has hit $48,000.

Sick of paying for gas and want to go electric? The average cost of a new EV is $66,000. Used cars offer no relief, either, with an average cost of $33,341 — slightly down from peak prices in March.

If you’re thinking about repairing an old vehicle, that’s going to cost an arm and a leg, too. The cost of car parts has increased by an astonishing 14.9%.

Want to dine out? Expect to pay 7.7% more. But if you want a nice home-cooked meal, it’s worse — 12.2%.

All of this makes me more appreciative for being married. Between gas prices and restaurant tabs, it’s painful to imagine how expensive dating in 2022 must be. At least if single people go home together, they can more easily explain why they’re turning off the lights. (To save money! Get your mind out of the gutter!)

So how can Americans — wedded or not — find investments that both (1) benefit from inflation and (2) pay shareholders as those companies drive up prices for consumers?

How to Battle the Bulge

Knowing which sectors are performing the best over a given period establishes a critical foundation. Of the S&P 500’s 11 sectors, utilities, healthcare and consumer staples have been the top three year to date, and unsurprisingly so. No matter how burdensome inflation is, people will always need electricity, medical treatment and food.

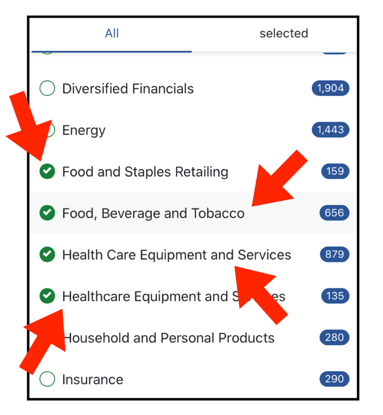

Armed with that knowledge, investors can navigate to the Weiss Ratings’ stock screener and add filters to target those sectors.

And since it’s appropriate — particularly in a late cycle environment — to find companies that pay shareholders to, well, hold their shares, I added one last filter for dividends yielding between 2.5% and 5%.

To simplify the search results, I took the top-rated company in each of those industries — utilities, food and healthcare — that’s significantly benefitting from inflation.

1. Utilities

The cost of electricity has increased so dramatically since the start of the year, cities like New Orleans are placing moratoriums on shut-offs due to delinquent accounts.

Those cost increases are being reflected in the S&P 500’s utilities sector, which is the second-best performing sector year to date with a 3.16% gain. Over the past three months, it’s the top-performing sector with a gain of 3.68%.

As a result, utility companies are experiencing outsized performance, and one of them happens to be just one of only four companies currently receiving a Weiss Rating of “A” or better.

Hydro One (H.TO) is an electricity transmission and distribution utility serving the Canadian province of Ontario. It not only services Ontario … it dominates the region. The company operates 98% of the high-voltage lines in the province, serving 1.4 million customers, which makes it Ontario’s largest distribution utility.

Hydro One has market capitalization of $21.11 billion, and shares are up 8.97% over the past six months. At the current price of $35.44, they’re just off their 52-week high and testing overhead resistance.

The Wall Street Journal gives the stock a high-end price target of $39, but even if it’s unable to break through resistance, the company’s dividend yields an impressive 3.16%.

Note: Hydro One does not trade on a major American exchange but is available on the Toronto Stock Exchange and the OTC market.

2. Food & Staples Retailing

Just like restaurant-goers, home cooks and grill masters are feeling the pinch this summer. And while shoppers aren’t happy when they have to pay nearly $20/lb. for grass-fed strip steaks, companies like SpartanNash (SPTN) are.

Founded in 2013, SpartanNash is a food distributor and grocery store retailer. The company owns 145 supermarkets across the U.S. — primarily under the banners of Family Fare, Martin’s Super Markets and D&W Fresh Market — and serves 2,100 independent and chain retailers around the country.

This food solution company's core businesses include distributing food to independent grocers, military commissaries and corporate-owned retail stores in 44 states, Europe, Latin America and the Middle East.

SPTN earned a Weiss Rating of “B+,” making it a “Buy.”

The company has a fairly small market capitalization of $1.15 billion, but the stock is up an impressive 27.54% over the past six months.

At the time of writing, shares are trading for $32.93, and SPTN’s dividend yields a solid 2.61%.

3. Healthcare

Medicine. Wellness exams. Non-elective surgeries.

No matter how bad inflation is (or gets), people will always require medical care, and publicly traded companies that provide it or produce ancillary goods and services are becoming shelters for bruised investors.

That’s why “Buy”-rated Patterson Companies (PDCO) receives a “B-” Weiss Rating. The company partners with dental practices of all sizes to provide expertise, products, technologies and services needed to keep them running smoothly.

And since 2001, PDCO’s been involved in the animal health industry after acquiring Webster Veterinary. In 2015, Patterson expanded with the acquisition of Animal Health International. They now provide all the technology, expertise and solutions needed to deliver animal care and drive profitability across the companion, production and equine markets.

Patterson has a modest market cap of $3.01 billion and the stock is up 8.63% over the past six months.

At a current share price of $30.34, the stock has plenty of room to grow toward The Wall Street Journal’s high-end price target of $42. Meanwhile, the company pays a dividend currently yielding a generous 3.34%.

Knowing which industries are benefitting from — if not downright outpacing — inflation, points investors in the right direction.

That information can be built upon by using the Weiss Ratings to discover companies within those industries, their respective ratings and whether they pay dividends.

If you’re interested in tailored picks within those sectors, members of Senior Analyst Tony Sagami’s service, Disruptors & Dominators, are currently in positions with dividends yielding as much as 2.85% while enjoying open gains of more than 33%, 42% and 56%.

As always, conduct your own due diligence before entering any trade.

Until next time,

Jordan Chussler

Managing Editor

Weiss Ratings Daily