3 Tech Stock Buying Tools for a Top-Heavy Market

|

| By Michael A. Robinson |

When I tell you I have a track record of beating Wall Street to the punch, I can back it up.

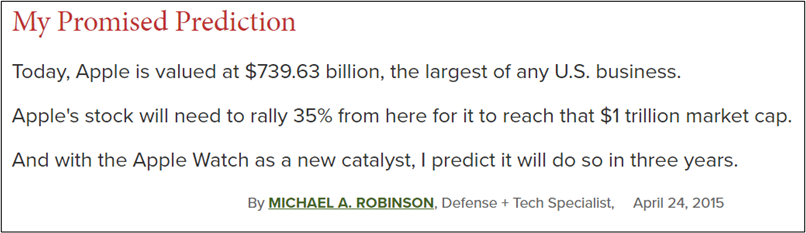

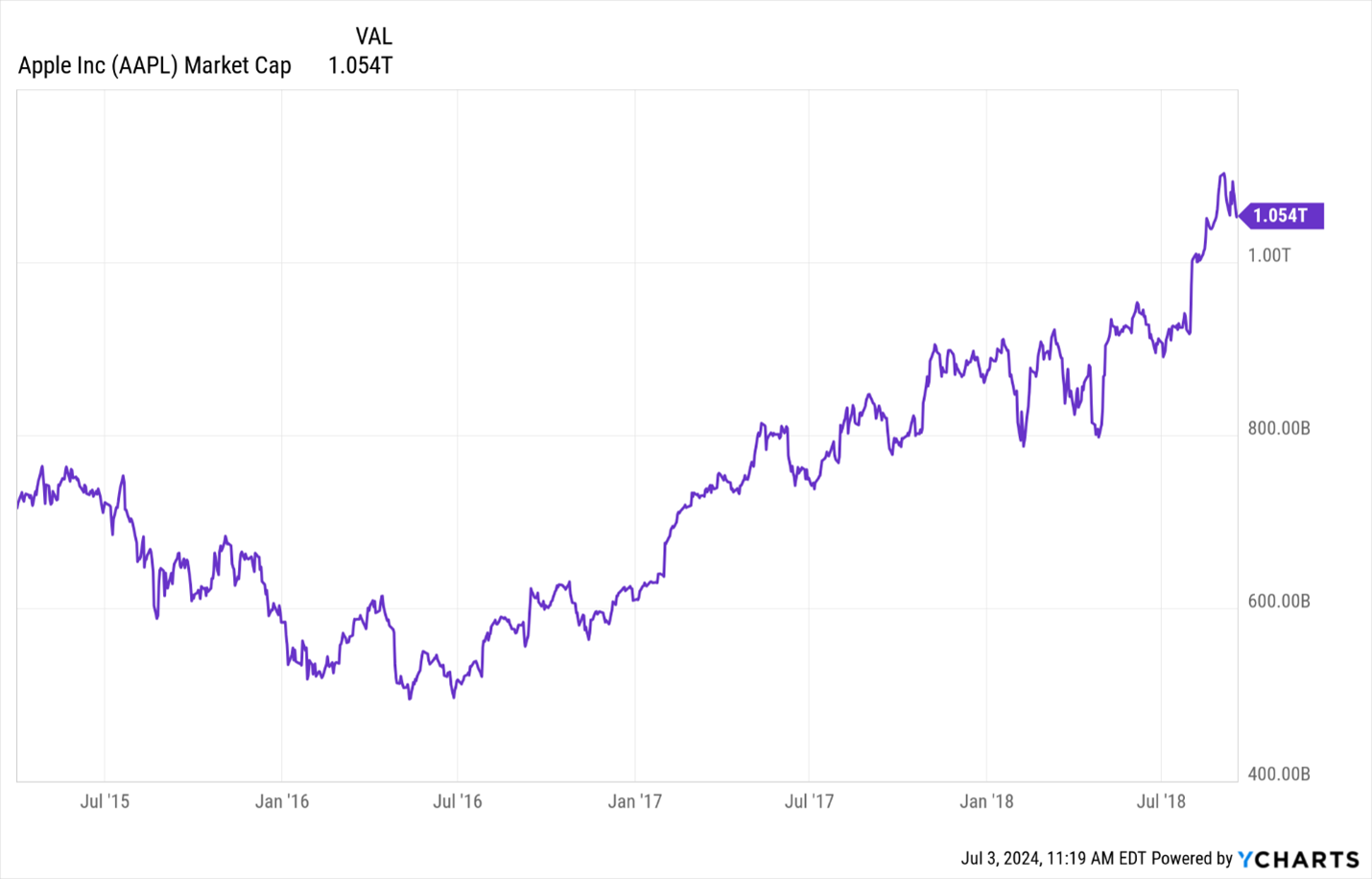

And no case is more pertinent to today’s market conditions than the prediction I made back in November 2015:

I predicted that Apple (AAPL) would become the first tech firm to have a market value of a cool $1 trillion. At the time, lots of so-called experts thought I was crazy.

But less than three years later — the time frame I gave for this to happen back then — Apple hit that milestone, making stock market history.

Irony abounds. Today I believe the market has gotten what I call “top heavy.”

Consider that the top five tech firms alone are worth a combined $14.8 trillion.

That’s roughly on par with the economies of Japan, Germany, India and the U.K. — combined.

Moreover, just five Big Tech stocks make up more than half of the S&P 500’s 14.5% returns so far this year, with Nvidia (NVDA) alone accounting for 30%, according to a story last week in The Wall Street Journal.

The paper followed that up with a story on Monday showing that the average S&P stock had gained 4.1% in the first six months. That is the largest difference between total performance and average stock performance since 1990.

Now you know why I believe too many investors are too heavily focused on the AI boom and financial results of just a few firms.

As I see it, an earnings miss by any of these leaders — but especially Nvidia — could put pressure on stocks on fears of slowing AI or economic growth.

Not to worry. Today I am going to share three tools to enter new positions and at the same time protect your portfolio from any sell-off. So, let’s get started:

Top-Heavy Market Tool No. 1:

The Cowboy Split

I’m shocked more professional investors don’t know about this powerful moneymaking tool. But it’s one I use all the time.

Simply stated, the Cowboy Split is a staggered-entry system.

You take a position in a stock at current market prices — and then enter a “lowball limit” order to buy more if a discount comes your way.

In general, I recommend employing a 15% to 20% discount from your entry price as a second buy point. Here’s how it works …

You acquire 50% of your intended stake in XYZ Tech Corp.at a price of $50. In this case, should the market trigger your “lowball limit” order, you would automatically buy a second 50% stake at $40 a share, for an average price of $45.

Now assume XYZ rallies all the way to $60. You would then have 16.6% appreciation on your original shares. But it’s that second stake that really juices your profits.

See, that second half’s gains are double those of your first buy. This way, you end up with overall gains of 25%, or roughly 50% more than had you just bought your full stake at $50.

Top-Heavy Market Tool No. 2:

The Free Trade

Whenever a stock doubles in value, you can take a free trade and lock in gains.

That’s a sell order for half your stake. Doing so means you have all your original capital back and are then playing with the house’s money.

It’s a powerful way to protect profits against an unsettled market, with two side benefits.

First, you can end up owning a suite of stocks for free. And second, you stay in the position to reap any new upside.

To me this is particularly appealing for stocks that show rapid appreciation in a market like we have today, which is dominated by a few names.

As I noted a moment ago, a retreat by a famous name could well spread to other stocks.

If you want to put this on autopilot, that is easy to do. You set a limit order to sell automatically half the holding when the stock hits returns of 100%.

Top-Heavy Market Tool No. 3:

Lock In Gains with Trailing Stops

These days, when I talk with investors, a lot of them seem worried about their profits and what might happen if the market reverses, possibly with vigor as we move into election season.

I get it. After all, we have been reaching record highs for some time now. And the old adage that “what goes up, must come down,” gives them some anxiety.

Remember this fundamental investing rule: There is no such thing as perfect timing.

That’s why I advocate in conditions like we have now to lock in gains and get on with your life.

This may be the simplest tool of all: trailing stops. By that I mean you decide how much of a reversal you are willing to take in advance and then use that as a trailing stop, with 20% as a good rule of thumb.

It’s easy to do. You simply tell your broker to set a 20% trailing stop that is good-till-canceled.

That way, if the stock reverses by that amount, you automatically exit with most of your profits still in hand.

You can see that by using our Top-Heavy Market Tools you can keep on investing in winning tech stocks and know that you’re prepared for anything the world throws your way.

And you won’t drive yourself nuts on the road to wealth that is paved with tech.

Best,

Michael A. Robinson

P.S. I use these strategies all the time. And in light of this recent breakthrough presentation, you can join me in doing so. In it, you’ll see exactly what Nvidia’s $1 trillion pivot means for other tech companies on the road to wealth.