|

| By Mike Larson |

There’s no better way to describe the selling in this market than relentless.

The averages are down notably, with the SPDR S&P 500 ETF (SPY) off 15% year to date earlier this week — its worst start to a year since 1939. But in several sub-sectors of this market, the action is absolutely horrendous.

The selling there is just like what I’ve seen before when other asset bubbles have popped, from Dot-Com stocks in the early 2000s to housing and mortgage names a decade and a half ago.

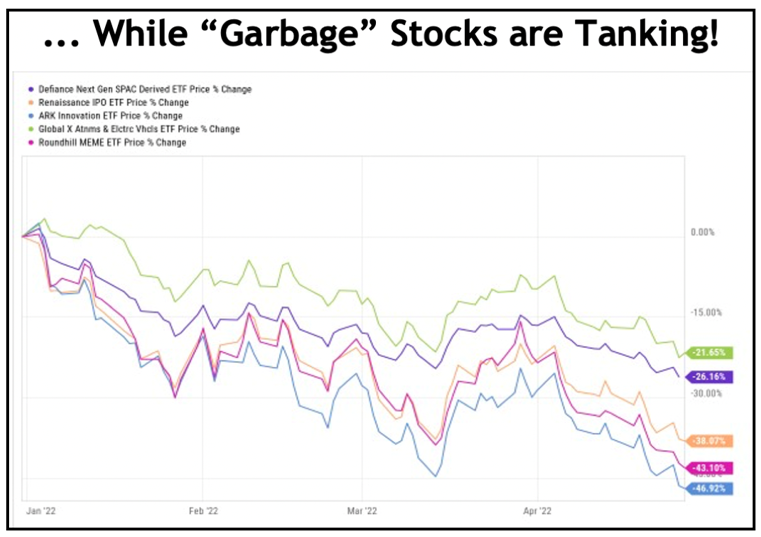

Case in point: I’m in Las Vegas right now for the MoneyShow, and this is a slide from one of my presentations today.

It tallies up the carnage in the most “bubble-icious” sectors of the market from the past few years:

Think of things like meme stocks, money-losing electric vehicle (EV) stocks, special purpose acquisition companies (SPACs), profitless initial public offerings (IPOs) and more. Losses on exchange-traded funds (ETFs) that track those sectors are approaching 50% ... YEAR TO DATE! That’s astonishing considering 2022 isn’t even half over.

You know some of the obvious reasons the market is struggling:

- Federal Reserve rate hikes are slowly but surely tightening money.

- The inflation news continues to stink up the joint, with prices rising at the fastest pace in 41 years.

- The flattening and then inverting of the yield curve earlier this year, along with a handful of disappointing economic reports, raises concerns about a recession later in 2022 or 2023.

But there’s also something more fundamental — and simple — going on here: We had MASSIVE bubbles in many sectors, and all bubbles eventually pop. That’s it. That’s the pattern we’ve seen again and again in the past, and it’s the pattern playing out again now.

So, what do you DO about it? What’s the best course of action for investors like you? Follow my “Safe Money” game plan!

The complete details, along with specific recommendations, can be found in the May issue that hits subscriber email boxes this Friday. Look for it then.

But if you’re not quite ready to take that step and join me, at least consider …

3 General “Safe Money” Guidelines

1. Avoid or dump the junk! I wholeheartedly hope you aren’t stuck holding garbage meme stocks, profitless IPOs or overhyped, Dot-Com-esque tech stuff. I warned you several quarters ago to stay away, and our objective Weiss Ratings for many of these names are “Sells,” too.

But, if for any reason, you ARE still holding on to names like those, my recommendation is sell and don’t look back. The losses we’ve seen so far are bad. But the lesson of the Dot-Com bust is that they can just keep getting worse. Some of these stocks will likely turn out to be zeros.

2. Invest in higher-yielding, cycle-appropriate stocks instead! There are plenty of higher dividend, higher rated stocks with real business models and recession-resistant operations out there. You just have to be willing and able to find them.

They won’t get as much press as more exciting names. But if you ask me, losing gobs of money on exciting stocks isn’t exciting at all! Focus on consumer staples, utilities, energy companies and others that can prosper in a late-cycle environment like this one.

3. Hedge against declines — or PROFIT from them! The world of inverse ETFs has expanded dramatically over the past several years. These specialized funds RISE in value when select indices or sectors FALL.

Therefore, you can use them to hedge against losses in other parts of your portfolio by targeting lousy market groups. Or you can go for profits from declining markets with them.

If you follow this Safe Money game plan and Safe Money strategies, I’m confident your portfolio will thank you.

And I’ll do everything I can to keep you ahead of this relentless market, come what may!

Until next time,

Mike Larson