How would you like to receive a year-end bonus of 30 times your annual salary?

Who wouldn’t?!

That’s exactly what happened to employees of COSCO Shipping (OTCMKTS: CICOY), China’s largest transoceanic shipping company.

That’s not a one-off aberration, either.

Evergreen Marine (TWSE: 2603) of Taiwan paid their employees a bonus that was as high as 40 times their monthly pay!

The reason for the windfall bonuses? Profits are skyrocketing thanks to record-high freight rates.

- The cost to ship a 40-foot container jumped from $2,000 in 2019 to $20,000 last year.

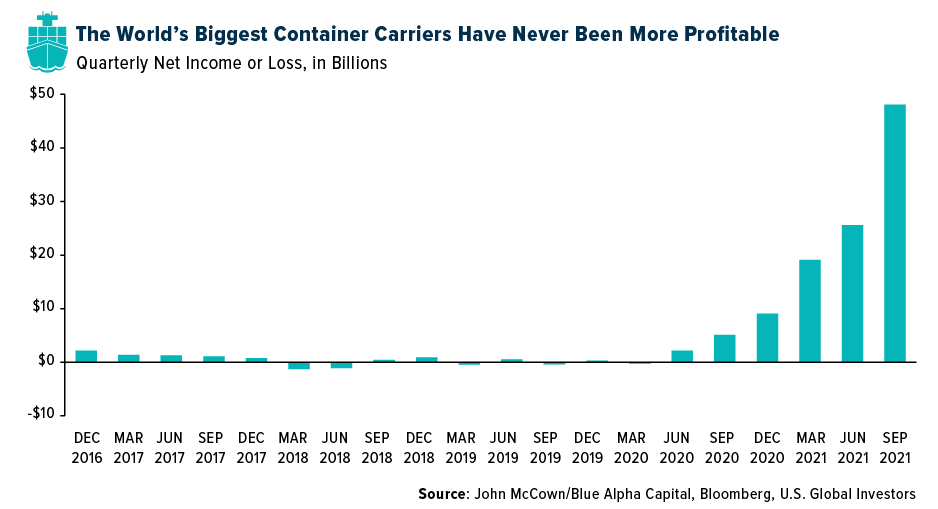

That impacted bottom lines in an eye-popping way because the combined profits of global cargo carriers hit a record $150 BILLION in 2021.

The global economy is picking up steam … and shipping companies have seen a massive increase in volume.

Example: The Ports of Long Beach and Los Angeles handle 25% of the inbound cargo containers into the U.S. … and business is booming.

In 2021, Long Beach and Los Angeles handled 9.38 million and 10.7 million cargo containers, respectively, in 2021, a 16% year-over-year increase.

And 2022 is shaping up to be an even more profitable year for shippers because of worldwide supply chain bottlenecks. Importers and manufacturers are scrambling to lock in cargo space and signing lucrative, long-term contracts.

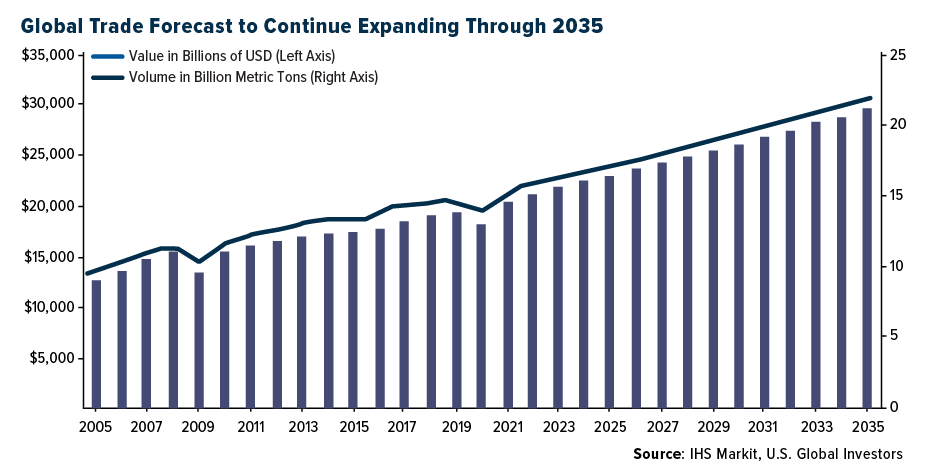

IHS Markit expects global trade to increase from 15.2 billion metric tons in 2021 to 15.8 billion metric tons in 2022. And even more from there.

So, how can you hop on this shipping bandwagon?

There are three types of shippers: tankers (liquids like oil), cargo containers and dry bulk shippers of commodities (grains, metals, coal).

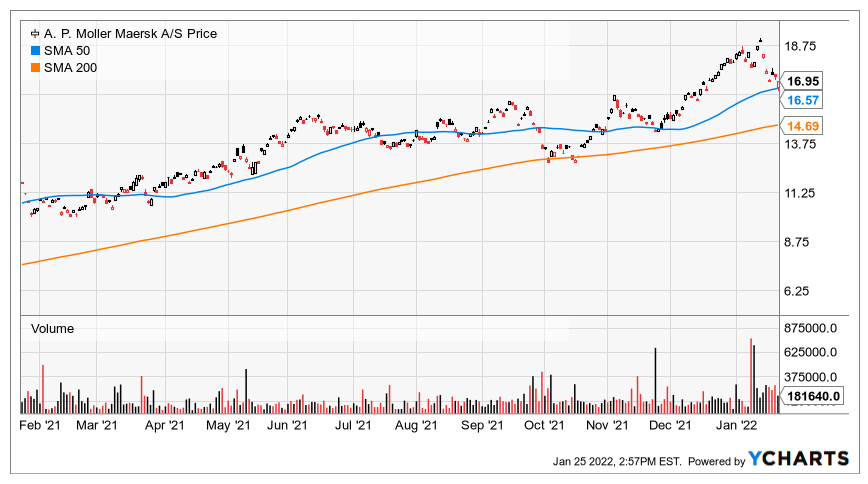

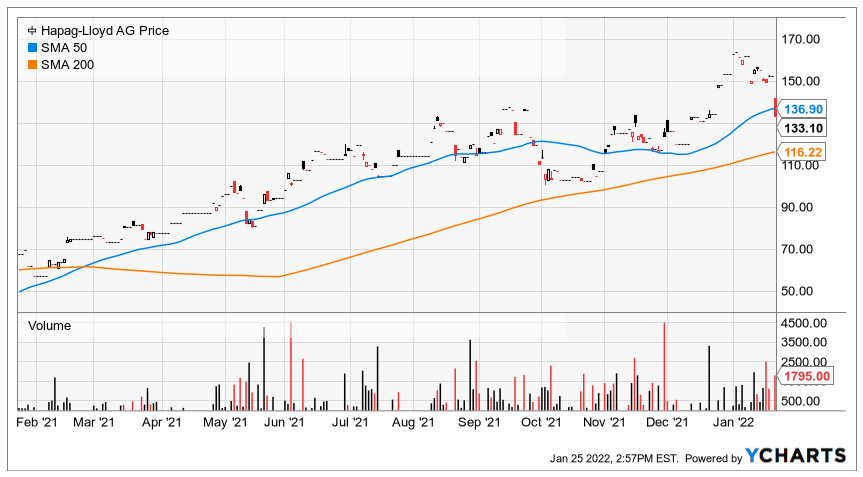

Cargo containers are the sweet spot and the two largest in the world are A.P. Møller Mærsk (OTCMKTS: AMKBY) and Hapag-Lloyd Aktiengesellschaft (OTCMKTS: HPGLY). Both are worth your consideration.

Trading volume for both can be thin, but that shouldn’t make potential investors shy away. Here are the one-year charts, with volume, for each:

If you prefer the relative safety of an exchange-traded fund (ETF), there’s good news ... a new ETF — the U.S. Global Sea to Sky Cargo ETF (NYSE: SEA) — focuses on the global maritime and air freight industries.

The advantage of SEA is that many of the world’s most profitable shipping companies are non-U.S. companies and in markets (like China) that are difficult, if not impossible, to invest in.

As a result, SEA’s holdings include some of the top freight companies from around the globe.

- SEA just started trading on Jan. 20 and is a one-stop way to become a global shipping tycoon.

And don’t forget about trucking stocks, which transport 72% of all the goods in North America.

I wrote about the trucking industry last week. It’s a crucial part of the transportation food chain … and a potentially lucrative investment option.

But for my best pick right now, you have to be a subscriber.

I’m putting the finishing touches on my monthly newsletter, Dominators & Disruptors, and will be hitting the send button today around noon Eastern.

I’m dishing out a new glistening stock recommendation … and to be one of the first to get it in your inbox, click here now.

Best wishes,

Tony Sagami