|

| By Tony Sagami |

I was the only hell my mother ever raised.

She paid more attention to my 1 a.m. high school curfew than to how many beers I drank before I got home. She had good intentions but didn’t see the forest for the trees.

Similarly, financial media and Wall Street are focused on the wrong thing when it comes to the Federal Reserve. I’m talking about interest rate policy.

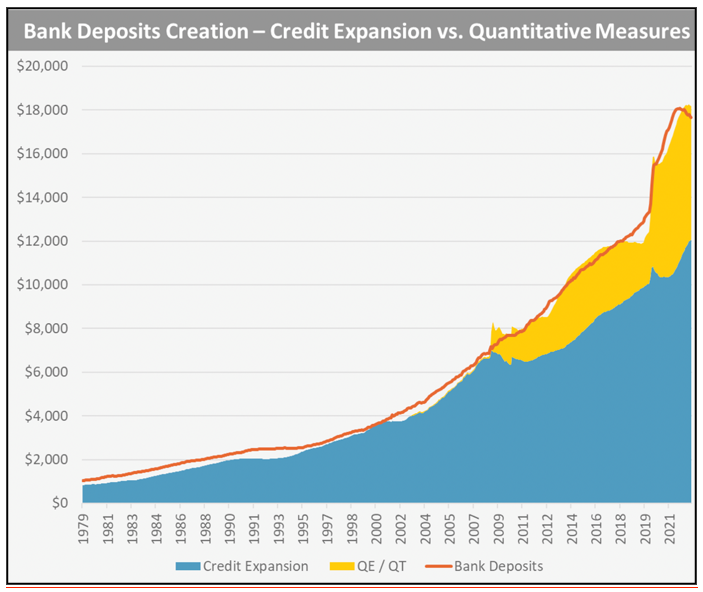

Sure, interest rate policy is important to the economy but it’s no longer the primary driver of the stock market. Far more important is quantitative easing or quantitative tightening.

Click here to see full-sized image.

What’s driving the stock market is the Federal Reserve’s balance sheet policy.

QE — not interest rates — was the primary driver of money growth over the past decade … especially during the COVID-19 pandemic. QE became the new form of money supply growth and is completely controlled by the world’s central banks.

Since 2008, roughly half of the growth of money supply has come from QE.

But QT has been replaced with a return to QE. The Fed is replacing all the money it sucked out of the economy via QT.

In March, U.S. banks lost $390 billion in deposits, the biggest monthly outflow in history.

The Fed realized that QT — not interest rates — was one of the causes of the banking liquidity crisis that took down Silicon Valley Bank, Signature Bank and Credit Suisse.

The Fed's response was to create new emergency lending facilities to bail out insolvent banks, injecting $392 billion into the banking sector in the past three weeks.

It’s the old Fed playbook: When in doubt, flood the economy with money. That is why those major banking failures didn’t sink the stock market.

And that is also why the old adage of “don’t fight the Fed” still applies today.

However, as we have been pointing out for months, the Fed’s actions should have investors concerned.

Starting as soon as May 2023, the central bank’s insidious “Fed Control” powers could go live, which means that any accounts linked with the U.S. banking system could soon be at risk for surveillance of all transactions.

Investors who want to take action to protect their money should click here for four steps to take now to stay safe and grow your wealth.

Mountains of Cash

On top of the Fed’s money fountain, retail investors are sitting on $5.1 trillion of cash today.

That’s more cash on the sidelines than during the worst of the COVID-19 pandemic, as well as an all-time high.

The last two times investor cash surged like this was in 2008 and 2020 — both of which occurred near major market bottoms.

Between the Federal Reserve and sideline cash waiting to pour into the stock market, the next major move for the stock market will be higher.

That doesn’t mean there won’t be uncomfortable pullbacks, including triple-digit declines for the Dow Jones Industrial Average. But the primary trend is higher.

If you’re an aggressive investor who agrees with me, you should look at some leveraged ETFs, which will give you double or triple the return, such as:

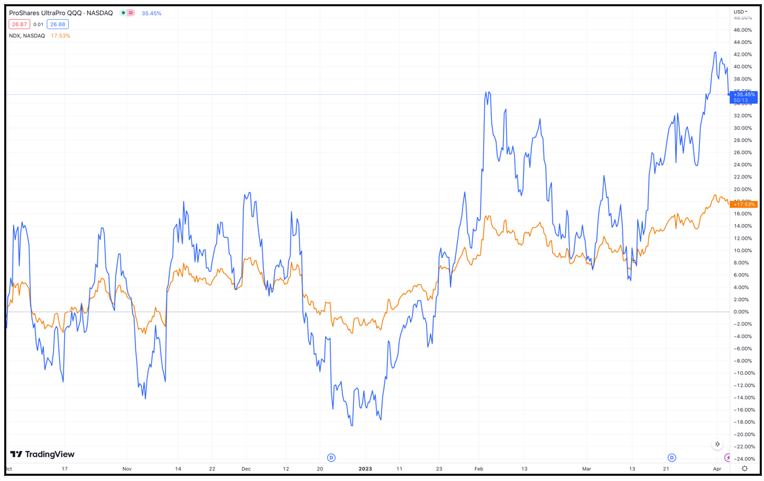

1. The ProShares UltraPro QQQ (TQQQ): Delivers 3x the daily performance of the Nasdaq-100 Index.

2. The ProShares Ultra Dow 30 (DDM): Delivers 2x the daily performance of the Dow Jones Industrial Average index.

3. The ProShares Ultra S&P500 (SSO): Delivers 2x the daily performance of the S&P 500 index.

4. The ProShares Ultra Russell2000 (UWM): Delivers 2x the daily performance of the Russell 2000 Index.

Warning: That double and triple performance applies to the downside as well as the upside. For every 1% the index declines, you can expect the value of a leveraged ETF to drop by 2% or 3%.

For example, if the Nasdaq-100 declines by 10%, you can expect the ProShares UltraPro QQQ to lose 30% of its value. Everybody loves upside volatility, but nobody likes downside volatility.

But in a year that we’ve seen the major indices rebound, these could be strong plays for investors who keep a watchful eye.

Sticking with the TQQQ as an example, at the time of writing, the Nasdaq-100 has risen 19.41% year to date. As a result, the TQQQ is up over 59% over the same time frame.

Click here to see full-sized image.

If the stock market continues to rally, the aforementioned leveraged ETFs will make you a small mountain of profits.

Best wishes,

Tony