|

| By Tony Sagami |

In 1950, Patricio “Paddy” Martinez, a member of the Navajo Nation, crawled under a rock ledge near Haystack Mesa in New Mexico to escape some rain.

Hours later, while at a nearby bar, a handful of uranium prospectors’ Geiger counters started to go wild when Martinez walked in.

He was covered in yellow dust, and that chance encounter between Martinez and the uranium prospectors ushered in the beginning of nuclear power in the U.S. The rest, as they say, is history.

World Energy Demand & Nuclear Power

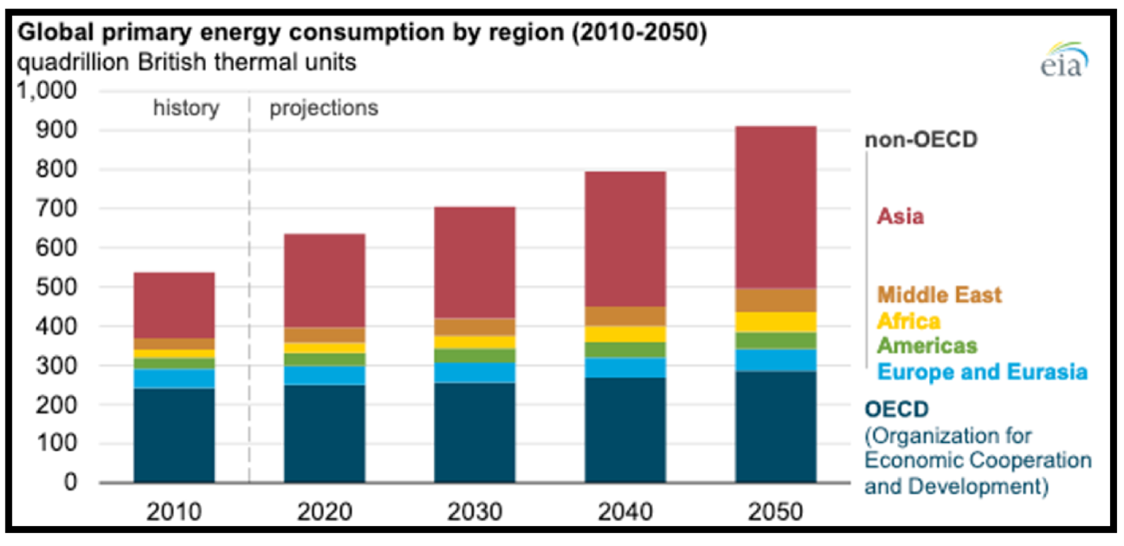

The U.S. Energy Information Administration (EIA) expects global electricity consumption to increase by 50% by 2050. The reason is simple: the world’s population is surely and rapidly growing.

So, where is all that electricity going to come from?

Solar and wind power will definitely be part of the solution, but the sun isn’t always available, and wind doesn’t always blow.

The modern world needs around-the-clock sources of power. Why? Take, for example, the U.K., which gets 25% of its power from wind turbines that obviously can’t work without wind.

- Last year, unusually calm weather in the North Sea reduced wind power output to only 5% of capacity.

U.K. wind farms produced less than 1 gigawatt of power while full capacity is 24 gigawatts. As a result, electricity power prices skyrocketed to new highs.

Wind and solar power are — by the very nature — intermittent sources of electric power production and cannot be solely relied upon for output.

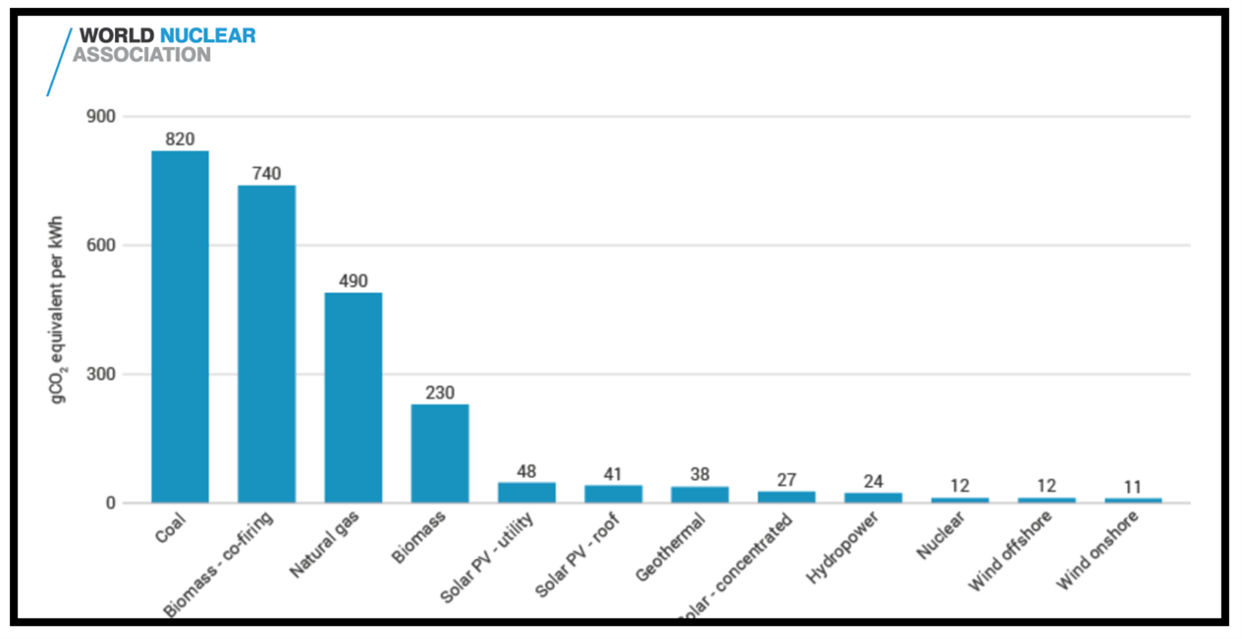

- Nuclear power, however, is 24/7 and does not emit any greenhouse gases.

And nuclear power is already an established source of electricity that provides about 10% of the world’s electricity.

5 Reasons the World Needs More Uranium

Reason No. 1: Rapid Buildout of Nuclear Plants. There are 440 operating nuclear plants in 32 countries. According to the World Nuclear Association, there are 55 nuclear power plants under construction, another 74 that are approved and another 300 in the proposal stage.

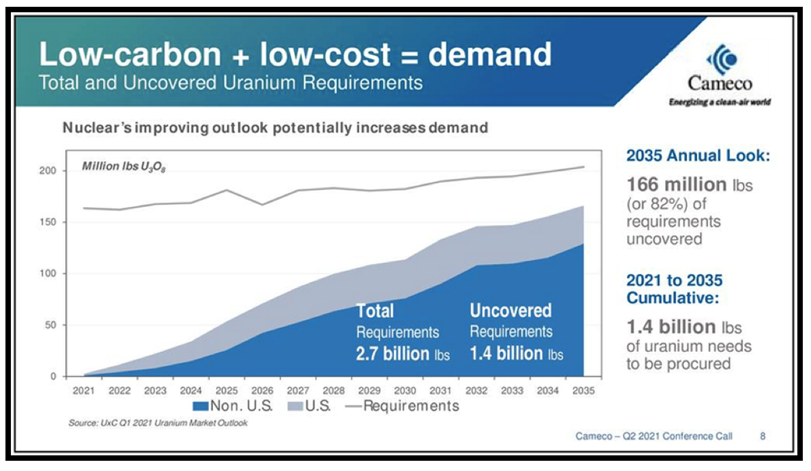

- And all those new nuclear power plants are going to need uranium. Lots of it.

Here’s the math: A typical nuclear plant requires a first fill of around 600 tons of uranium and then consumes around 200 tons each year thereafter.

That’s on top of the 80,000 tons of uranium the world’s 440 nuclear reactors already consume.

Get this: According to the Uranium Information Centre, the world only produced 46,720 tons of uranium last year, and the shortfall was covered from by inventory stockpiles, mostly from reprocessed Russian nuclear weapons.

- We’re talking about a huge increase in the demand for uranium and a severe production shortage.

That is, of course, extremely positive news for uranium prices and uranium producers.

Reason No. 2: Nuclear Power Is Safer Than Ever. Of course you’ve heard about the Fukushima nuclear disaster. I was born in Fukushima province, so it is especially personal to me.

The good news is that nuclear plants are safer today than they have ever been thanks to technology and improved engineering.

Today’s nuclear reactors employ duplicate emergency cooling systems to prevent overheating and are built with core catchers that contain the reactor core in a worst-case meltdown event.

Reason No. 3: Energy Security. As the Russian invasion of Ukraine has proven, you need to get your head examined if you trust Russia as a source of energy.

Eliminating dependency on foreign energy — be it Russia or OPEC — is an important benefit of nuclear power.

And nuclear energy is cheap. According to the Nuclear Energy Institute …

- Nuclear plants can produce electricity for 1.68 cents per kilowatt hour, the cheapest alternative there is.

Consider this: The last of the 103 operating nuclear reactors built in the U.S. was in 1993 when gasoline was selling for roughly $1.30 a gallon. With gasoline around $4.30 a gallon today, you can understand why uranium has a glowing future (pun intended).

And the higher oil prices rise, the more economical nuclear power becomes.

Reason No. 4: Air Pollution. The slap-your-forehead moment for me was earlier this year when 10 European countries — France, Bulgaria, Croatia, Czech Republic, Finland, Hungary, Poland, Slovakia, Slovenia and Romania — petitioned the EU to include nuclear energy as a green energy source.

That’s right …

- A consortium of European countries is using the European Commission to recognize nuclear power as a low-carbon energy source and include it as a key piece of decarbonization.

Nuclear power is the second-lowest greenhouse gas–emitting energy source.

Nuclear plants produce a fraction of the air pollution that coal-fired power plants generate and are one of the cleanest power sources.

Reason No. 5: Global Warming. Governments around the world are committed to combating global warming … and nuclear power, which emits no greenhouse gases, is widely seen as an essential part of the green energy solution.

The nuclear industry and uranium miners/processors received a big shot in the arm from Emmanuel Macron, the president of France.

According to Macron:

"To guarantee France’s energy independence, to guarantee our country’s electricity supply, and to reach our goals — notably carbon neutrality in 2050 — we will for the first time in decades revive the construction of nuclear reactors in our country, and continue to develop renewable energy.”

- France plans to build up to six new nuclear reactors to reduce dependence on foreign oil and gas to meet global warming targets.

France already has 56 nuclear power plants in operation and generates 70% of its electricity from nuclear energy.

Nuclear energy is the total package: low impact, high performance, zero emissions. It is the only form of clean-air energy that can supply power around-the-clock, anytime of day or night.

While not unanimous, it is becoming more accepted to believe that achieving global goals to cut carbon emissions, and decarbonize the world, will require nuclear power.

There are several ways to invest in nuclear power. If you’re an exchange-traded fund (ETF) investor, take a look at the following:

- The Global X Uranium ETF (URA)

- The North Shore Global Uranium Mining ETF (URNM)

- The VanEck Vectors ETF Trust - Uranium+Nuclear Energy ETF (NLR)

Warning: URA and NLR are heavily invested in utility stocks, which happen to own nuclear power plants. In my opinion, that won’t give you much of a uranium bang.

If, instead of an ETF, you’d like a specific stock recommendation, I pointed my Disruptors & Dominators subscribers to one uranium company in particular. That company has the largest uranium reserves in the world with 580 million tons.

Those who acted on my recommendation are now sitting on open gains of since 55.61% since hopping in on Jan. 28. If you’d like to join them in receiving my picks, click here now.

In 1978, uranium topped out at $43.40 per pound, which is around $145 in today’s dollars. With uranium currently selling for roughly $60 a pound, it would have to almost quadruple to reach its old highs.

I’ve seen forecasts for as high as $500 a pound, but even if uranium only hits $100, that company is going to need a fleet of trucks to cart all its profits to the bank.

Best wishes,

Tony