|

| By Michael A. Robinson |

To say that Wall Street doesn’t like Trump’s tariffs is one of the classic understatements of all time.

Everywhere you look, the alleged pros are hitting the panic button.

But here’s the thing …

We’ve seen this pattern before. Disruption always creates opportunity — if you know where to look.

While the headlines scream panic, smart investors are already adjusting for the next round of profits.

Today, I’ll walk you through five savvy tools designed to do just that.

They will help you stay focused and make moves to protect your capital and cash in on the pullback.

So, let’s get started …

Tariff-Driven Market Tool No. 1: Build Your Shopping List

Big selloffs like this one can shake investors’ confidence. But for those paying attention, they offer the chance to pick up future winners at a discount.

That’s why now is the perfect time to build your shopping list — a watchlist of strong, promising companies you’ll be ready to buy once the dust settles.

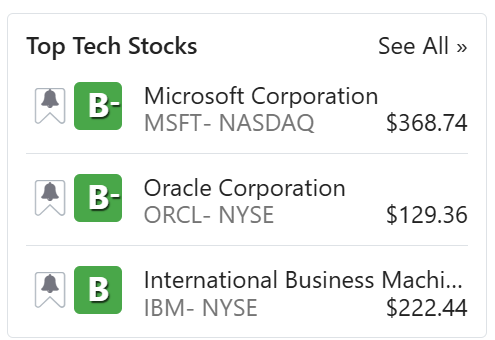

A great place to start is right here at Weiss Ratings. For more than 50 years, Weiss has helped regular Americans stay ahead of Wall Street by providing independent, data-driven analysis.

Today, Weiss actively rates more than 53,000 stocks, ETFs and mutual funds. Over the past two decades, it has issued “Buy,” “Sell” and “Hold” ratings on more than 12,500 stocks.

And get this — the average gain on all its “Buy”-rated stocks, winners and losers included, is 303%.

That’s the kind of research that turns pullbacks into profits.

Tariff-Driven Market Tool No. 2: Buy "Stupid Cheap" Stocks

One upside of a sharp market selloff? Great stocks get stupid cheap.

No one rings a bell at the bottom — and that’s fine. We’re not chasing perfection. We’re looking for deep discounts that give us a margin of safety.

Here’s how to do it: Set a few simple metrics. Maybe it’s a stock that’s dropped 50% from its high. Or one trading at half its historical P/E ratio.

The exact numbers don’t matter as much as the discipline.

Once you’ve identified your price, don’t wait — set a lowball limit order in advance. That way, if the stock drops to your target, the trade happens automatically.

No hesitation, no second-guessing.

This is how disciplined investors build serious wealth — one smart buy at a time.

Especially when you’re targeting fundamentally strong firms like Oracle (ORCL) with a solid “B-” rating from Weiss.

I’ve recommended it in the past and continue to do so.

Tariff-Driven Market Tool No. 3: Take the Free Trade

When you’re sitting on a double in volatile market like this one, it can be a great time to take what I call the “free trade.”

You sell half your position and get all your original risk capital back. And that means the rest of the ride is pure upside. You’re playing on the house’s money, with zero out-of-pocket exposure going forward.

And in this kind of market, that’s a beautiful place to be.

This move also helps you stay disciplined. It takes the pressure off and keeps you from panic-selling a big winner just because the headlines are filled with fear.

Plus, it frees up capital you can redeploy into other opportunities — like the “stupid cheap” names on your buy list.

It’s a smart way to stay aggressive without taking on more risk

Tariff-Driven Market Tool No. 4: The Autopilot Profit System

You don’t have to wait for a double to lock in profits — and you don’t need to sell on a whim either.

That’s where the Autopilot Profit System comes in. It’s a simple two-step formula: Take partial gains when a stock hits your first target, then set a trailing stop on the rest to protect your upside.

For example, you might sell 30% of your position when it’s up big. Then set a stop near your original entry — or higher — to guarantee profits if the stock pulls back.

This approach removes emotion and second-guessing. You predetermine your gains, protect your downside and let the rest ride.

It’s a tool I use constantly. When we hit a free trade, we often put a 50% trailing stop on the remaining shares — so we’re locked in for 75% gains even if the market turns.

Tariff-Driven Market Tool No. 5: The Cowboy Split

I’m surprised more investors don’t use this. It’s a simple, powerful tool we rely on all the time.

The Cowboy Split is a staggered-entry strategy. You buy half your intended stake at market — then set a “lowball limit” order for the other half in case the stock dips.

Let’s say you buy 50% of your position in XYZ Tech at $50. You set a limit order to buy the rest at $40 — a 20% discount.

If it triggers, your average cost drops to $45. And if the stock rallies to $60, your second buy delivers double the gains of the first.

That boost pushes your total return to 25%, or 50% more than if you’d gone all-in at $50.

In today’s choppy, tariff-driven market, these five tools are more than just tactics — they’re your playbook for long-term success.

Because the real goal isn’t just beating the noise — it’s building serious wealth over time.

Stay focused, stay strategic … and let the market work for you.

Best,

Michael A. Robinson