|

| By Chris Graebe |

I have terrible news to share that many other private equity and pre-public investors wouldn’t even acknowledge …

Startup scams have increased 250% since 2013.

But … I’ve also been diligent in this time frame to dissect and identify these scammers. And I'm here today to show you everything that I do to avoid being suckered by con artists.

As you know, scams and frauds are not new. I wish it weren’t true, but it's an unfortunate reality in the world of finance.

Think about crypto exchange FTX. The company lost $7.7 billion of everyday peoples’ money in a Ponzi scheme.

Theranos, a consumer healthcare technology startup, once reached a $10 billion valuation despite being a scam and complete fraud.

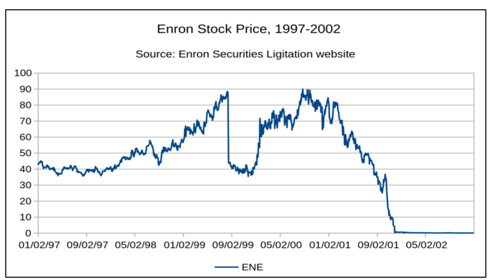

Then there’s the Enron debacle of many years ago. The Houston, Texas-based energy company’s collapse impacted thousands of employees and rattled Wall Street.

At Enron’s peak, its shares sold for $90.75. Just prior to declaring bankruptcy on Dec. 2, 2001, they traded at a measly $0.26.

Those are obviously big financial names — some public, some private. In equity crowdfunding, scams are inevitable because good and bad players dot the landscape.

You should avoid the bad ones like the plague … so, knowing how to spot them is key. Here are the six “tells” of a fraudster startup.

Fraudster Tell No. 1: Promises, Promises

Start by looking for unrealistic promises: things that just sound too good to be true.

If you come across a startup that's promising or guaranteeing returns, or they're promising you returns without a track record or some way to prove them, run for the hills.

Fraudster Tell No. 2: Not Passing the Bad Actor Test

Another reason not to stick around is an unverifiable credential. Let’s say you do a quick Google search of the founder or entire team. You’ll find past reviews and gain insight into what’s happening in the background of the founder’s story.

One thing to be aware of is legislation put in place by the Securities and Exchange Commission (SEC) that addresses the world of equity crowdfunding. It is now mandatory that any portal that's vetting a founder run a bad actor check.

If the founder doesn’t pass the bad actor check, he or she is not allowed to raise money via equity crowdfunding. However, passing the bad actor check also doesn’t mean that the person doesn’t have a shady past.

That’s why I always dig deeper, search for reviews online about the founder, as well as a startup itself … and talk to everyone I can with connections.

Fraudster Tell No. 3: No Contact Info, Multiple Platforms

Another no-no for me is when a startup’s team has holes in its story. Meaning, when you look it up, there's no contact information … there's no email … there are no phone numbers. If there’s no way for you to get in contact with them, that tells me something fishy is going on.

One way to do so is to find out if they are Reg CF (Regulation Crowdfunding). This can mean that they are raising money over and over and over again. And they’re doing it on multiple platforms.

That’s an approach associated with scams. Typically, you want to pay close attention to stories about founders who raised on Wefunder, then raised on Republic and then went onto StartEngine, etc.

Fraudster Tell No. 4: Website Lacks Credibility

You also need to make sure a startup uses a credible funding platform. Sure, some smaller platforms are willing to say, “Hey, we don't have a big market share. But if you want to come here, you can kind of do whatever you want.”

Now, they’re supposed to have compliance. They're supposed to have people checking the offerings and walking through the paperwork. However, it doesn't always happen. So, you must be really cautious about the portal a startup chooses.

That’s why I spend just as much time vetting portals as startups themselves. I’ve worked with all the major ones. So, I already have this “tell” down.

Fraudster Tell No. 5: Lacking Answers to Investors’ Questions

Another thing I look for when investing in a startup is information on patents, plans for an exit or anything general in nature. Most of these portals should have an area to ask questions and get feedback directly from the founders and the team.

The best founders have answers for everything. How they respond can be very telling. If they’re brash or talk down to the investors, that tells me a lot about character and the way they're going to lead their business.

And if founders can’t answer all of the questions from investors, they're not going to handle your money well either.

Fraudster Tell No. 6: Raising Capital Prematurely

You need to know whether the startup is just an idea or an actual company. That’s because sometimes people come up with great ideas and want to raise money from the crowd … but it’s premature.

I like to deal with actual companies that make real money. Profits aren’t necessary right away, but revenue definitely is. That tells me that people are paying for the product they’re building.

In that situation, I love engaging those in leadership and hearing about their visions or growth. I'll visit their manufacturing facilities and check out their technology. I'll ask the entire team questions because I love to see the faces behind the company. I like to shake their hands and look them in the eyes.

It’s just so important before investing in any startup that you do your homework and due diligence … so you’re confident in their potential success.

I have been using these tells for years when searching for hot startup prospects. But I can also tell you that this legwork is worth it. While not every startup winner is a moonshot, the upside is often far greater than other investment avenues.

In fact, I just found one startup that passes every test with flying colors. On top of that, after thorough vetting, I discovered that it is disrupting a $4 trillion industry right now. I sat down with Chris Hurt to share my findings. Click here to check it out.

Until next time, my friend!

Happy hunting,

Chris Graebe