6x the Market with This Hidden Quantum Play

|

| By Michael A. Robinson |

Nothing gets me more excited than when I sense an opportunity before Wall Street and the talking heads do. Let me explain …

You see, a few weeks back, a company focused on quantum technology announced a huge breakthrough that went largely unnoticed.

The company, a U.S./U.K. firm called Quantinuum, revealed something that could very well signal the dawn of what’s known as “generative quantum artificial intelligence.”

No doubt that’s a mouthful. And I will break it down for you in a moment.

But for now, note that this breakthrough’s importance has a chance to mirror that of ChatGPT, the viral generative AI service available to the public.

ChatGPT was a huge catalyst for AI-centric firms and their soaring stocks.

And funny enough, both Quantinuum and ChatGPT’s creator, OpenAI, share something in common …

Neither are publicly traded!

So, why write about all of this? Because the company that helped create Quantinuum is set to undergo a major restructuring to unlock shareholder value.

And that presents an opportunity for us to potentially wind up with 6x the gains of the S&P 500 …

The Emergence of Quantum Computing

To set the stage, let’s talk about quantum computing. It’s a type of computing that leverages the principles of quantum mechanics to solve complex problems much faster than traditional computers.

It relies on quantum bits, or qubits, that can represent multiple states at once. This allows quantum computers to solve complex problems much faster than supercomputers by processing vast amounts of information simultaneously.

Make no mistake. The technology is rapidly advancing.

Look no further than a recent announcement from Quantinuum. On Feb. 4, the company unveiled its Generative Quantum AI framework. This leverages unique quantum-generated data to enable commercial applications.

Generative is a key part here — it means the ability to create new content.

And with this AI, we’re looking at the potential to develop new medicines, produce predictive models of financial markets, and optimize global logistics and supply chains in real time.

For the first time, data generated by Quantinuum’s quantum computer can be used to train AI systems. This can help enhance the fidelity of AI models and allow them to tackle challenges previously deemed unsolvable.

Since it is ordinarily difficult to invest in private companies — with key exceptions brought to you by my colleague Chris Graebe — I wouldn’t usually bring up a company like Quantinuum.

But there is a back door we can funnel in through here …

You see, its majority stakeholder is a company we can invest in — and recent news from its leadership suggests we might soon be able to take advantage of Quantinuum’s rise.

You see, Quantinuum launched in 2021 through the merger of two companies: U.S.-based Honeywell Quantum Solutions and UK-based Cambridge Quantum.

A Storied Leader Gets Bold

Today, Honeywell (HON) owns a majority stake in Quantinuum, having invested more than $500 million since 2021, making this a great “hidden quantum play.”

And as I’ll explain, a major move from this company could be great news for investors like us …

In case you’re unfamiliar, Honeywell is sort of a do-it-all company. It makes products and services for industries ranging from aerospace to energy to industrial automation.

Interestingly, Honeywell’s roots date back to 1895, when inventor Albert Butz patented the furnace regulator and alarm to launch the business that would one day become Honeywell.

This regulator was a predecessor to the modern thermostat. It was also the first of many Honeywell inventions.

In 1969, Honeywell played an integral role in the Apollo 11 mission. Without the 16,000 Honeywell parts that went into more than a dozen electronic devices that made up the Stabilization and Control Systems, Neil Armstrong and Buzz Aldrin would never have stepped foot on the moon.

More recently, Honeywell underwent mergers and acquisitions. In 1999, the company merged with AlliedSignal, a manufacturer of aerospace, automotive and engineering products.

And between 2005 and 2016, Honeywell expanded its business with a series of acquisitions.

Lately, though, Honeywell has underperformed. From the start of 2024 through Nov. 11, company shares rose 7.7%. Meanwhile, the broader market gained 26.6% during that same period.

The lackluster performance is partially why Honeywell just announced a shakeup. Here are the details …

3 Businesses Are Better Than One

Honeywell will soon split its business into three primary publicly traded companies: Automation, Aerospace and Advanced Materials.

Why the split?

For starters, investors have increasingly pushed conglomerates to break up or sell off unrelated businesses — the goals being to simplify and focus operations and make their value propositions clearer to Wall Street.

And there is strong research suggesting this spinoff has market-beating potential.

Consider that two professors at Penn State University examined 30 years of market data covering 174 spin-offs. Their study revealed that in the first three years of operations, these new companies showed price appreciations of 76%, beating the S&P 500 by 31%.

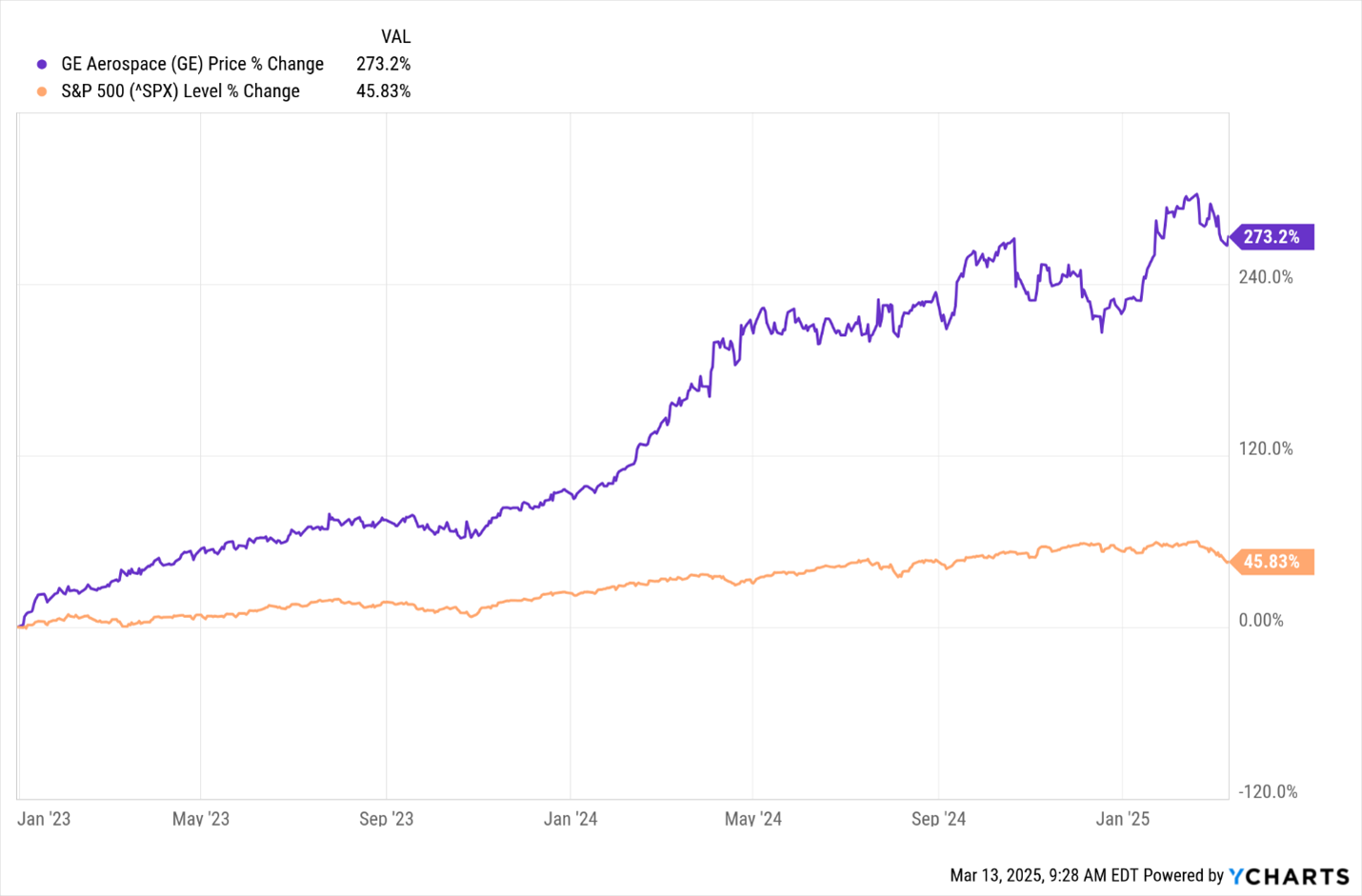

But recent history suggests much better returns. Look no further than fellow industrial giant General Electric (GE).

Last year, GE completed a three-way split, dividing its aerospace, energy and healthcare units into standalone businesses.

Interestingly, the combined market value of the new divisions was nearly four times bigger than GE’s total market cap in 2022.

Meanwhile, GE investors earned returns that nearly sextupled the overall market since the start of 2023.

Time to Act

Returns like that are incredible. And I see the same profit potential with Honeywell’s upcoming split.

Even better, Quantinuum is emerging and could propel Honeywell’s value even higher.

This is an exciting opportunity, but one we want to get in on now before the split happens. That way, we can maximize our profit potential.

With this play, we’re setting ourselves up to profit from the recent trend of company splits … and from the increasingly exciting — and valuable — capabilities of quantum computing.

Best,

Michael A. Robinson

P.S. If you prefer pure-play companies with game-changing technology like Quantinuum, you have to comb the private equity crowdfunding space. That’s where Chris Graebe comes in.

He just discovered a pre-IPO opportunity in a company that is set to revolutionize the U.S. energy industry.

Its tech and operations could change the landscape in a massive industry right when it needs it the most. He’ll tell you all about it right here.