A Rare Opportunity to Own a Life-Changing Tech Startup

|

| By Michael A. Robinson |

The medical community doesn’t use the word “cure” very often, especially with respect to rare diseases.

That’s hardly by design, though.

It’s just that the idea behind health innovations has historically focused on managing or treating diseases.

Vaccines play a huge role in preventing or lessening the severity of illness. And other drugs play huge roles in relieving symptoms and pain and/or extending lifespans.

When we or our loved ones become the patients ourselves, it gives us hope to hear that something is treatable.

But let’s face it …

No one wants to feel sick. Nor to stick to a treatment plan or visit a doctor regularly for an extended amount of time.

Everyone wants to hear a doctor say that our condition has been conquered for now … or even for good.

And now, thanks to a revolutionary new technology that’s already approved by the FDA, more cures may become possible.

More on that in a bit.

First, let’s talk about a not-so-small elephant in the room.

To call diseases “rare” can be an understatement.

Know this: Rare does not always equal “only affects a small percentage of people.”

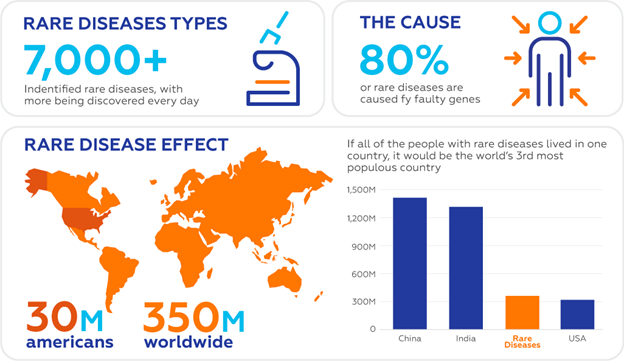

There are more than 7,000 rare diseases, according to the National Institutes of Health. That are known, anyway.

These rare diseases impact a staggering 475 million people worldwide today.

In the U.S. alone, about 1-in-10, or 25 million to 30 million Americans, suffer from them.

Sadly, more than 50% of these people are children.

So right now, more than 200 million children in the world, and their loved ones, are desperately hoping for cures.

Rare diseases are incredibly challenging to manage with traditional medicine.

They are often chronic, progressive and life-threatening.

They can affect many different parts of the body, including the heart, blood, lungs, kidneys, skin, bones and nervous system.

The most common denominator, however, is that 80% of rare diseases originate from a genetic condition.

That’s according to Rifat Atun, professor of Global Health Systems at Harvard University.

Altering Genes Is Key to Cures

One of the most groundbreaking tools today may be the key to cures: gene-editing technology.

Also known as CRISPR, it aims to get to the bottom of diseases by addressing their underlying causes to find cures — not just treatments.

It allows for precise, targeted modifications to DNA.

Developed by gene-editing company CRISPR Therapeutics (CRSP), the CRISPR Cas9 system is commonly used by scientists to alter DNA and fix faulty genes.

This activity holds the key to curing various genetic disorders.

In fact, the first-ever CRISPR-based therapy for sickle cell disease was approved in 2023 in the U.S. and Great Britain.

Unfortunately, the time to get into CRSP might be over.

Since its 2016 IPO, shares are up 325%.

And for those who had excellent timing, they could have cashed out even before this approval for gains of more than 1,300%.

But the earliest investors — those who were able to get in before it went public — have done even better.

Those Alpha Round investors got in long before CRSP went public at $15 per share. If they held on to those early shares, the gains would be exponentially higher than that 1,300% run-up.

So if they held on to their shares through its monster run as a public company, their gains should be exponentially higher.

That’s often the case for these medical breakthrough companies with a successful product.

Now, we can’t go back in time and get in on those gains.

But we can look out for the next pre-IPO biotech with a revolutionary technology.

My colleague and startup specialist Chris Graebe has one such company in his crosshairs right now.

It’s a startup whose product helps with tissue regeneration and reconstruction. Specifically for treating severe wounds and burns.

At least, that’s what it set out to develop.

But what they now have is something far, far bigger.

I won’t spoil it.

But I can tell you that it’s already leaving a footprint in a $20 billion-per-year industry.

And now, the company now has its sights set on another industry … one that’s worth some $600 billion.

Be sure to watch until the end to see how to own shares BEFORE it ever IPOs.

This could be like owning CRSP before 2016.

Maybe even better.

Watch this video right now and see if you agree.

Best,

Michael A. Robinson