A Safe-Play ETF in a Volatile Housing Market

Earlier this month, Zillow (Nasdaq: ZG) had a rude awakening.

In February, it started a house-flipping program that embraced artificial intelligence (AI) for housing valuations.

But it appears the online real-estate marketplace behemoth oversold the idea … even to itself.

From Flip to Flop

The company was certain of its ability to use AI to estimate home values. So certain that it began using its “Zestimate” to represent an initial cash offer to purchase a prospective property.

But what was first touted by a Zillow executive as “an exciting advancement” turned into a disaster. The company took a $304 million hit in the third quarter, blaming it on recently purchased — overvalued — homes.

Now, there is plenty of evidence from the past year about people who upped the financial ante to buy or sell their dream home.

Unfortunately for Zillow, it reportedly listed two-thirds of its homes with an asking price below what it paid.

Now Investors Are Paying the Price

In February, when Zillow rolled out its “iBuyer” program — which entails purchasing homes directly from sellers then relisting them after minor upgrades — its stock was trading near a 52-week high above $210.

At the time of writing, shares have plummeted 75% to the $54 area.

|

And they can go even lower as the company executes on its plans to fire 2,000 workers … which equates to roughly 25% of its workforce … over the next few quarters.

In the meantime, the company is looking to move some 7,000 homes off its books.

This will provide some much needed inventory. But not necessarily respite for those who are hoping for another housing market crash.

In other words ...

The Housing Bubble Is Set to Get Even Bigger

The fallout from the Zillow debacle hints at how volatile the housing market is now. It showed us how susceptible iBuying is to that volatility.

Whether the red-hot housing market broke Zillow’s AI, or whether the technology wasn’t built to keep up, is up for debate.

But one thing is clear ...

• Zillow’s example does not serve as a bellwether for the housing sector.

If investors know where to look, more secure opportunities are available.

So, let’s look at The Weiss Stock Ratings and the Weiss ETF Ratings for …

A High-Rated Way to Play the Housing Boom

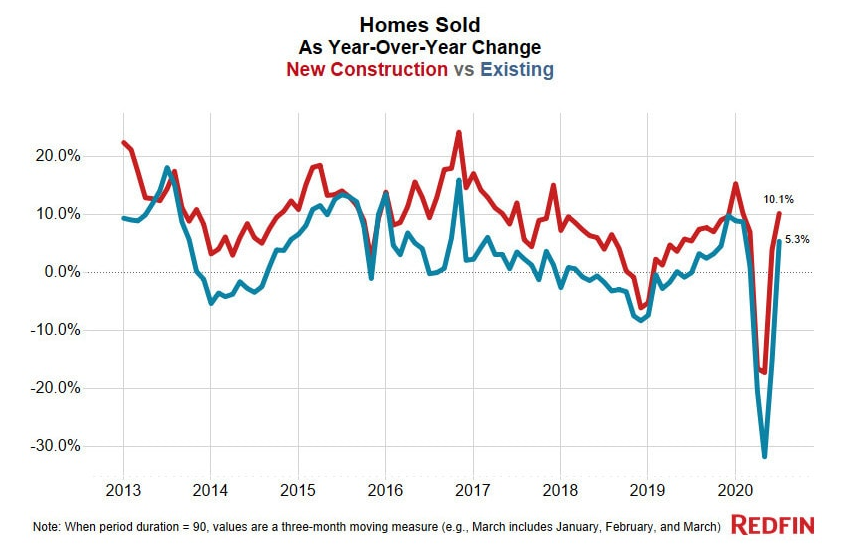

The 2020 dip in new home construction was nearly as brief as the COVID-19 pandemic-induced recession, which officially lasted all of one month.

|

| Source: Redfin |

According to real estate brokerage Redfin, “newly built homes now make up one of every five houses for sale — the largest share on record.”

One way to take advantage of this boom in new home construction is through housing exchange-traded funds (ETFs), which tend to minimize investors’ risk while broadening exposure to the entire industry.

One of those ETFs is the SPDR S&P Homebuilders ETF (NYSE: XHB, Rated “B”).

XHB is the benchmark for the homebuilders’ segment of the S&P Total Market Index. It has $2.24 billion in assets under management (AUM) and an expense ratio of 0.35%.

|

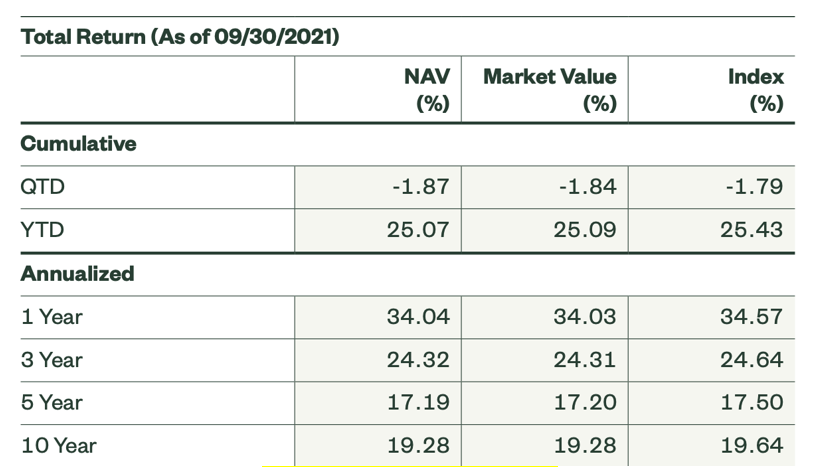

| Source: State Street SPDR |

XHB has an annualized return of over 34% in the last year and 24.32% over the past three years. Those returns have mirrored year-over-year increases in housing costs, which stand at 19.8%.

The SPDR S&P Homebuilders ETF is up 48.45% over the past year and 145.42% over the last five years.

|

Looking at the one-year chart, XHB was rangebound since May, but it recently broke out, hitting a 52-week high.

This Could Push XHB Even Higher

While there are rumblings about the Federal Reserve raising interest rates at some point in 2022, any policy changes will likely be gradual and carefully measured.

Consequently, the impact on the housing market could be negligible, as price forecasts remain strong.

According to Fannie Mae, “median home prices are expected to rise 7.9% between the fourth quarter of 2021 and the fourth quarter of 2022.”

Investors should consider using any near-term weakness in XHB’s price as a buying opportunity. Always remember to conduct your own due diligence before making any investment decisions.

Finally, as this is Thanksgiving week, we would like to share a note of thankfulness. We are always grateful for the opportunity to serve you and provide you with research and ideas based on our proprietary ratings, which were designed foremost with safety in mind.

Speaking of which, we wish you a wonderful and safe holiday weekend!

Best wishes,

The Weiss Ratings Team