A Space Investment That's Lightyears Ahead of Its Peers

|

| By Chris Graebe |

I can't say whether space is really the final frontier. But it’s certainly the next big frontier for investing.

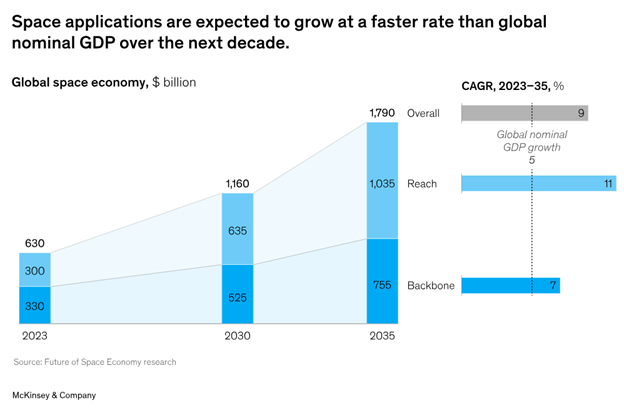

How big? Right now, I’m looking at an opportunity to get in on a potential $1.8 trillion tech disruption.

That’s comparable in size to the red-hot AI industry!

We’re at the point in history where things that were once dreamed up by futurists are now discussed in boardrooms.

The tech and funding have finally caught up with the ideas, and the opportunities are right around the corner.

Also, there’s an interesting trend to watch for, and it’s not something you would expect …

NASA’s “Decline”

Since the end of the Space Race, it's seemed like NASA has had no competition. Anything big happening in space happens because of them.

Just a few years ago, saying a private company could do NASA's job better would’ve sounded ridiculous.

But now, due to funding limitations and fierce private competition, NASA is often forced to look to the private sector for aid.

It’s not so much that NASA is outright losing to competitors. Rather, it’s changing its strategy to enlist their help.

Today, I'm going to show you how NASA's diminishing role in space opens the doors for public and private companies to fill in the gaps — and how you can position yourself to capitalize.

It’s Time to

Engineer a Turnaround

The world’s most respected space agency gave a press conference yesterday about a tough situation that still awaits resolution.

Two astronauts are marooned on the International Space Station in a real-world case of David Bowie’s “Space Oddity.”

Thruster failure on the Starliner crew capsule is to blame for the delay that could see the duo stuck there until 2025.

Boeing (BA), the spacecraft’s manufacturer, is mostly at fault.

Meanwhile, NASA is the one who financed this mission — to the tune of $4.2 billion.

You see, Boeing is one of the old guards of NASA's commercial contracts.

The two have worked together since 1988 on the then-U.S. Space Station Freedom. That later became the International Space Station.

So, it didn’t come as much of a surprise that, years later, Boeing was selected to build a spacecraft to transport astronauts to and from the ISS.

SpaceX, Sierra, Blue Origin, ULA and Paragon were also in the running for the lucrative contract.

Ironically, NASA’s second pick, SpaceX, with its Dragon spacecraft, may now need to swoop in and rescue the two astronauts.

SpaceX is new blood in the aerospace industry, and its success here could signal a changing of the guard from old favorites like Boeing to younger, fresher faces.

Speaking of fresh faces and SpaceX rockets, here’s a flashback to when our very own Weiss School students sent a mini-satellite into orbit aboard the Falcon 9 rocket as a part of a once-in-a-lifetime science project.

2 Publicly Traded Ways

To Get into Orbit

There’s no direct way to invest in NASA or SpaceX. At least, not yet.

If you’re looking to get into orbit right away, you can consider Lockheed Martin (LMT) or L3Harris (LHX), both publicly traded on the NYSE.

Just last week, L3Harris announced a multi-launch agreement with Firefly Aerospace. Firefly is a private company out of Cedar Park, Texas, that makes launch vehicles for commercial use.

L3Harris does a ton in the aerospace industry, both terrestrial and beyond. They’ll use Firefly’s launches to grow their orbital presence, launching satellites for navigation, surveillance, missile defense and much more.

Along with competitors Boeing and Lockheed Martin, L3Harris is traded on the S&P 500. LHX is an interesting pick, although it was recently downgraded here on Weiss Ratings.

However, if you’re willing to wait just a few more days, I will be revealing a much bigger opportunity later this month.

It’s a little-known company set to disrupt the projected $1.8 trillion space industry.

And the only way to get the name is to watch this video and fill out the short form that pops up toward the end.

We filmed this video, and several more, on location in Cape Canaveral in a mysterious hangar owned by NASA.

Which gave our team a bird’s eye view of …

NASA’s New Role

Due to funding limitations, NASA can no longer be on the bleeding edge of all things aerospace.

To compensate, it’s bringing commercial businesses deeper into the fold each year.

Essentially, NASA is learning to outsource innovation and manufacturing to the private sector so it can continue leading the space race while managing its tight federal budget.

For example, just last month, SpaceX won a nearly $1 billion contract to develop a special vehicle capable of pulling the ISS down into the atmosphere where it will fall and burn up.

This may sound shocking, but NASA has been planning to decommission the ISS for years and hopes to do so by 2030.

Back in February, Intuitive Machines (LUNR) landed its Odysseus lander on the moon, becoming the first craft to do so since 1972 — and did so on NASA’s dime.

Lastly, I’ll leave you with this …

In its quest to reach, study and eventually colonize Mars, NASA awarded 12 different “concept studies” to nine U.S. companies.

Each company will be paid between $200,000 and $300,000 to create a presentation of their potential services that could serve a future Mars mission.

Even More Space

Ideas for Investors

I see a kind of hierarchy developing within the space industry. There appear to be three tiers, each one creating different opportunities for public and private investors.

- NASA is at the top, commissioning spacecraft and outsourcing launches, landings, R&D and more. It acts almost like a startup accelerator for its contractors, providing them with vital funding and guidance.

- Below that, we have the big aerospace players: Lockheed, Boeing, SpaceX, Blue Origin and the like. They themselves give contracts to smaller more specialized companies while simultaneously eyeing them for potential acquisitions.

- Finally, we have the little guys, the rapidly growing startup ecosystem within the space industry. These companies fight for contracts from the larger companies and aim for exits either by being acquired or through an IPO or SPAC.

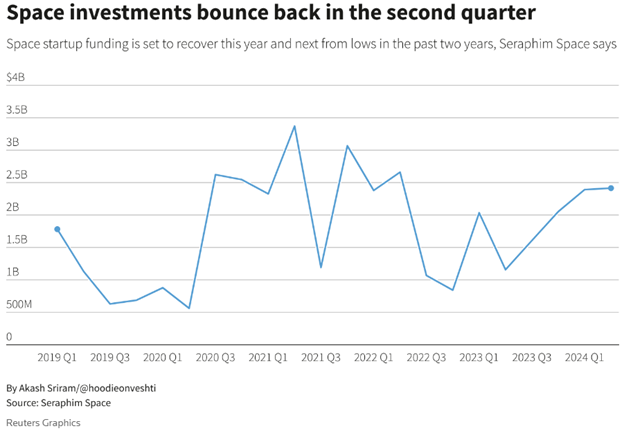

According to investment firm Seraphim Space, in Q2 of this year alone, space startups garnered $2.4 billion in global investments. This marks the third consecutive quarter of funding increases.

In the short term, I see great opportunities for space startups working on satellites, launch vehicles, tourism and R&D related to all aspects of space exploration and exploitation.

In the longer term, there is huge potential in off-Earth mining, cleaning space debris, in-space manufacturing and colonization.

There is so much room for innovation in space. Whether startups are doing something different or just doing it cheaper, many will earn their slice of the cosmic pie.

In all my analysis of the aerospace industry, I’ve found one startup that is uniquely poised for success.

It’s a private company with a disruptive strategyto compete with the likes of Boeing and SpaceX.

They’ve developed a new way to get to orbit for 92% less than what Elon Musk charges — without using rockets.

I just met with their team in person in Cape Canaveral, Florida, and now I’m ready to bring the deal to you.

And later this month, I’m giving all the details about this opportunity to my Deal Hunters Alliance members.

The SEC has already reviewed and approved this company for Reg-A funding, which allows accredited AND non-accredited investors to partake. This means that just about anyone can invest.

Click here to watch a powerful video where I explain everything you need to know about this out-of-this-world opportunity.

Hope to see you there.

Happy Hunting,

Chris Graebe