|

| By Kenny Polcari |

I hope you didn’t waste your time watching all the drama unfold this week as a fresh stream of economic data and another interest rate hike caused investors to throw a collective fit.

While you absolutely shouldn’t pay attention to the market’s minute-by-minute moves, I do because it’s my job. This way, I spare you from taking that roller-coaster ride and can report back here as to what it all means.

And Tuesday’s episode of “As the Market Turns” was particularly dramatic and emotional. It epitomized the depth of investor uncertainty and confusion surrounding the Fed’s intentions.

With the Fed meeting happening Wednesday, and November’s inflation, employment and wage figures also due out sometime during the week, markets were in full-blown anticipation mode.

Here’s my play-by-play, starting with …

Monday’s Action

I’m still a bit stunned at the early morning reaction to the start of the week. The anticipation built all morning. The clock ticked closer and closer to 8:30 a.m., the time the government would release the latest Consumer Price Index report.

Would it be what we expected, better than what we expected or worse than what we expected?

Because so much depended on this one data point, speculation ran rampant. The algorithms — prepared for a better-than-expected result — were getting ready to explode. The tension was palpable.

JPMorgan Chase (JPM) actually posted an early morning, very orchestrated article that laid out the odds of five possible reactions to the monthly inflation number. The lower the number, the bigger the rally and vice versa.

Potential moves for the S&P 500 ranged from an 8%–10% rally for 6% inflation or a 4.5%–5% loss if the rate came in between 7%–7.2%. JPM made sure that all the media outlets reported on the bank’s position.

Becky Quick of CNBC turned giddy when she came on air at 6 a.m. Her enthusiasm was beyond ridiculous. But as the sun moved across the sky, pressure grew and futures moved higher. However, it was nothing to write home about.

Then it happened.

The government reported that November’s CPI only rose 0.1% month over month and 7.1% year over year. Excluding food and energy, the read was +0.2% and 6%.

The algos went into hyperbolic mode as both sets of figures appeared better than expected. Futures shot higher, suggesting the Dow Jones Industrial Average would open up 800 points and the S&P 500 up 120 points.

Click here to view full-sized image.

Market’s Reaction

The analysis began with everyone opining on what it meant and what the Fed would do now. By the time the 9:30 a.m. opening bell rang, stocks reacted as expected.

Right out of the gate, the Dow Industrials shot up 700 points, and the S&P surged by 110 points to kiss 4,100 — a key resistance marker. The Nasdaq advanced by 428 points.

You’d think the report had shown a negative 7.2% CPI number as the conversation suggested that this would surely cause the Fed to pivot, stop raising rates or even cut rates in the summer of 2023!

That line of thinking lasted about five minutes, and then the indices started to fall. The Dow Industrials turned negative at 12:10 p.m., the Dow Transports did so at 12:50 p.m., and the S&P, Nasdaq and small-cap Russell all traded down to the flat line before rising into the bell.

When all was said and done, the Dow Jones Industrial Average, S&P 500, Nasdaq and Russell gained, 0.3%, 0.7% and less than 0.1%, respectively.

For all the drama created by early morning articles and TV segments, the expectations for up to a 5% jump fizzled along with the market.

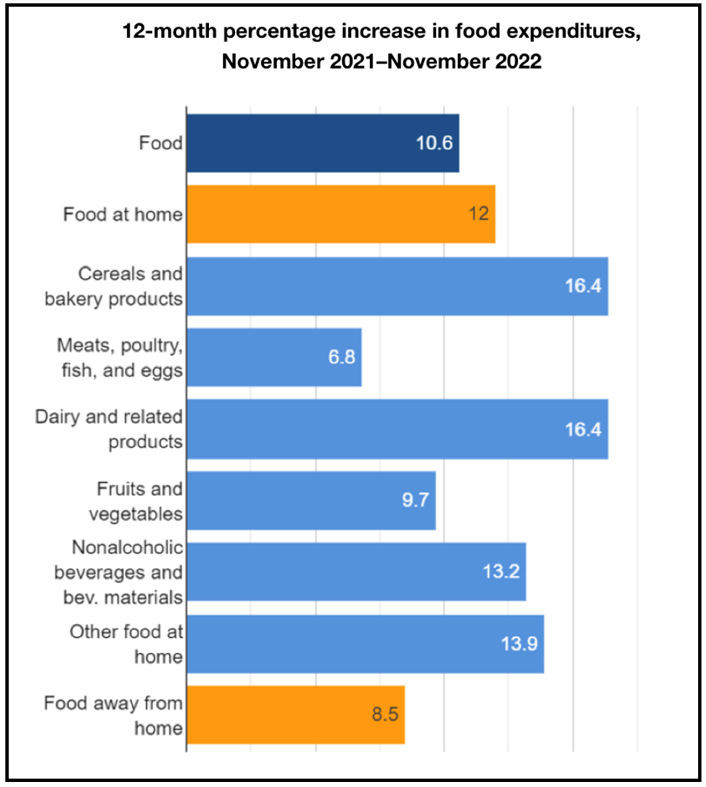

Part of the problem is taking a lower CPI number on face value and not digging deeper into precisely what sector prices rose and which ones fell.

Making Sense of the Inflation Cycle

So, the real question becomes: Is the trend lower in the places that really affect you and me? I’d answer that with a resounding “No.”

Here are those sectors with rising costs: Healthcare (20%), airline fares (42%), housing (40%), utilities (20%), coffee (15%), milk (15%), butter (33%), chicken (15%) and hotels (42%).

And what’s coming down in price? Used cars, home prices, TVs and gas at the pump, at least for now.

So when you just look at the hard number, the trend is lower, but when you look at the cost of living, the trend is still up.

The last time I checked, you can’t eat a TV.

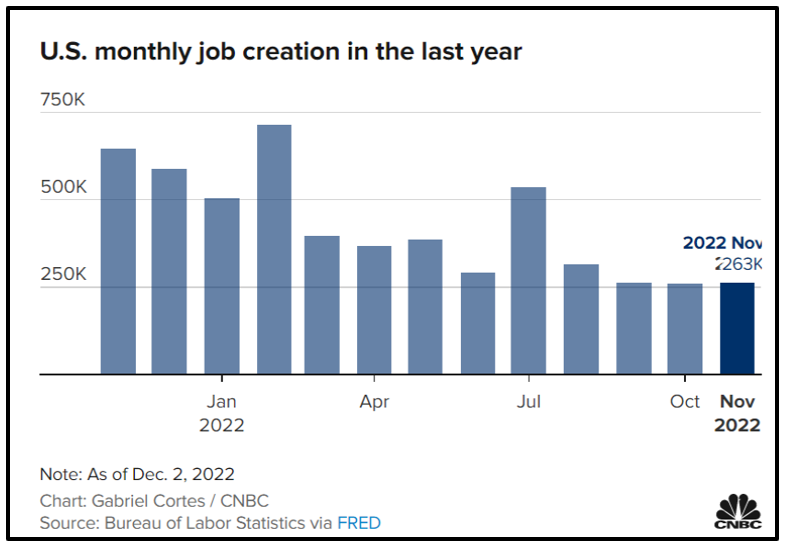

When we shift our focus to the services sector, wages — the smoking gun in the equation — surged in today’s tight labor market.

Wages surging in a tight labor market do nothing to help the long-term story, as the current part of the inflation cycle is now defined as cost push vs. demand pull.

You see, cost-push inflation is the result of rising wages and other costs that then cause producers to pass on those higher costs to consumers, pushing prices higher.

Demand-pull inflation is the result of demand exceeding supply of available goods, causing producers to take advantage of the demand and raise prices.

The first part of this inflationary cycle between April 2021 and August 2022 was demand pull, but now that the supply chains have opened, the rise in prices is now being driven by cost push.

That’s because workers are demanding more money. As long as that happens, we can expect the services component of the CPI to advance. And that’s …

The Problem the Fed Needs to Fix

How do they do that? They force the economy into a slowdown, causing millions to lose their jobs and hiking unemployment to somewhere between 5%–6%.

Employers added a healthy 263,000 jobs in November, and average annual wage increases picked up to a vibrant 5.1% from 4.7% the prior month.

Click here to view full-sized image.

One more thing to keep in mind is that never once, in any inflationary cycle going back to the 1950s, has the Fed not raised rates beyond the rate of inflation. The Fed funds rate stands at 4% and well below the 7.1% rate of inflation.

So, no surprise, the Fed hiked up rates 50 basis points on Wednesday, something that had been telegraphed for weeks.

Like clockwork, futures traded as flat as a pancake in the morning, highly anticipating if Jerome Powell would provide a dovish or hawkish message.

And, like clockwork, he reiterated that there will be no pivots or slowdowns until the job is done. The market tanked mid-day but recouped some losses as the closing bell neared.

Nothing new here. Speculation, anticipation and wishful thinking, all big parts of the investment equation.

However, stocks in the most beaten-up sectors (technology, biotech, real estate, consumer discretionary, etc.), down more than 25% year to date, are gaining ground.

That makes me wonder if asset managers are positioning themselves for next year, expecting that 2023 will get better sooner rather than later.

I’m pretty sure they don’t have any secret knowledge to warrant such moves. I certainly prefer to think and act on the here and now, rather than what may or may not happen down the road.

There’s no secret to my message: Think safety and persevere as we continue to navigate a bear market, don’t get greedy during bear market rallies and focus on your long-term goals.

Stay true to the plan,

Kenny Polcari

P.S. If you still haven’t joined my friend and colleague Tony Sagami’s Disruptors & Dominators service, now is the perfect time. You can grab some end-of-year gains, just like members of his service who are currently sitting on open gains of 39%, 30% and 18%!