Achieve Wealth & Wisdom With the Market’s Best Minds

Even in an unsettled market, setbacks don't have to stay setbacks for long. There are numerous ways to capitalize on current market conditions.

In this segment, Analyst Kenny Polcari speaks with Financial News Anchor Jessica Borg about stocks with staying power, the inevitability of a recession, and his informative new weekly series.

You can watch the video here or continue reading for the full transcript.

Jessica Borg (narration): He's been a pro trader and TV commentator for decades.

Weiss Ratings Analyst Kenny Polcari weighs in on the market's turbulence.

JB: There are so many facets of the market right now to home in on. Where do you see it moving, generally?

Kenny Polcari: I think the Fed is going to have to force us into a recession. The question is how deep is it going to be and how long is it going to last?

I don't think "soft" and "landing" should be in the same sentence anymore. I think it's going to be bumpy at best, and at worst, a crash landing where the wheels are going to come off the plane.

JB (narration): He's hoping to help guide investors through these rocky times as the host of Wealth & Wisdom, a new weekly video series.

Each week, he'll speak with senior analysts of our team to highlight the hottest trends and trades.

JB: Kenny, congratulations on the launch of Wealth & Wisdom. Tell us all about it.

KP: There's so much noise out there that what I'm hoping to do is help people focus on what they should be listening to and what they shouldn't be listening to, when it comes to making investment decisions.

What I find exciting about talking to the different editors is that they have different perspectives, they have different styles, they have different products and they look at different data points, and macro data points, technical data points and real-life data points … and that makes it all exciting and interesting.

So, it's great for me to have those types of conversations.

JB (narration): To kick off the series, Kenny interviewed Weiss Ratings founder, Dr. Martin Weiss, about preparing for economic crises.

[Kenny's interview with Dr. Martin D. Weiss]

Dr. Martin D. Weiss: The biggest enemy of being ready is complacency. The consequence of complacency is catastrophe.

JB (narration): Martin says being open to the winds of change is key.

[Kenny's interview with Dr. Martin D. Weiss]

MW: You have to be flexible. I don't care how much you love all the profits you have in a particular stock.

KP: You can't be married to them. You have to be flexible.

MW: Right.

JB (narration): Kenny recommends using the Weiss Ratings website as an investment tool.

You'll get notifications about stock upgrades and downgrades to your stock watch list.

KP: When I get those notifications, it does cause me to think about whether I should stick with a name or not, and that's going to depend on what I find on the Weiss Ratings website.

The website is easy to use. It has a wealth of information for the retail trader.

JB (narration): In bear markets, safe money strategies shine.

Kenny spoke with Mike Larson, editor of Safe Money Report.

Mike has been making winning trades in the energy sector.

[Kenny's interview with Mike Larson]

Mike Larson: It's definitely been a more volatile and choppier market, and we've responded by moving the types of stock we target to be more defensive-type plays.

JB (narration): Kenny has a similar approach.

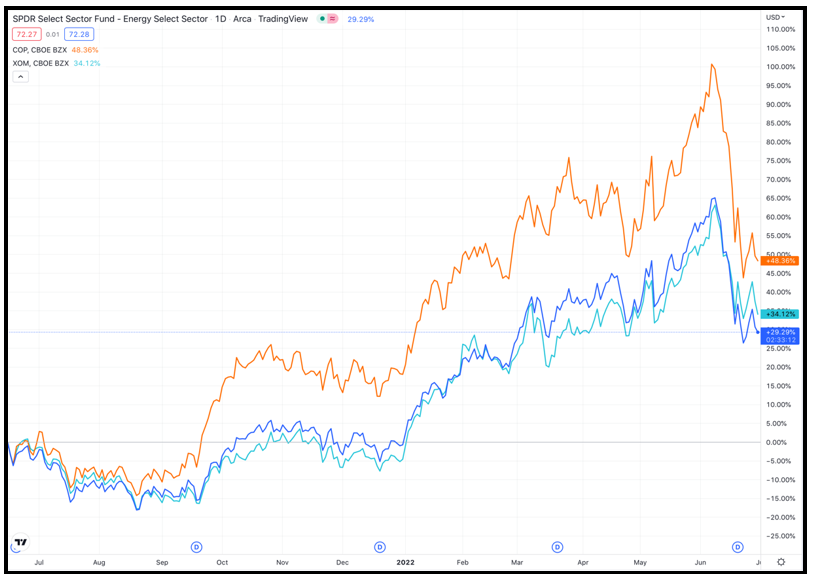

KP: I played energy through the Energy Select Sector SPDR (XLE), but in addition, I added ConocoPhillips (COP) and Exxon Mobil (XOM) as individual names — partly because I like them, partly because they're good dividend payers, partly because they're in the energy space … but they're also firms in transition.

They're not the old stodgy fossil fuel energy — that is some of the story — but part of the new and exciting story is where they're going in the future.

JB (narration): He's also put money to work in other sectors this year.

KP: I went for the big industrial names. I went for financials like JPMorgan Chase (JPM), Bank of America (BAC). I added International Business Machines (IBM) to my holdings.

JB (narration): And he added consumer staples to his portfolio.

KP: Names like Procter & Gamble (PG), Johnson & Johnson (JNJ), AT&T (T). People are going to say AT&T is boring. You're right, but it pays a 5% dividend, and it's relatively safe.

So, if you're looking for some safety in an unsettled market, those are great places to be.

JB (narration): When it comes to tech …

KP: I own big mega-cap tech, Apple (AAPL), Amazon.com (AMZN), Microsoft (MSFT). I own those stocks for a reason — their stories are unbelievable! They're not going anywhere.

They give me exposure to tech. They're also big mega-caps, so they are going to survive any drawdown in the market better than some of the newer names that popped up over the last four or five years.

Those names drove a lot of excitement, but when push came to shove, they failed miserably — some of them down 70% and 80% in a bat of an eye.

JB (narration): Kenny interviewed veteran tech analyst Tony Sagami, the brains behind Disruptors & Dominators.

[Kenny's interview with Tony Sagami]

Tony Sagami: I was really looking for a way to combine blue chips with high growth stocks in a coherent manner.

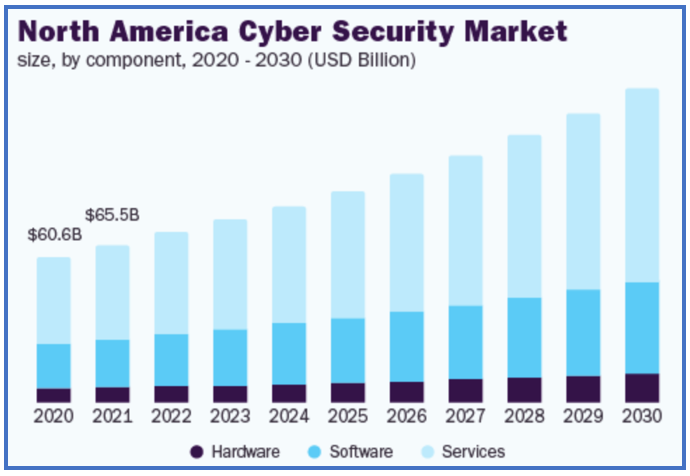

JB (narration): Tony reveals the area of cybersecurity where the next wave of money is headed.

[Kenny's interview with Tony Sagami]

TS: When you're looking at cybersecurity today, the cloud-based cybersecurity is really the sweet spot in the cybersecurity industry.

JB (narration): Part of Wealth & Wisdom is to educate investors about the changing landscape of finance.

That includes the crypto market and DeFi, so that you're empowered to join the conversation.

KP: If you want to be a long-term investor, at the very least you must have a basic understanding of what the blockchain is and what decentralized finance is, and the names in that space and whose making headway.

JB (narration): He interviewed renowned blockchain expert Chris Coney, the host of Weiss Ratings' weekly video series Crypto Focus.

[Kenny's interview with Chris Coney]

Chris Coney: It's hard to articulate the size of the opportunity in DeFi, maybe because some of the stuff is what we haven't even thought of yet.

The best way to draw a metaphor or analogy for DeFi is to say that the internet was "DeI" — decentralized information.

JB (narration): Kenny says in the broad market, look at this period of pullbacks as a great buying opportunity for high-quality stocks.

KP: I always like to use the Bloomingdale'sanalogy ...

Bloomingdale's has fine clothing, and when it puts its clothes on sale for 30% or 40%, people rush into the store thinking, "How can I leave that on the rack?! It's down 30%, I have to buy it!"

Use that same mentality for stocks that are on sale.

JB (narration): Big picture? There are gains to be made if you know where to look.

JB: Veteran market analyst Kenny Polcari, it's always so fun to speak with you. Thank you so much for your insights today.

KP: Always a pleasure, Jessica.

Best wishes,

The Weiss Ratings Team