|

| By Michael A. Robinson |

To hear the media and Wall Street tell it, AI is an overnight success.

I’d say they got it half right. Is AI a success? Absolutely.

Did it happen overnight? Not even close.

In fact, the AI revolution we’re experiencing right now is thanks to nearly 60 years of trial and error.

Over these many decades, some of the real investment “winners” have been those that have pushed the boundaries of AI’s capabilities and potential.

And today, I’ll reveal a savvy tech leader that’s been pushing these boundaries for years …

And I expect it to double profits in a tad more than three years …

AI in the 1950s

Any recency bias when it comes to AI can easily be forgiven. After all, headline-making innovations like ChatGPT, the first consumer-facing application for a mass audience, are only a few years old.

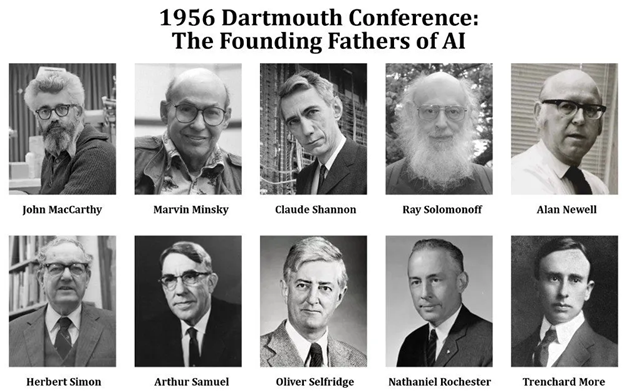

But perhaps surprisingly, the roots of AI date back to the 1950s. That’s when, in the summer of 1956, 11 mathematicians and scientists gathered for a 10-week workshop at Dartmouth College.

After this seminal meeting, the group predicted that a machine as smart as a human would be produced in about a generation’s time. It was a bold prediction, but one that didn’t quite come to fruition.

In the decades that followed, AI produced a whole lot of nothing … giving rise to a period often referred to as the “AI winter.”

But rest assured, winter is over …

AI is Hot, Hot, Hot!

Today, AI is hotter than the summer sun. And the reason is simple …

Companies understand its growth potential, while investors understand its profit potential.

Consider some of these eye-opening statistics:

- According to McKinsey, AI has the potential to create roughly $13 trillion of additional global economic activity by 2030.

- According to Fortune Business Insights, the market for AI is projected to be worth $2.7 trillion by 2034.

- And according to data from Crunchbase, there were nearly 200 deals involving AI-related companies last year. Apple alone acquired more than two dozen AI firms in 2023.

As I mentioned, though, despite AI’s recent foray into the spotlight, I’m focused on companies that have been harnessing this technology for years. And one of my favorites is a $7 billion software company.

Introducing Globant

Based in Luxembourg, Globant (GLOB) is an IT and software-consulting company with a global presence. It operates in the U.S., Mexico, France, Germany, Argentina and the UK, among other countries.

Globant has been ushering in the use of AI since 2013. And it has a presence in several massive industries — from aviation and supply chain to consumer banking, healthcare and media and entertainment.

The company’s business model is simple. It uses AI and other tools to help clients convert almost any long-standing process into a digital application. And this model has helped it earned quite the reputation.

Globant was named a “Worldwide Leader” in AI services in an IDC MarketScape report. And it was featured as a business case study at Harvard, MIT and Stanford.

Helping with Generative AI

Notably, the emergence of generative AI — this is AI that helps create content like text, images and videos — has been a plus for firms like Globant.

Many companies are looking to put generative AI and ChatGPT-like capabilities to work. But they lack the expertise to do it on their own.

Furthermore, most companies need to learn about the large language models behind generative AI. And companies are racing to develop customized AI for specific industries using their own proprietary data. These are all areas in which Globant can help.

In fact, the company’s achieved notable success as AI has entered the spotlight.

Chalk it all up to Globant X, the firm’s AI division for platforms and products. It offers nine proprietary approaches.

These cover such areas as healthcare and the life sciences, finance, enterprise applications for large organizations and connected devices like mobile computers.

It proves what I have been saying for some time now. Today, every business is a tech business, and increasingly that means a focus on AI.

No wonder Globant boasts a marquis client list. We’re talking the likes of American Express (AXP), the Google division of Alphabet (GOOGL), Johnson & Johnson (JNJ), Netflix (NFLX) and Toyota (TM), just to name a few.

In fact, it boasts more than 300 firms that each account for $1 million in sales. Of its top seven sectors, none accounts for much more than 20% of revenue, and 87% of its clients are repeat buyers.

Founded in Buenos Aires in 2003, the firm is expanding in Latin America. Last August, it announced a plan to invest $1 billion in the region that includes a big push into AI.

One Stop Shopping

With its hand in so many different sectors, Globant offers us the opportunity to own what amounts to a diversified AI-focused exchange-traded fund — all in one stock.

Over the next five years, I expect per-share profits for Globant to grow at a rate of 22% a year.

At that rate, profits would double in a little over three years.

As I have noted recently, many software stocks are currently out of favor. And Globant finds itself in this position.

That’s actually good news for us. It gives us a chance to scoop up shares of an experienced AI leader at a major discount from its long-term trajectory.

In that manner, it positions us to secure windfall profits over my favorite time horizon — the long haul.

Best,

Michael A. Robinson

P.S. Of course, you don’t have to always wait for the long haul to see sizable returns. In fact, if you take a seat for this Superyield Conference, you can see huge income yields — upwards of 125x the average dividend — right away.