|

| By Dawn Pennington |

The current tech supercycle is now AI-driven.

This is creating a big shift in the stock market.

One you can take advantage of!

Since ChatGPT’s October 2022 launch, the market’s massive returns have been driven largely by Big Tech companies.

Seven of them. You might have heard of them!

The multitrillion-dollar Magnificent Seven have made a lot of money. And they’re spending a ton of it on developing AI.

While they are unquestionably at the forefront of AI spending, the return on those investments remains to be seen.

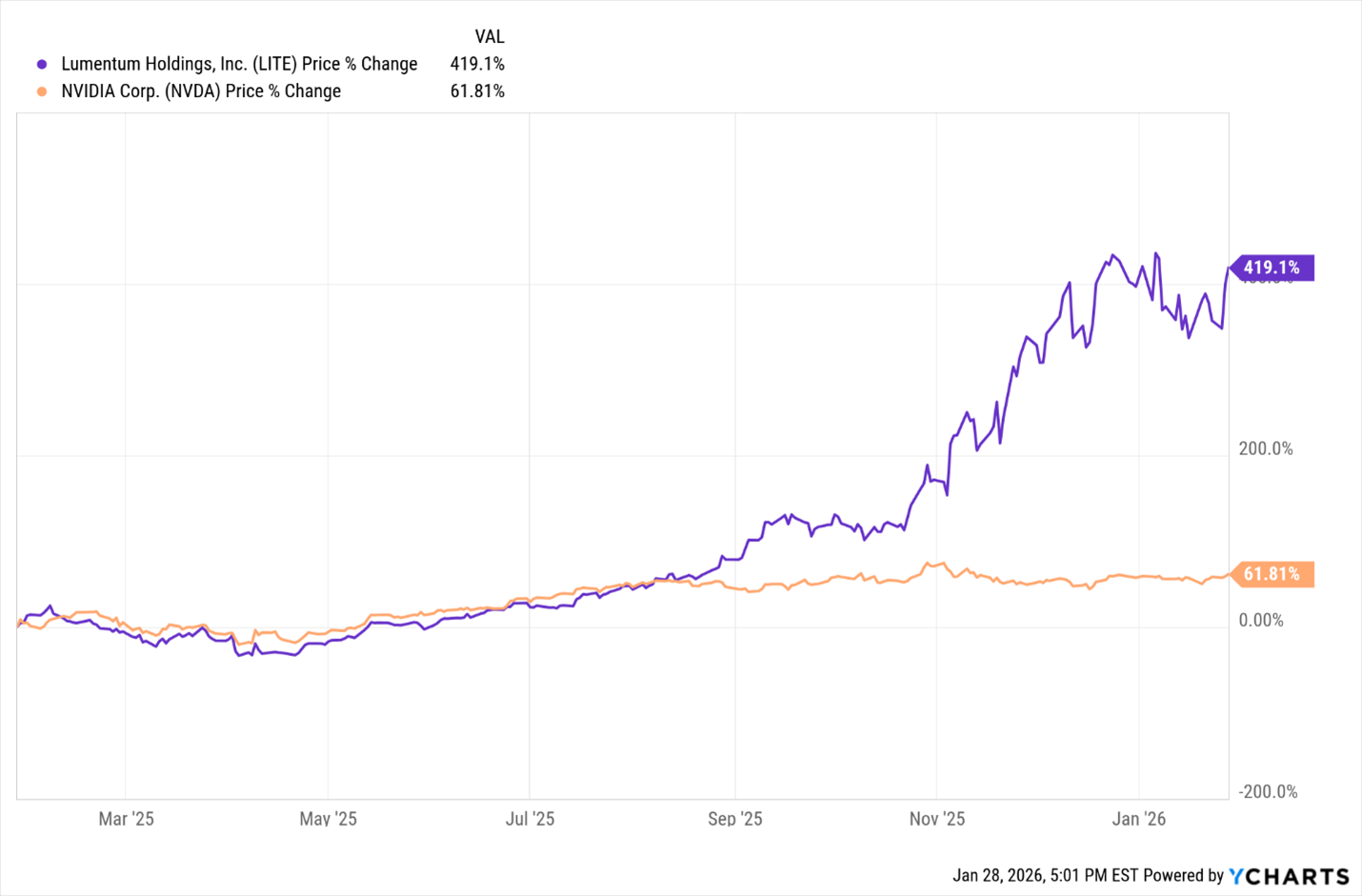

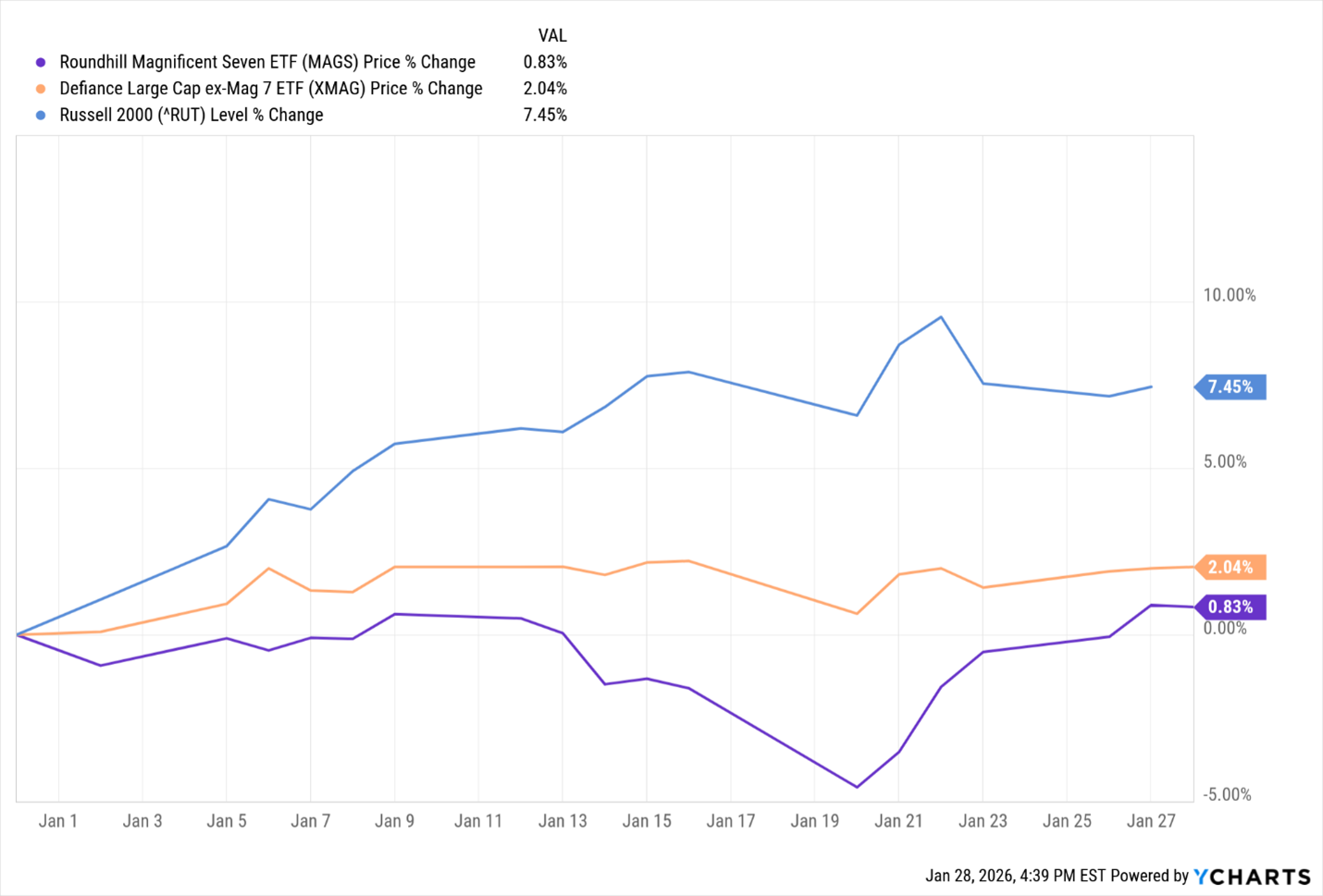

What we can see is that many of these companies now lag the broad market’s gains.

But don’t feel sorry for Alphabet (GOOGL), Apple (AAPL), Amazon (AMZN), Meta (META), Microsoft (MSFT), Nvidia (NVDA) and Tesla (TSLA).

The fact that smaller companies now dominate the markets is a good long-term sign for the market.

And while AI technology has been practically synonymous with the Mag 7, there are plenty of other companies out there solving the problems that it can’t …

Namely, the energy crunch that AI is creating.

One such company is Lumentum (LITE).

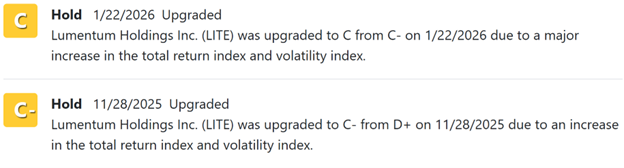

This stock is on our radar because it got an upgrade in the Weiss stock ratings three days ago.

That upgrade was to “C,” or “Hold.” And it was thanks to “a major increase in its Total Return and Volatility indexes.”

Normally in this space, I like to talk about higher (“Buy”) rated stocks with you.

But besides the fact that Lumetum shed its “Sell” rating just two months ago …

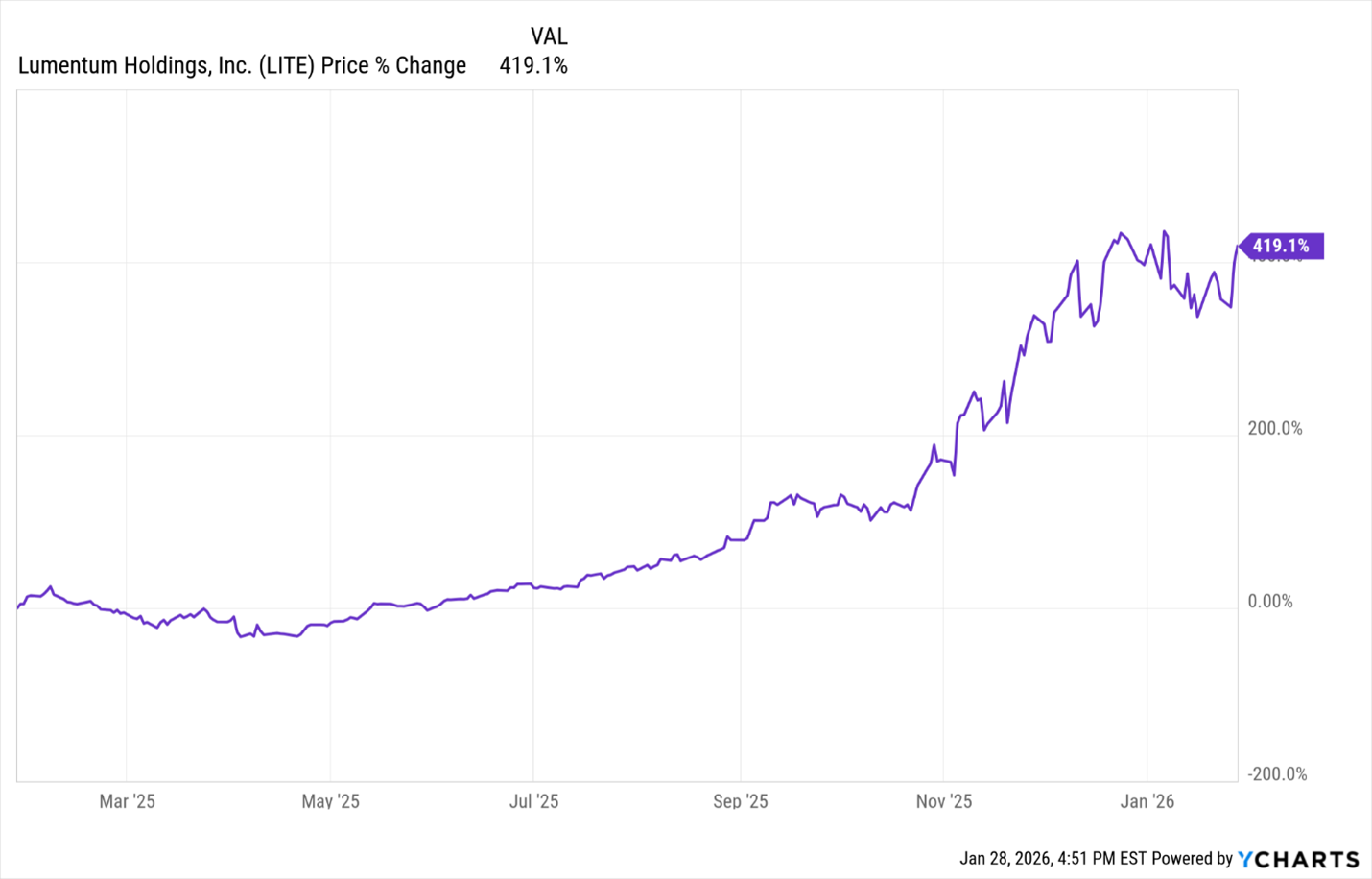

LITE has surged some 419% in the past 12 months.

Lumentum at a Glance

Lumentum makes the optical and photonic components that enable high-speed data transmission in AI data centers.

As AI workloads grow exponentially, hyperscalers are shifting from copper-based scale-up to optical-based scale-out architectures.

That creates demand for Lumentum's tech.

And now, the company sits at a critical architectural inflection point.

Inside every AI data center, optical transceivers act as gateways between chips.

They convert electrons into photons for transmission and back again.

Without these components, AI “compute” would hit the limits imposed by copper's physical constraints.

Lumentum’s recent financials show exactly how this shift is playing out:

- Q1 FY2026 revenue topped $534M. That’s up 58% YoY.

- Q2 guidance came in at the $630M-$670M range.

- That’s 62% growth over the same quarter in 2025.

- Cloud and AI Infrastructure now represents over 60% of its revenue. Which is ramping up faster than initial targets.

Plus, the company is set to hit its $600M quarterly revenue milestone …

And to do so, two quarters ahead of schedule!

Then there’s its customer list …

Lumentum’s 2023 acquisition of CloudLight helped make it possible for the company to deliver complete transceiver modules directly to hyperscalers like Google, Amazon and Microsoft.

Perhaps most compelling is the sheer scale of the opportunity.

Nvidia's CEO Jensen Huang forecasts that $3T to $4T will be spent on AI infrastructure by 2030 to support accelerated computing and AI applications.

McKinsey & Co. puts that figure closer to $5.2T by 2030 “to meet worldwide demand.”

Lumentum is positioned to capture a meaningful portion of this spending as optical networking becomes essential infrastructure.

And yet, this is still just a $20B market cap company. That’s less than 1% of the size of Nvidia.

At this size, it’s much easier for LITE to see the kind of big returns that NVDA has seen in the past 10 years.

Naturally, there are a few potential headwinds here.

LITE trades at roughly 34x-56x forward P/E, depending on estimates. That isn’t cheap, but it is in line with high-growth companies.

Also, any pullback in Amazon, Google, Microsoft and other AI infrastructure budgets would directly impact Lumentum.

But long as Lumentum can continue its momentum, further big returns should be on the table.

- It offers investors direct exposure to AI infrastructure spending.

- It’s experiencing rapid revenue growth and improving margins.

- And it operates in a supply-constrained market.

For growth-focused investors with conviction in the AI infrastructure build-out and tolerance for volatility, Lumentum presents a smart opportunity that’s well out of the Mag 7 stocks.

Especially right here in front of its Feb. 3 earnings report.

But there are even better ideas out there right now …

After all, the prospect of bigger … not to mention, potentially faster … gains in smaller stocks is Sean Brodrick’s specialty!

In his brand-new video, “Three Stunning New Predictions for 2026,” he details the enormous opportunity in this new tech supercycle.

An opportunity that’s valued at over 22.3 trillion dollars!

Sean breaks down how, based on the historical pattern, today’s AI boom is still alive and well … and, frankly, just getting started.

It’s a compelling opportunity … one that’s within everyday investors’ reach. For now.

Sean will tell you exactly what’s coming. And you’ll see how to get guaranteed access to the top 3 stocks set to ride this multitrillion-dollar wave of wealth creation.

But you’ve got to hurry.

This video is so timely … and these stocks are moving so quickly …

That this urgent video goes offline at midnight sharp tonight.

So don’t wait to watch it and act upon the valuable insights Sean shares with you.

But again, after midnight, this video goes offline forever.

To your health and wealth,

Dawn Pennington

Editorial Director