AI Upside Without All That DeepSeek Danger

|

| By Michael A. Robinson |

Last November, Nvidia (NVDA) was on top of the financial world.

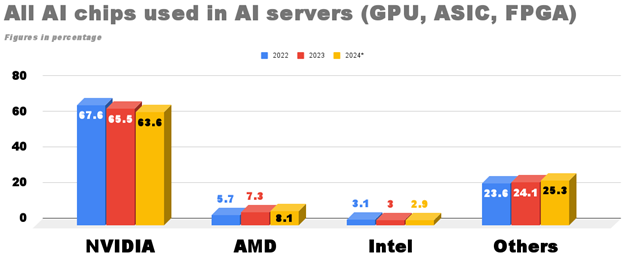

The company held a whopping 80% share in the growing market for AI chips. And it was a stock-market darling.

But shortly after, investors weren’t satisfied. They wanted to see if Nvidia’s momentum would continue, particularly at such a fast pace.

And they were focused on the company’s latest creation, a next-generation piece of technology known as Blackwell.

Blackwell is a highly advanced processor developed by Nvidia and designed to supercharge AI performance and computing power.

It can perform generative AI on large language models with up to 25x less energy consumption than previous iterations.

Blackwell was to be used by top clients like Microsoft (MSFT) and Alphabet (GOOGL), and throughout industries like healthcare, manufacturing, retail and robotics.

Now, in this week’s earnings announcement, Nvidia was able to claim that Blackwell demand is higher than expected.

But since its initial unveiling, the tech industry was rocked as a tiny startup called DeepSeek entered the spotlight, claiming to have created a leap in AI capabilities using less advanced — and much cheaper — Nvidia chips.

Of course, that’s where the story gets messy. Jensen Huang, CEO of Nvidia, has talked openly about supplying his company’s chips to the Chinese AI upstart.

The man considered to be the poster child for America’s lead in the global AI arms race is the same one who undercut its entire cost structure.

This presents us with an important conundrum as investors.

How do we ride the massive upside Huang has helped create with Blackwell, but still protect ourselves from any more low-cost surprises like DeepSeek using Nvidia’s cheaper chips?

Today, I’ll show you how — with an investment that’s beating the S&P 500 by nearly 60%.

The Benefits of DeepSeek

Recently, The Wall Street Journal ran an article titled “Everyone’s Rattled by the Rise of DeepSeek — Except Nvidia, Which Enabled It.”

That’s because the AI giant sees a long game in China — even if not many others do.

You see, when Donald Trump was being inaugurated, Huang wasn’t at the ceremony. He wasn’t even in the country.

He was in Beijing, telling customers of his commitment to the Chinese market. He intended to keep selling chips for AI in China.

One week later, Nvidia’s stock fell 17% in a single day after DeepSeek stole the headlines. So, why is Huang still so keen on a good relationship with China?

For one, Huang argues that Chinese customers help his company bring in more revenue to keep its position as a global leader of AI chips.

In his mind, it’s better to have them paying Nvidia billions of dollars and remaining hooked on its chips — plus accompanying software — than sending those dollars to a Chinese alternative.

Furthermore, Huang described DeepSeek’s models as further evidence of how Nvidia chips can power advances in AI.

Nvidia believes China will be an important market for years, and a country that figures to be among the leaders in AI-related areas like robotics and autonomous driving.

Still, while Nvidia still has lots of room to run, the Street will likely panic again if we get word of another low-cost AI taking on America’s giants.

So, do we scoop up shares of Nvidia, especially after yesterday’s post-earnings drop? Not quite. I’ve got a better idea …

Check Out This ETF

I have previously mentioned Project Stargate, the $500 billion endeavor to enhance the power and capabilities of AI.

That’s a lot of money up for grabs. And we want to make sure we get our share. Here’s how …

By investing in the iShares Expanded Tech Sector ETF (IGM).

This fund gives us broad exposure to the technology industry — it’s filled with nearly 300 technology-related companies in the hardware, software, marketing and interactive media sectors.

Inside, you’ll find big names like Meta (META), Nvidia, Apple (AAPL), Microsoft, Broadcom (AVGO) and Alphabet.

But there are plenty of lesser-known names as well. I’m talking stocks like Sprinklr (CXM), a software company focused on the customer experience sector, Netgear (NTGR), a maker of networking hardware and Shutterstock (SSTK), which provides stock photography, video, music and editing tools.

Essentially, every company in this ETF either is already using, or has plans to use, AI in its business. And that makes this an ideal way to target the AI trend and at the same time reduce our risk from punchy startups like DeepSeek.

A Win-Win

It’s an age-old conundrum: How do you invest in major trends and position yourself for significant returns, while at the same time preventing yourself from taking on too much risk?

The answer is to take a broad approach. And when it comes to investing in AI, IGM is the way to do it.

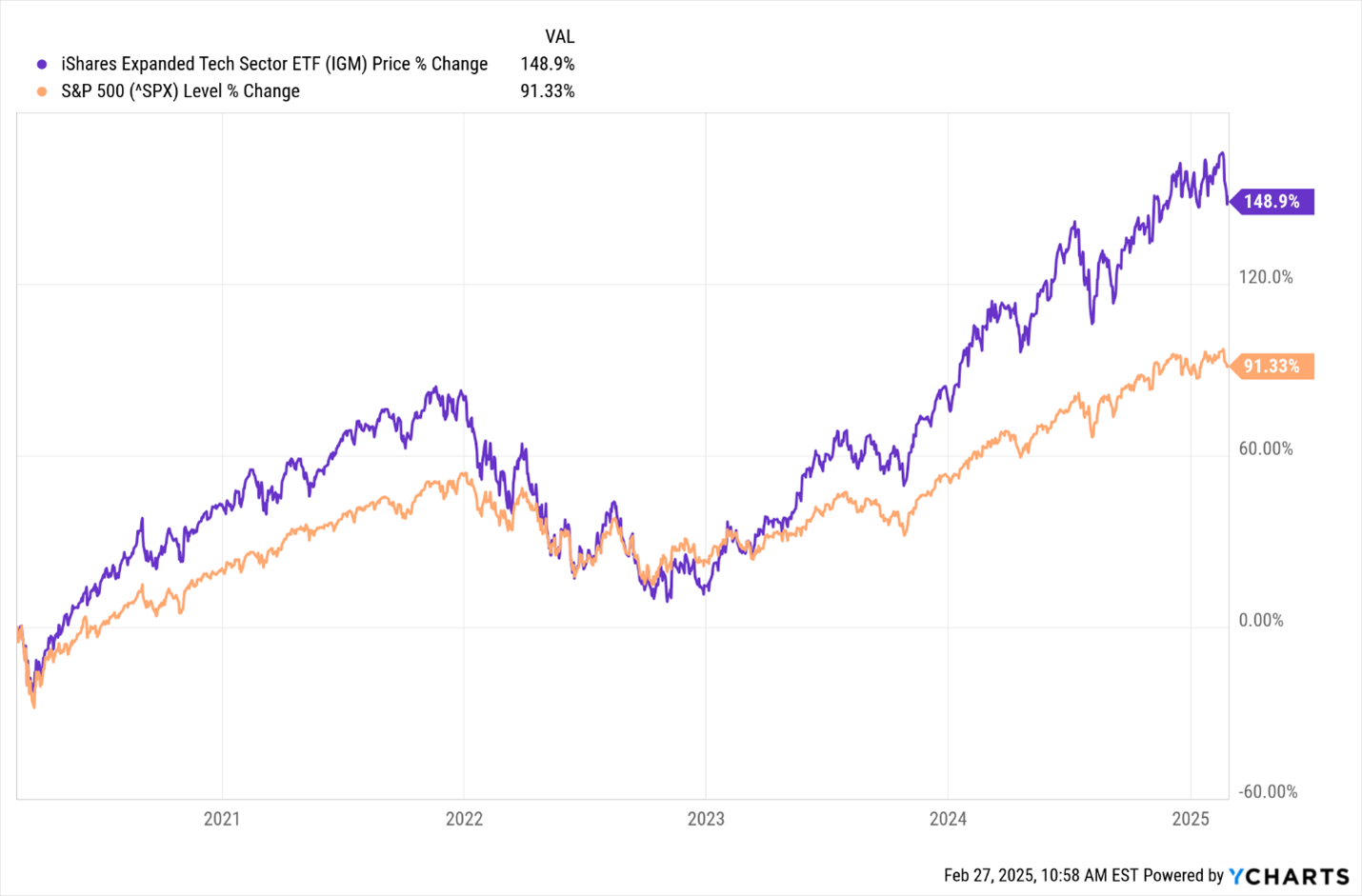

Over the past five years, this ETF has delivered returns of 149%, compared to 91% for the S&P 500 during that stretch.

By investing in this ETF, we’re gaining relatively safe exposure to AI and still positioning ourselves with an investment that’s beating the overall market.

And one that has plenty of upside ahead to help you build your wealth.

Best,

Michael A. Robinson

P.S. Another angle to get all the profit potential of AI, while protecting yourself from the next DeepSeek, is to invest in Nvidia’s partners.

I’ve uncovered three you need to know about and get in before the next chapter in this AI story begins. Click here for the full scoop.