|

| By Jordan Chussler |

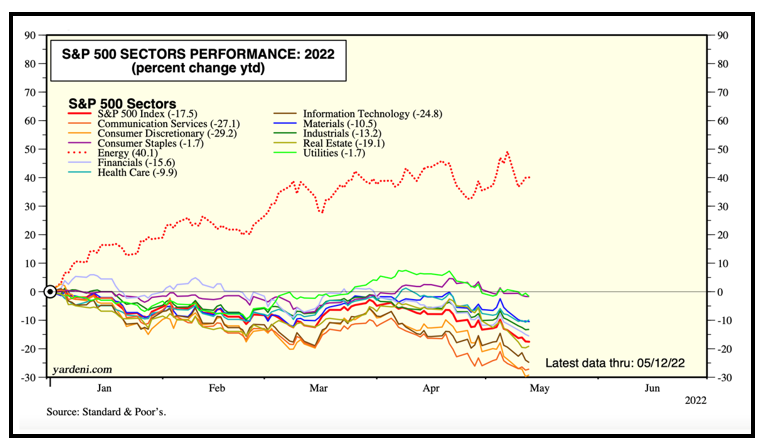

I recently saw a chart that caught my eye. It was the year-to-date (YTD) performance of the S&P 500’s 11 sectors.

And one of these things is not like the others:

Energy isn’t simply outpacing the other 10 sectors — it’s clobbering them. Its 2022 YTD performance is up nearly 45%, and its year-over-year performance is up over 55%.

For perspective, every other S&P 500 sector is in the red YTD.

There’s no shortage of reasons why energy is surging, but briefly:

- Russia’s invasion of Ukraine resulted in most of the world boycotting its natural gas. And Russia has a LOT of natural gas. In fact, they rank first in the world in proven reserves and account for 24% of global production. Earlier this month, natural gas prices hit their highest level since 2008 — 14 years ago.

- Yesterday, RBOB (wholesale gasoline) futures hit an all-time high. They've now taken out the levels hit back in 2008 when crude flew up to $150/barrel.

- As deaths from the COVID-19 pandemic continue to wane, and with summer vacation season around the corner, travel is gaining momentum. More travel equates to more demand for oil.

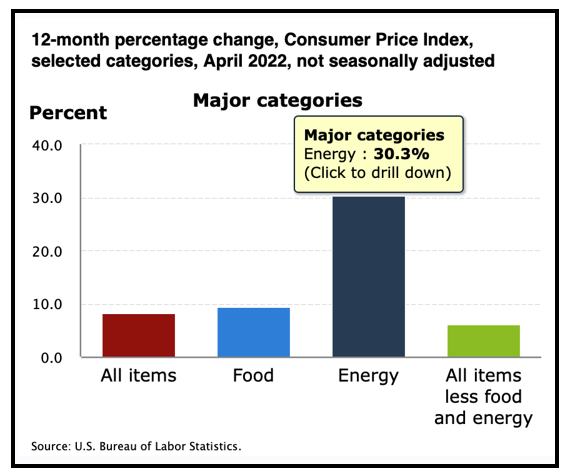

- And as a whole, U.S. energy inflation — which was steadily declining since November — swelled to 32.04% in March and stands at 30.3% in April.

From an investment standpoint, large-cap industry stalwarts like Exxon Mobil (XOM) and Chevron (CVX) are logical stocks to own. XOM — with its 3.99% annual dividend yield — is up nearly 40% YTD. CVX is up over 40% over the same time, and its dividend spins off 3.5%.

Both would be smart late-cycle investments. But at share prices of $88.86 and $167.87, respectively, they’re not particularly accessible to run-of-the-mill retail investors.

So, where can Average Joe turn for more affordable — but highly rated and high-yielding — energy stocks as the sector continues to burn its S&P 500 sector competition?

Drilling Down for Small Cap Success Stories

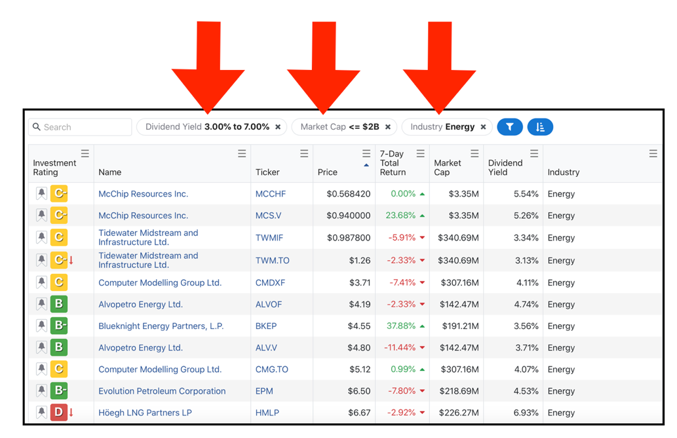

The Weiss Ratings stock screener is a good start.

First, I added an industry filter for energy. Since I mentioned XOM’s and CVX’s dividends, I added another filter for yields between 3%-7%. (Because who doesn’t like to be paid to hold shares?)

Looking to avoid stocks with hefty price tags, the last filter I added was for small-cap companies — those with market capitalization under $2 billion.

There were 24 results. But since I was specifically looking for stocks trading for under $25 a share, I sorted by ascending price and got 17 results.

Lastly, I only wanted to look at companies with a strong Weiss Rating of “B” or better, which produced three results:

1. Alvopetro Energy (ALVOF)*

Alvopetro Energy is an upstream natural gas producer, midstream pipeline and processing operator and an exploration company with operations in the state of Bahia in Brazil.

The company’s focus on natural gas is particularly compelling given how explosive the hydrocarbon’s price action has been of late:

The company reported Q1 earnings on May 11, with earnings per share (EPS) of $0.25 beating expectations of $0.05 by a whopping 25.28%. Revenue also beat by 10.32%.

Analysts believe shares are heading in the right direction. Zacks Investment Research issued estimates for Q2 earnings of $0.06 EPS, Q3 earnings at $0.07 EPS, Q4 earnings at $0.08 EPS and FY 2022 earnings at $0.27 EPS.

Weiss Rating: “B”

Price: $4.25

52-week range: $0.73-$8

Dividend yield: 4.75%

One-year gain: 77.82%

2. Freehold Royalties (FRHLF)

Freehold Royalties is an oil and gas royalty company with assets located in five Canadian provinces and eight U.S. states totaling seven million gross acres.

Royalty companies traditionally provide reduced investor risk as they serve as financiers that fund exploration and production for cash-strapped companies. In return, companies like FRHLF receive royalties on whatever the projects produce.

Freehold Royalties announced Q1 earnings on May 10, posting an EPS of C$0.25 compared to C$0.04 for the same quarter a year prior. Revenue of C$87.6 million surprised by 16.81%. The company said its royalty production rose 25% to 13,676 barrels of oil equivalent per day, while its average price per barrel equivalent rose 87% to C$69.71.

Shares are heading in the right direction: 12-month price target forecasts are between $15-$20. With a dividend yield of 4.49%, it pays investors to hold it in the interim.

Weiss Rating: “B”

Price: $11.28

52-week range: $6.29-$12.88

Dividend yield: 4.94%

One-year gain: 43.15%

* Denotes over-the-counter (OTC) stock. At times, liquidity of OTC stocks can be low.

3. North European Oil Royalty Trust (NRT)

Another royalty, NRT is also a strong inflation hedge in the energy sector. The trust — one of just a few German natural gas enterprises — is poised to profit given the country’s reliance on Russian gas, which has been disrupted because of the war in Ukraine.

Organized in 1975, NRT has joint ventures with Exxon Mobil and Shell (SHEL) for exploration, production, import, underground storage and sales of natural gas.

NRT reported earnings on May 13, posting revenues of $2.55 million, good for a 798.26% year-over-year (YoY) increase. Net income was $2.35. million, good for an astounding 2,0028% YoY increase. Three-month price target forecasts range from $25.57-$31.88, with shares trading at $16.40 at the time of writing.

Weiss Rating: “B”

Price: $16.40

52-week range: $5.75-$20.72

Dividend yield: 3.94%

One-year gain: 166.67%

Gas prices are hurting Americans’ pockets every time they go to the pump. And with an average sticker price of $60,054, most people can’t afford to bypass the gas station in favor of a new electric vehicle.

One way to alleviate that pain at the pump is by using the Weiss Ratings stock screener to search for companies riding energy’s outsized gains while the sector continues to lead the S&P 500.

The three companies described above are just a few of the lower risk, higher yield, late-cycle value stocks that are performing well alongside the energy sector.

Another way to alleviate the pain at the pump is by joining my colleague Sean Brodrick, senior analyst and editor of Gold & Silver Trader, for his best picks in energy, metals and more. Click here to learn more.

No matter what you decide, always conduct your own due diligence before entering a trade.

Until next time,

Jordan Chussler

Managing Editor

Weiss Ratings Daily