|

| By Michael A. Robinson |

Apologies for the mental whiplash you may have experienced lately. You have AI to thank for that.

You see, on Jan. 21, reports surfaced that the Trump administration would back a $500 billion consortium to secure U.S. dominance in AI — a venture known as Stargate.

Then, news of Chinese startup DeepSeek creating an advanced AI model at a fraction of the cost of U.S. tech giants sent shockwaves through Silicon Valley.

Trump’s news bolstered AI stocks. But the DeepSeek news brought a broad sell-off in the sector.

What’s going on here? How can we make sense of this recent head spinning back and forth?

Don’t worry, because I’ve got answers — including a surprising backdoor way to profit from AI’s huge future, no matter what happens with the headlines of the moment.

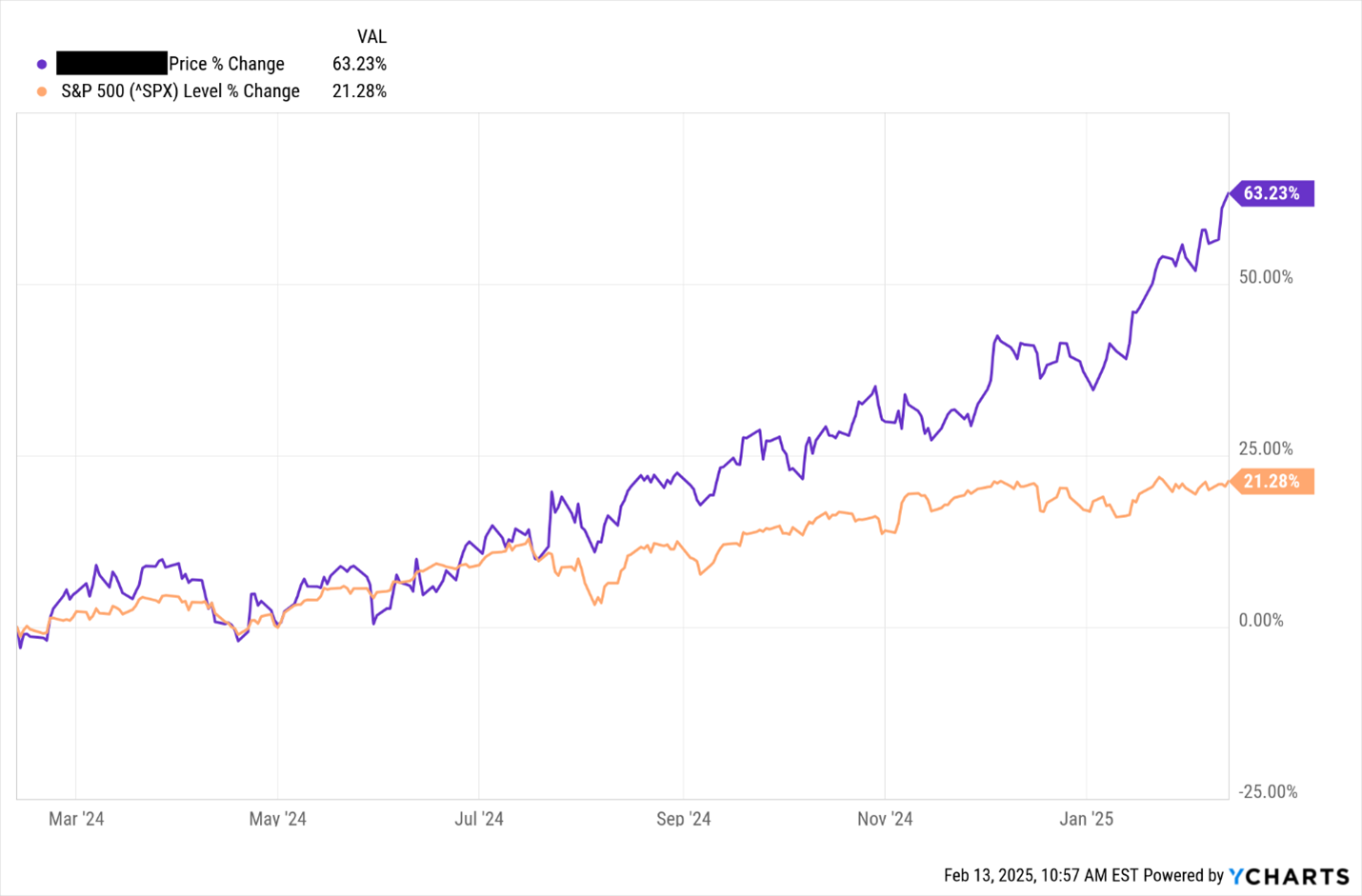

And did I mention that it nearly tripled the S&P’s returns over the past year?

The Emergence of DeepSeek

On Monday, Jan. 27, the Nasdaq suffered a bruising sell-off, falling more than 3%.

AI hardware leader Nvidia (NVDA) did much worse. It lost about 17% of its market value, or close to $593 billion — a massive one-day loss for any company …

And it was all thanks to a Chinese startup called DeepSeek.

On that day, DeepSeek announced a new AI-powered chatbot, one that looks, feels and works like the increasingly popular ChatGPT.

The twist, however, is that DeepSeek’s chatbot was reportedly built for less than $6 million. U.S. companies have spent hundreds of millions of dollars on their creations.

DeepSeek’s emergence sent the market — AI stocks, in particular — into a tailspin. But hold on a moment …

In my view, the market overreacted. In fact, it gave us an opportunity to scoop up stocks at a discount.

I think China’s claim of a $6 million ChatGPT competitor is hogwash. This is a nation with a long and robust record of making false statements.

Don’t take my word for it. The U.S. government says between 2012 and 2023, some 14,000 Chinese scientific papers were retracted, much of that having to do with false statements included in the reports.

Furthermore, I can’t find a single credible U.S. source to back up China’s cheap AI statement.

Software is Supreme

The thing is, despite Nvidia’s plunge following the news of DeepSeek, irony abounds. That’s because DeepSeek was built on AI chips created by Nvidia.

The true takeaway I had from this whole saga was that AI appears to be getting cheaper to develop. And that’s where our investment opportunity begins to take shape.

You see, investing directly in AI has its benefits. But picking the right AI-focused company can be risky in a choppy news-driven market.

Instead, let’s focus on an overlooked sector that has the potential to benefit from the entirety of AI’s success, especially as the technology becomes more affordable to develop.

I’m referring to the software industry. Instead of spending billions on AI R&D, companies can now buy or license AI models at a lower cost. And that means cloud providers can continue to power AI, even as development costs drop.

With that in mind, I’m looking at one of the world’s leading software companies …

Premium Customer List

That company is SAP (SAP), one of the world’s largest vendors of enterprise resource-planning software.

Many of the world’s biggest companies rely on the German giant. We’re talking the likes of Walmart, Coca-Cola, Ford, Amazon, IBM, Apple — even Microsoft.

SAP offers tools used by major corporations and big organizations for their operations such as supply chains, sales and Human Resources.

And it helps businesses handle a variety of tasks, including storing and managing data, improving supply-chain management and improving financial accounting.

Of course, nearly every company these days is focused on AI. Don’t worry: SAP is investing heavily in that, too …

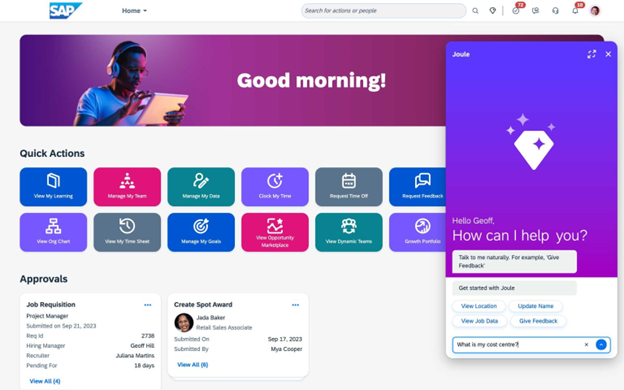

SAP uses AI to analyze large volumes of data, generate insights, automate repetitive tasks and provide productive capabilities.

Its primary offering is SAP Business AI which features machine learning algorithms and an AI copilot named “Joule” to power it all.

In a recent interview with Investor’s Business Daily, CEO Christian Klein mentioned that “AI was always, for us, a key value driver for all of our solutions and for the platform.”

A Heavy Dose of AI

Klein said DeepSeek’s AI was actually “good news” for software firms like SAP. The success of DeepSeek’s technology suggests it’s possible to dramatically reduce the hardware costs in building an AI platform.

That could eventually benefit companies like SAP. With such a heavy investment in AI, leaders like SAP will be in great position to facilitate the growth of AI with its software products.

And the fact that it’s not an AI pure play is great news for investors like us. We get a “twofer,” a focused software leader that stands to benefit from the global AI build-out.

As I mentioned, the whipsaw-like headlines regarding AI may have left you feeling uncertain about the sector.

But trust me, this isn’t the end of AI — it’s merely the beginning.

We’re on the cusp of a faster, more scalable and more profitable AI revolution.

SAP is a great way to target this revolution. And keep in mind that this is a very shareholder-friendly company. Over the past five years, SAP has bought back nearly $6 billion of its own stock.

Investors are waking up to a great story here. And the fact that SAP has a history of beating the market makes this story even more exciting.

Over the past year, SAP’s stock has climbed about 63%. That’s nearly triple the growth of the S&P 500.

I see similar market-crushing potential ahead for a firm that is not only involved in AI but is also a well-focused software giant that we can count on for the long haul.

Best,

Michael A. Robinson

P.S. Even before DeepSeek came onto everyone’s radar, I’ve been following these alt-AI investment ideas. I found that the next huge batch of AI profits will come from the partners of the first batch. Specifically, Nvidia’s “silent partners.”